In the fast-paced world of finance, having access to accurate and timely data is pivotal. When it comes to forex trading, this notion is further amplified, as data serves as the cornerstone upon which profitable trading decisions are made. Forex data opens the door to a wealth of actionable insights, enabling traders to navigate the tumultuous currency markets with greater precision and confidence.

Image: bestmt4ea.com

Forex data encompasses a vast array of economic indicators, market news, and technical analysis tools. These data points provide invaluable information about currency movements, global economic conditions, and investor sentiment. By harnessing the power of this data, traders can gain a comprehensive understanding of the forces that drive currency fluctuations. This heightened understanding serves as a guiding beacon, illuminating the path towards informed and potentially lucrative trading decisions.

Deconstructing the Essential Components of Forex Data

To master the art of forex trading, it is crucial to have a thorough understanding of the various types of forex data and their respective roles in the decision-making process. Let’s delve into the essential components of this financial intelligence:

Economic Indicators: Unveiling the Economic Landscape

Economic indicators are indispensable tools for gauging the overall health and direction of an economy. These indicators offer insights into various economic aspects, from GDP growth and inflation rates to employment figures and consumer confidence. By carefully analyzing these data points, traders can assess the strength and stability of different economies, enabling them to make informed judgments about future currency movements.

Market News: Tapping into Real-Time Market Dynamics

Market news provides a real-time pulse on the financial markets. News events, such as political developments, central bank announcements, and major economic releases, can have a profound impact on currency valuations. By staying abreast of the latest market news, traders can react swiftly to changing market conditions and adjust their trading strategies accordingly.

Image: www.dailyfx.com

Technical Analysis Tools: Deciphering Market Patterns

Technical analysis tools, employing historical price data and chart patterns, empower traders to identify trends and forecast potential market movements. These tools include Bollinger Bands, moving averages, and support and resistance levels, offering valuable insights into price behavior. By combining technical analysis with fundamental analysis, traders can enhance their ability to predict price trajectories and make well-informed trading decisions.

Harnessing the Power of Forex Data: A Path to Trading Success

The ability to effectively utilize forex data is a key differentiator between successful traders and those who fall short. Here are some practical ways to harness the power of this invaluable resource:

Understanding Currency Correlations: Embracing Interdependencies

Forex data can reveal the interdependencies between different currency pairs, a phenomenon known as currency correlation. By understanding these correlations, traders can diversify their portfolios and mitigate risk. For instance, if the US dollar strengthens against the euro, it is likely to appreciate against other currencies that are positively correlated with the euro.

Unveiling Market Sentiment: Deciphering the Collective Mindset

Forex data can provide insights into market sentiment, indicating whether traders are bullish or bearish on a particular currency pair. This information can be gleaned from various sources, including market news, social media sentiment, and technical indicators. By aligning trading decisions with market sentiment, traders can increase their chances of success.

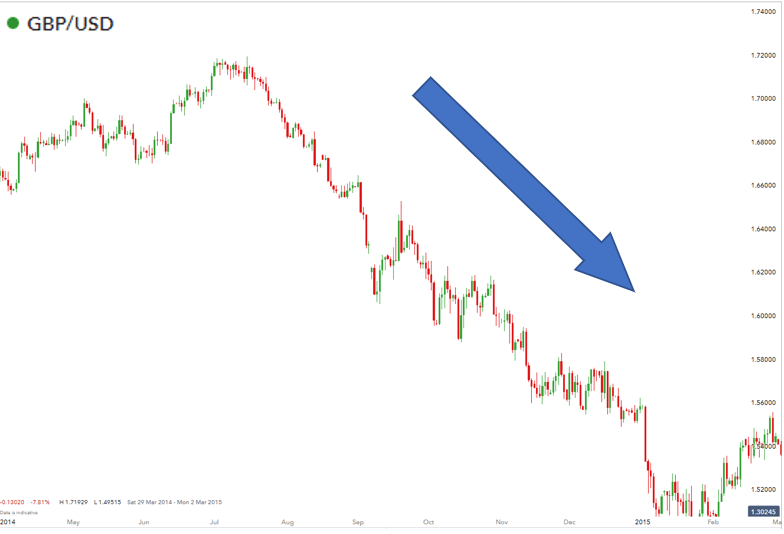

Identifying Market Trends: Riding the Waves of Currency Movements

Forex data can help traders identify market trends, enabling them to position themselves strategically. By analyzing historical price data and applying technical analysis tools, traders can determine whether a currency pair is likely to continue trending in the same direction or if a reversal is imminent. This knowledge empowers traders to make timely entries and exits, maximizing their profit potential.

Forex Data And Its Impotance

Conclusion: Embracing Forex Data for a Brighter Trading Future

In the dynamic and ever-changing world of forex trading, having access to accurate, timely, and informative forex data is indispensable. By embracing the power of this invaluable resource, traders can unlock a wealth of actionable insights into currency movements, global economic conditions, and investor sentiment. This knowledge empowers them to make informed and potentially profitable trading decisions, navigating the financial markets with greater confidence and precision. As the saying goes, “Knowledge is power,” and when it comes to forex trading, forex data is the ultimate source of that power.