In the ever-evolving landscape of financial markets, traders are constantly on the lookout for profitable trading strategies that provide them with an edge over the competition. Within the realm of technical analysis, the Forex crab pattern has gained significant traction as a reliable tool for identifying potential market reversals. However, despite its effectiveness, the crab pattern is not immune to failures, leaving traders vulnerable to potential losses if they are not fully aware of the factors contributing to these setbacks. In this definitive guide, we will delve into the nuances of the Forex crab pattern, exploring its mechanisms, advantages, and the pitfalls that traders must navigate to maximize their profits and minimize their risks.

Image: www.profitf.com

What is the Forex Crab Pattern?

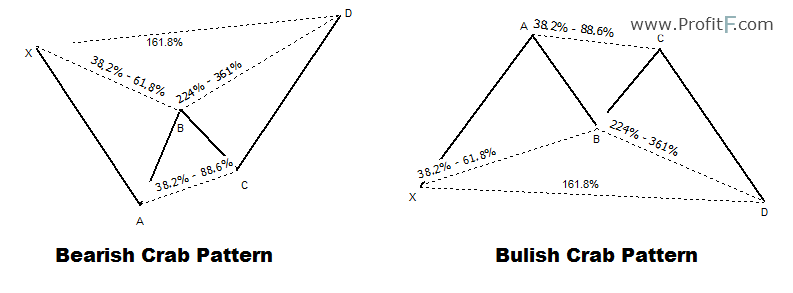

The Forex crab pattern is a specific chart formation that identifies potential market reversals. It is characterized by a series of five distinct legs, forming a distinct “crab” shape. The pattern begins with a strong impulse move (leg 1) followed by a sharp retracement (leg 2). Subsequently, there is a second impulse move in the opposite direction (leg 3), followed by another retracement (leg 4), and finally, a third impulse move in the direction of the original trend (leg 5). The crab pattern is considered complete when the price breaks through the high or low of leg 1, signaling a potential reversal of the prevailing trend.

Advantages of Utilizing the Forex Crab Pattern

Traders who have mastered the technique of identifying and trading the Forex crab pattern enjoy several key advantages:

- Early Identification of Market Reversals: The crab pattern is highly effective in identifying potential market reversals. By recognizing this pattern early on, traders gain a significant advantage in timing their entries and exits, allowing them to capitalize on profitable trading opportunities.

- Precision Entry and Exit Points: The distinct structure of the Forex crab pattern provides traders with precise entry and exit points. The break of the high or low of leg 1, coupled with proper risk management techniques, enables traders to minimize their losses and maximize their profits.

- Objective Trading Approach: Unlike other technical analysis techniques, the crab pattern is not subjective. It follows a set of predetermined rules, eliminating the influence of emotions in decision-making. This objectivity enhances the trader’s ability to make sound trading decisions based on the principles of sound technical analysis.

- High Probability Trades: The Forex crab pattern has a relatively high probability of success when correctly identified. By following its rules, traders can increase their chances of profitability in the financial markets.

Pitfalls to Avoid in Trading the Forex Crab Pattern

While the Forex crab pattern offers significant advantages, traders must also be aware of its pitfalls. Here are several common pitfalls to avoid:

- False Identifications: Not all crab patterns lead to successful trades. It is crucial for traders to develop a keen eye for identifying genuine crab patterns, avoiding false or incomplete formations that can result in unprofitable trades.

- Premature Entries and Exits: Traders should exercise patience when trading the crab pattern. Premature entries and exits before the pattern completes can lead to significant losses. It is advisable to wait for the break of the high or low of leg 1 to confirm the reversal and enter the trade accordingly.

- Invalidations: It is essential to have a clear understanding of the invalidation rules for the crab pattern. If the price action violates specific parameters, the pattern is considered invalid, and traders should immediately exit their positions.

- Overtrading: Recognizing the potential profitability of the crab pattern can tempt traders to overtrade. However, it is crucial to exercise restraint and avoid taking on excessive trades, which can increase the risk of financial losses.

- Lack of Risk Management: Proper risk management is paramount in Forex trading. Traders should have a well-defined risk management plan in place before implementing the crab pattern in their trading strategy. This plan should include stop-loss orders and take-profit targets.

Image: www.tradingview.com

Forex Crab Pattern Failures In Telegram

Conclusion

The Forex crab pattern is a powerful technical analysis tool that provides traders with the potential to identify profitable trading opportunities and capitalize on market reversals. By understanding the formation, advantages, and pitfalls associated with the crab pattern, traders can significantly enhance their trading performance. It is important to remember that no trading strategy is foolproof, and the crab pattern is not an exception. However, by incorporating the principles outlined in this guide and continuously refining their trading skills, traders can improve their ability to navigate the complexities of financial markets more effectively.