In the thrilling world of forex trading, timing is everything. Accurately pinpointing the optimal moments to enter and exit the market can make all the difference between securing profits and incurring losses. That’s where forex confirmed entry points indicators step into the spotlight.

Image: dadforex.com

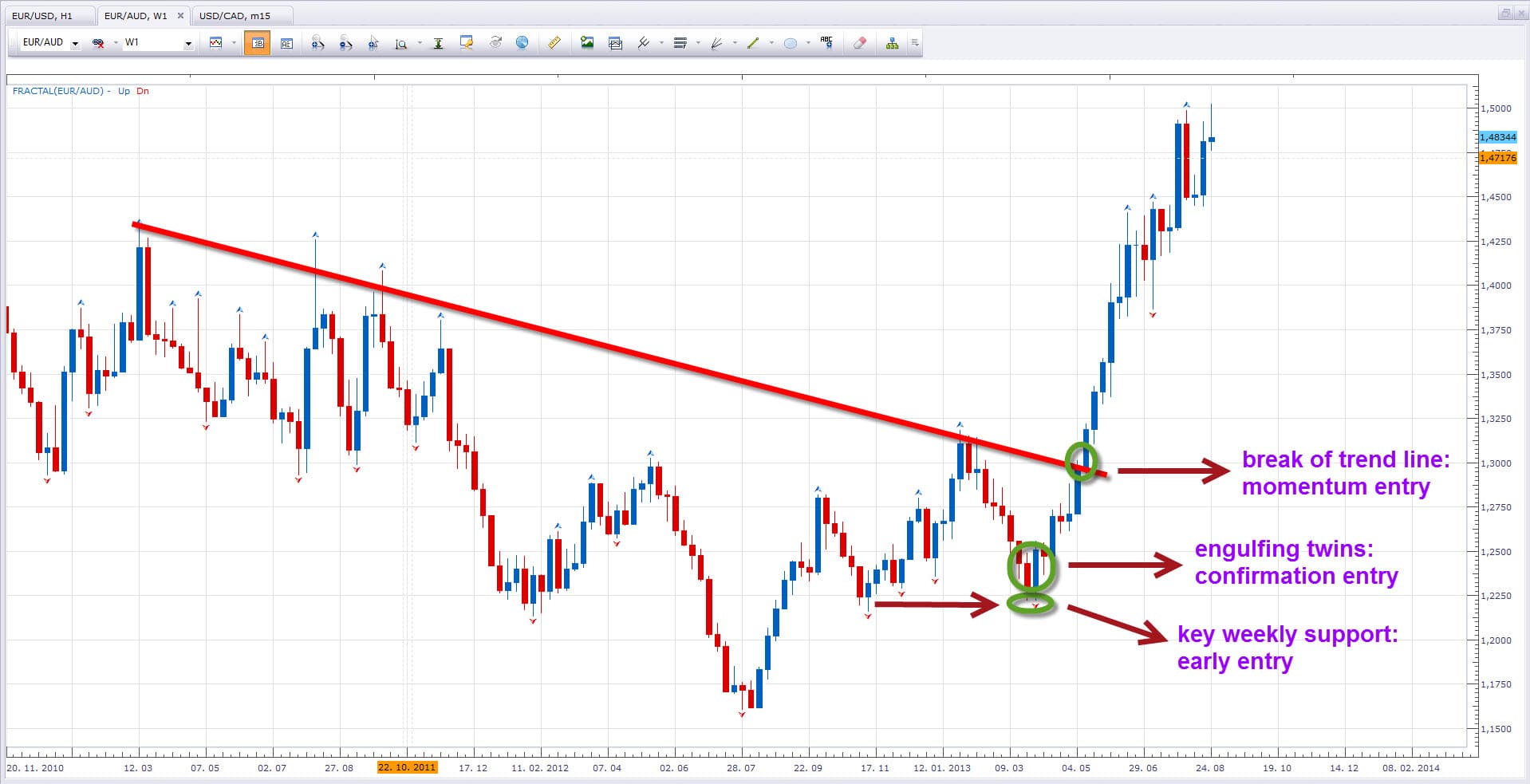

Forex confirmed entry points indicators are powerful tools that help traders identify the most favorable trading opportunities. These indicators analyze price action, market conditions, and other relevant data to determine the best time to buy or sell currency pairs.

Types and Uses of Forex Confirmed Entry Points Indicators

There are numerous forex confirmed entry points indicators available, each catering to specific trading styles and preferences. Here are a few commonly used examples:

- Moving Averages: Moving averages smooth out price fluctuations by calculating the average price over a defined period of time. Traders can use moving averages to identify trends and potential entry points when the price crosses above or below the average line.

- Bollinger Bands: Bollinger Bands consist of three lines: the moving average, an upper band, and a lower band. The bands create a Bollinger channel in which the price oscillates. Entry points can be found when the price touches or breaks out of the channel.

- Relative Strength Index (RSI): The RSI measures the strength of price momentum by comparing the average of recent gains to the average of recent losses. Traders can use RSI to identify overbought and oversold conditions, signaling potential entry points when the indicator crosses certain levels.

Latest Trends in Forex Entry Point Indicators

The forex industry is constantly evolving, and so are the tools available for traders. Recent trends in forex entry point indicators include:

- Artificial Intelligence (AI) powered indicators: AI algorithms can analyze vast amounts of data to identify trading opportunities that may not be evident to the human eye.

- Social trading indicators: These indicators aggregate data from the trading activities of experienced traders, providing insights into their entry and exit points.

- Volatility indicators: Volatility indicators measure the fluctuation of price movements. Traders can use these indicators to identify periods of high or low volatility, helping them plan their trading strategies accordingly.

Tips and Expert Advice

To maximize the effectiveness of forex confirmed entry points indicators:

- Use a combination of indicators: Don’t rely on a single indicator alone. Cross-referencing multiple indicators can provide a more comprehensive view of the market.

- Consider market context: Indicators should be used in conjunction with other analysis methods, such as fundamental analysis and technical analysis.

- Set entry and exit rules: Clearly define the conditions that will trigger your entries and exits. This will prevent you from making impulsive decisions that could affect your returns.

Image: tradingstrategyguides.com

Frequently Asked Questions (FAQ)

- Can forex entry point indicators guarantee profits?

No, no indicator can guarantee profits. Trading involves inherent risks, and traders should use sound risk management practices.

- What is the best forex entry point indicator for beginners?

Moving averages are a suitable choice for beginners due to their simplicity and versatility.

- How often should I check forex entry point indicators?

The frequency will vary depending on your trading style. Generally, it’s recommended to review indicators regularly, such as once or twice a day.

Forex Confirmed Entry Points Indicators

Conclusion

Forex confirmed entry points indicators are an invaluable asset for traders looking to improve their trading performance. By using a combination of indicators, considering market context, and implementing proper risk management, traders can increase their chances of entering and exiting trades at the most opportune moments.

So, are you ready to unlock the potential of forex entry point indicators? Embrace the knowledge and tools provided in this article to enhance your trading strategy and progress toward your financial goals.