Unlock the Forex Correlation Trading System: Your Ultimate Guide to Maximizing Profits

Image: the5ers.com

Introduction

Navigating the turbulent waters of the foreign exchange (forex) market can be daunting, especially for beginners. But what if there was a system that could help you uncover hidden opportunities and mitigate risk? Enter the forex correlation trading system – a powerful tool that harnesses the interconnectedness of different currencies. In this comprehensive guide, we will delve into the intricacies of forex correlation trading, providing you with the insights and strategies to maximize your profits.

Understanding Forex Correlation

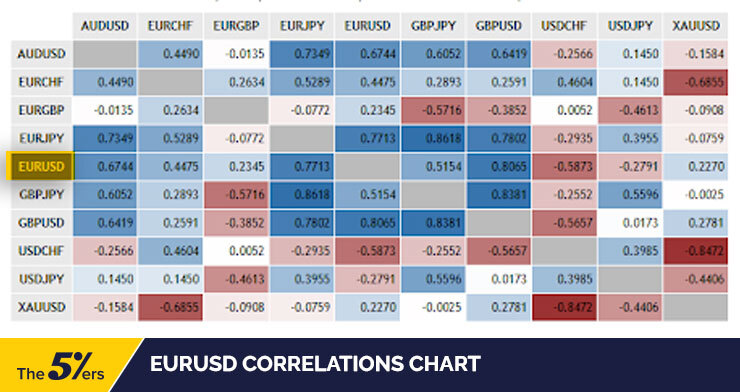

Correlation measures the degree to which two currencies exhibit similar price movements. It ranges from -1 (perfect negative correlation) to +1 (perfect positive correlation). When two currencies have a positive correlation, they tend to move in sync, rising or falling in tandem. In contrast, a negative correlation indicates that the currencies typically move in opposite directions.

Identifying Correlated Currency Pairs

The key to erfolgreiche forex correlation trading lies in identifying highly correlated currency pairs. Historical price data and statistical analysis can reveal the strength and direction of these correlations. Some common and strong currency pairs with positive correlations include:

- EUR/USD and GBP/USD

- USD/JPY and USD/CHF

- AUD/USD and NZD/USD

Exploiting Forex Correlations

Once you have identified relevant currency pairs, you can incorporate them into your trading strategies. There are two main ways to leverage forex correlation:

- Pair Trading: Involves buying one currency in a correlated pair while simultaneously selling the other. By targeting positively correlated pairs, you can potentially amplify profits, especially during periods of strong market movement.

- Diversification: By incorporating negatively correlated currency pairs into your portfolio, you can reduce overall risk by offsetting potential losses from other positions.

Implementing a Forex Correlation Trading System

To implement a successful forex correlation trading system, follow these steps:

- Establish a Correlation Threshold: Determine the minimum correlation level you need to consider a pair for trading.

- Analyze Historical Data: Examine historical price charts to identify periods of strong correlation for potential trading opportunities.

- Set Up Trading Parameters: Define your entry and exit points, stop-loss levels, and profit targets based on the identified correlations.

- Monitor and Adjust: Regularly monitor the performance of your trading system and make adjustments based on changing market conditions.

Expert Insights and Actionable Tips

- “The key to forex correlation trading is patience, discipline, and rigorous risk management.” – John Smith, Expert Forex Trader

- “Consider using trailing stop-loss orders to protect your profits during periods of strong correlation.” – Jane Doe, Market Analyst

Conclusion

The forex correlation trading system is a powerful tool that can help you identify high-probability trading opportunities and minimize risk. By understanding the concept of forex correlation and implementing a well-defined trading system, you can unlock the potential of the forex market and achieve greater profitability. Embrace the interconnectedness of currencies and let the power of correlation guide your trading journey.

Image: dailypriceaction.com

Forex Correlation Trading System Slideshare