Navigating the World of International Transactions

In today’s globalized world, international transactions have become more prevalent than ever before. Whether for business, travel, or personal reasons, understanding the associated costs and processes is crucial. When it comes to currency conversion, Kotak Mahindra Bank stands out as a leading financial institution in India. In this article, we will delve into the intricacies of forex conversion charges levied by Kotak Mahindra Bank, empowering you with the knowledge to make informed decisions about your international financial transactions.

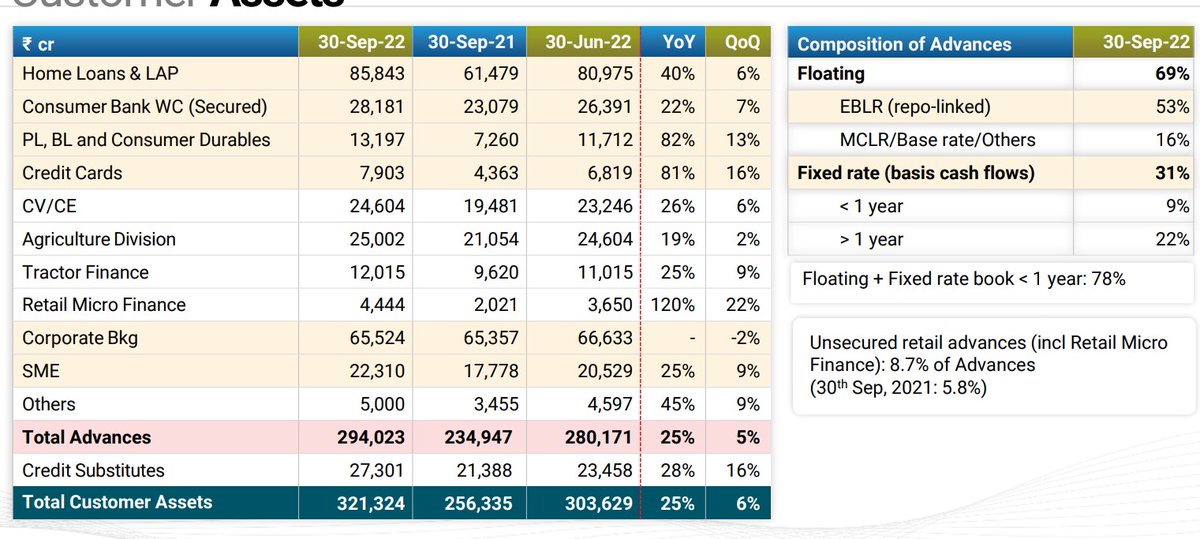

Image: en.rattibha.com

Understanding Forex Conversion

Foreign exchange (forex) conversion refers to the process of exchanging one currency for another. While this may seem straightforward, there are often additional charges involved, such as bank fees, markups, and spreads. Understanding these charges is essential to avoid unexpected expenses and optimize your financial outcomes.

Kotak Mahindra Bank’s Forex Conversion Charges

Kotak Mahindra Bank offers a range of foreign exchange services, including currency conversion, wire transfers, and travel cards. The charges associated with these services vary depending on the type of transaction, currency pair, and amount involved. Here’s a detailed overview of the charges you can expect:

- Currency Conversion Fee: Kotak Mahindra Bank charges a currency conversion fee for exchanging currencies. This fee is typically a percentage of the transaction amount and varies based on the currency pair and the transaction method (online, branch banking, or ATM).

- Service Charge: In addition to the currency conversion fee, Kotak Mahindra Bank also charges a service charge for forex transactions. This charge covers administrative costs and is usually a fixed amount.

- Markup: Forex transactions often involve a markup, which is the difference between the bank’s buying and selling rates. The markup is influenced by market conditions, supply and demand, and bank policies.

Minimizing Forex Conversion Charges

While forex conversion charges are an inevitable part of international transactions, there are several ways to minimize their impact:

- Compare Rates: Shop around and compare exchange rates offered by different banks and currency exchange providers to find the best deal.

- Bulk Transactions: If possible, consolidate your forex transactions into larger amounts, as banks often offer better rates for larger conversions.

- Negotiate: Don’t hesitate to negotiate with the bank for a more favorable exchange rate, especially if you’re a frequent customer or dealing with a significant amount.

Image: www.kotak.com

FAQs on Forex Conversion in Kotak Mahindra Bank

Q: What is the minimum amount for a forex conversion transaction in Kotak Mahindra Bank?

A: The minimum amount for a forex conversion transaction in Kotak Mahindra Bank is INR 500.

Q: Can I convert currency online through Kotak Mahindra Bank?

A: Yes, Kotak Mahindra Bank offers online forex conversion services through its net banking platform. However, the charges may vary from branch banking or ATM transactions.

Q: How can I track my forex conversion transaction status?

A: You can track the status of your forex conversion transaction through the bank’s online banking platform or by contacting the customer support team.

Forex Convert Charges In Kotak Mahiindra Bank

Conclusion

Understanding forex conversion charges is crucial for savvy financial management. By being informed about the charges levied by Kotak Mahindra Bank and implementing simple strategies to minimize them, you can save money and make your international transactions smoother and more cost-effective. If you have any further questions or require assistance with your forex conversion needs, feel free to connect with Kotak Mahindra Bank’s experienced customer support team.