Delving into the Realm of Forex Dealer Transactions

In the captivating world of financial markets, foreign exchange (forex) dealer transactions hold immense significance. These transactions form the bedrock of currency trading, facilitating the exchange of currencies between businesses, individuals, and financial institutions worldwide. Understanding the intricacies of forex dealer transactions is crucial for savvy traders eager to navigate the dynamic and lucrative forex market effectively.

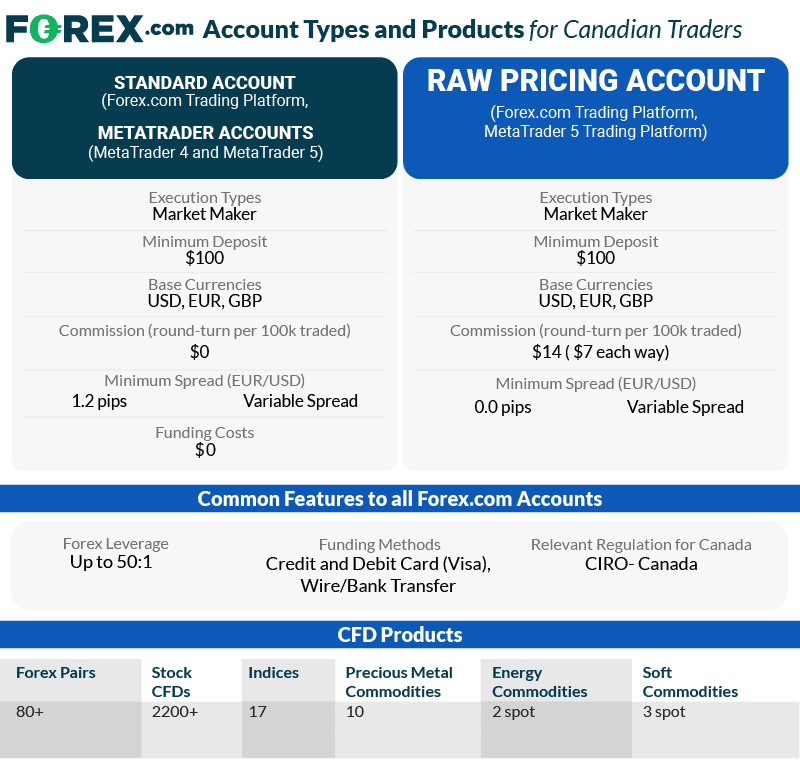

Image: www.compareforexbrokers.com

Forex dealer transactions involve two primary concepts: debits and credits. Debits represent payments made from a trader’s account, while credits reflect payments received into their account. Comprehending how debits and credits work is fundamental to managing forex trades successfully.

Demystifying Debits in Forex Transactions

Forex debits occur when a trader sells a currency pair and receives its equivalent in another currency. For instance, if a trader sells 10,000 euros (EUR) for US dollars (USD), their EUR account will be debited for the equivalent USD amount. This debit reflects the transfer of funds from the trader’s account to the counterparty who bought the EUR.

Understanding Credits in Forex Transactions

Conversely, forex credits arise when a trader buys a currency pair and pays for it using another currency. If the same trader from the previous example buys 10,000 USD with EUR, their EUR account will be credited for the equivalent USD amount. This credit signifies the addition of funds to the trader’s account from the party who sold the USD.

Practical Application: Leveraging Debits and Credits for Strategic Trading

Forex debits and credits play a pivotal role in strategic trading. By monitoring and analyzing transaction records, traders can gain valuable insights into market trends and make informed decisions. Debits can indicate periods of currency selling, while credits may suggest buying activities.

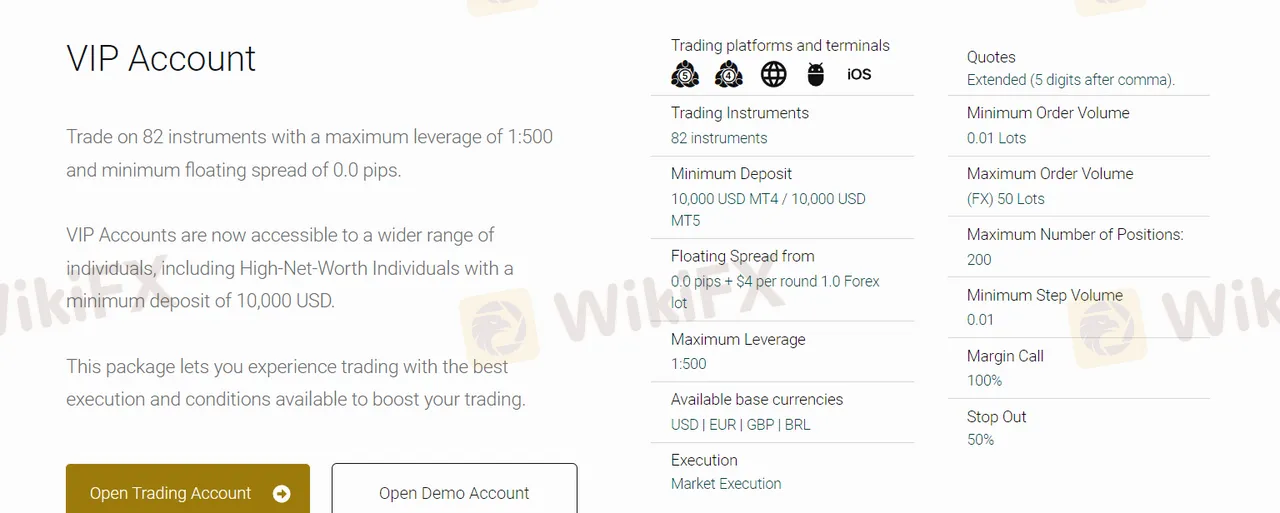

Image: www.wikifx.com

Expert Insights: Harnessing Debits and Credits for Trading Success

Expert Tip 1: Monitoring Transaction Flow

“Analyzing transaction flow can provide valuable clues about market sentiment,” advises Dr. Emily Carter, a renowned forex analyst. “Traders should pay attention to the size and frequency of debits and credits to identify potential trading opportunities.”

Expert Tip 2: Leveraging Credit Balances

“Credit balances in a forex account represent available funds that can be utilized for new trades,” says John Smith, a seasoned forex trader. “Traders should consider using these funds wisely by allocating them to promising trading opportunities.”

Forex Dealer Transaction Debit Credit

Conclusion: Empowering Traders with Forex Dealer Transaction Knowledge

In the dynamic world of forex trading, a thorough understanding of dealer transactions, debits, and credits is paramount for success. By delving into the intricacies of these concepts, traders gain unparalleled insights into market dynamics, enabling them to make informed trading decisions and maximize their potential profits. Remember, the ability to decipher debits and credits is not just a technical skill; it’s a key ingredient in the recipe of a successful forex trader.