In the fast-paced and ever-evolving world of forex trading, understanding the intricacies of position holding strategies is paramount. Two distinct approaches that traders employ are day light positions and overnight positions, each carrying its own set of benefits and considerations. This comprehensive guide delves into the nuances of both strategies, empowering you with the knowledge to optimize your trading decisions.

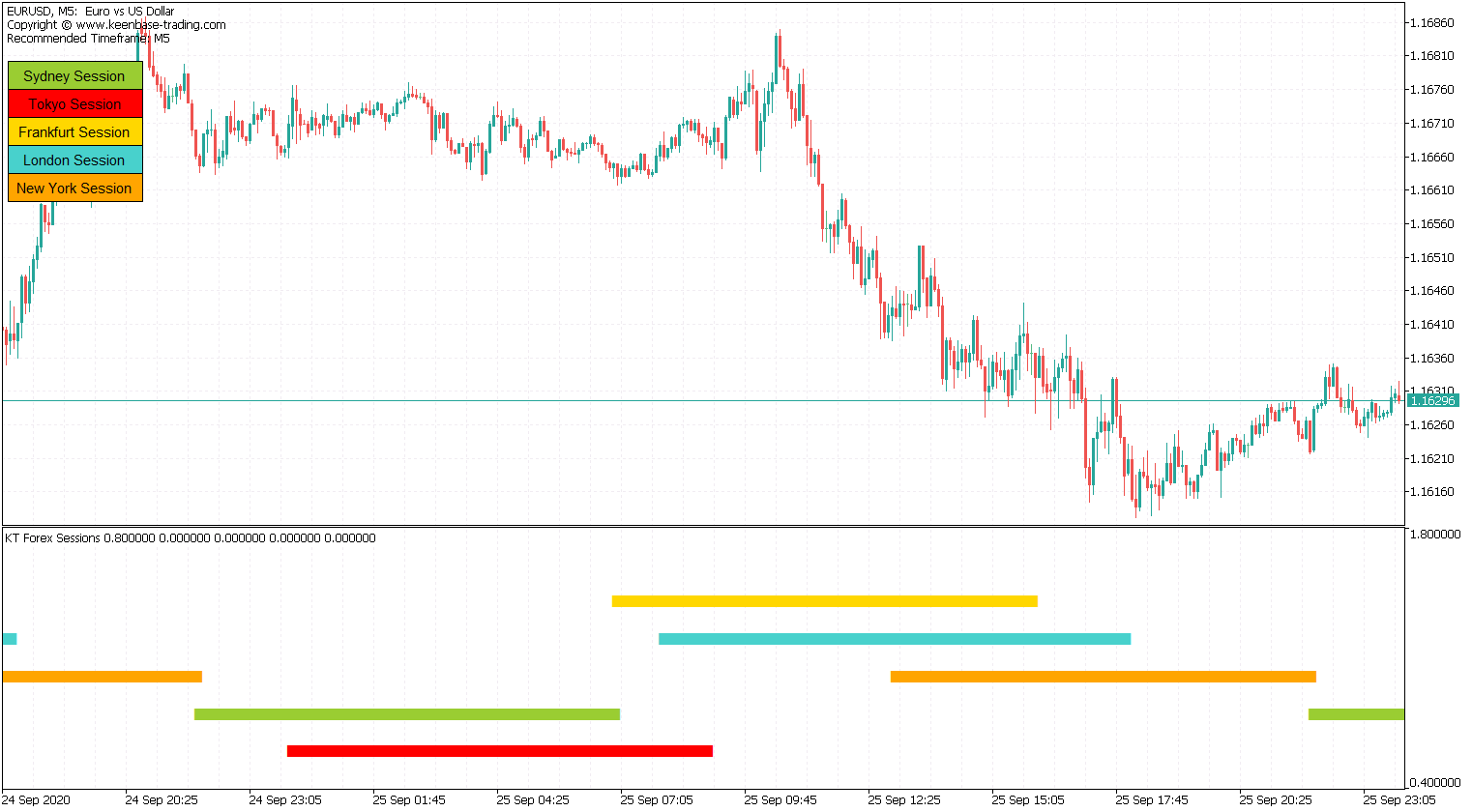

Image: www.keenbase-trading.com

Day Light Positions: Embracing Short-Term Opportunities

Day light positions epitomize the essence of short-term trading, where traders seek to capitalize on price movements within a single trading day. This strategy hinges on the ability to identify and execute profitable trades within a limited timeframe, adding excitement and momentum to the trading process.

Benefits of Day Light Positions:

-

Minimal overnight risk: By closing all positions by the end of the trading day, daylight traders effectively mitigate the risks associated with market fluctuations that occur outside of trading hours.

-

Enhanced liquidity: Intraday trading hours usually witness heightened market activity, ensuring ample trading opportunities and improved liquidity, leading to smoother trade executions.

-

Increased flexibility: Daytime trading allows traders to respond promptly to market news and economic events, enabling them to seize trading opportunities with greater agility and precision.

Overnight Positions: A Calculated Approach for Long-Term Gains

Overnight positions adopt a different philosophy, extending positions beyond the end of the trading day and into the next. This approach is often utilized by traders seeking to capitalize on broader market trends and capture potential price swings.

Benefits of Overnight Positions:

-

Potential for amplified profits: Holding positions overnight grants traders exposure to price movements across multiple trading sessions, increasing the chances of capturing larger market moves and amassing significant profits.

-

Elimination of day trading stress: Overnight traders can avoid the high-pressure environment of day trading, allowing them to make informed decisions without being subject to the intense emotions that often accompany short-term trading.

-

Leverage market volatility: Price fluctuations tend to be more pronounced during certain times of the day or night, and overnight positions enable traders to benefit from these market swings.

Choosing the Right Strategy: Matching Your Goals and Risk Tolerance

Ultimately, the best strategy for you hinges on your individual trading style, risk tolerance, and financial goals. Day light positions are ideal for traders seeking quick profits and who prefer to minimize risk, while overnight positions are better suited for those comfortable with longer holding periods and willing to embrace the potential for increased earnings.

Consideration for overnight positions:

-

Overnight risk: Market conditions can change drastically after trading hours, exposing overnight positions to potential risks and losses.

-

Additional costs: Holding positions overnight may incur additional costs, such as swap fees and commissions, which can impact profitability.

Image: www.pinterest.com

Mastering the Art of Position Holding

Irrespective of the strategy you choose, successful trading requires a thorough understanding of market analysis, position sizing, and risk management. By combining these elements, you can enhance your trading capabilities and develop a coherent trading plan that caters to your specific objectives.

Essential tips for position holding:

-

Conduct meticulous market research: Analyze market trends, geopolitical events, and economic data to identify potential trading opportunities and make informed decisions.

-

Establish clear entry and exit points: Define precise price levels for entering and exiting trades, based on technical analysis and market fundamentals.

-

Manage risk diligently: Implement stop-loss and take-profit orders to limit potential losses and secure profits. Monitor positions closely and adjust them as market conditions change.

-

Stay updated with market developments: Monitor economic calendars and news releases to stay abreast of market-influencing events that may impact your trading decisions.

Forex Day Light Position Overnight Position

Conclusion

Navigating the complexities of forex position holding strategies requires a thoughtful approach. By embracing the benefits of both day light positions and overnight positions, you can tailor your trading strategy to your unique needs and risk tolerance. Remember that continuous learning, disciplined execution, and a sound understanding of market dynamics are essential for achieving long-term trading success.