Introduction

Image: www.slideshare.net

In the ever-evolving world of forex trading, obtaining a license is paramount to establishing credibility, fostering trust, and operating legally. However, the path to licensure can be a maze of complexities that leave many perplexed. This comprehensive guide aims to illuminate the process, providing you with a clear roadmap to navigate the labyrinth of forex company licensing.

By delving into the intricacies of regulations, understanding the criteria, and grasping the practical steps involved, you will be empowered to secure your place within the recognized ranks of licensed forex companies. Prepare to embark on this journey of understanding, unlocking the gateways to a successful forex enterprise.

Understanding the Rationale for Forex Company Licensing

Forex licensing is not merely a formality but a crucial step to safeguard both traders and the financial sector as a whole. It ensures that companies:

- Adhere to stringent regulations, ensuring adherence to market best practices and ethical conduct.

- Possess the requisite capital to mitigate risks and maintain financial stability.

- Implement robust risk management frameworks, protecting clients’ funds from unauthorized activities.

- Maintain transparency and accountability through regular reporting and audits.

Navigating the Licensing Landscape: A Step-by-Step Guide

The licensing process varies across jurisdictions, each with specific requirements and procedures. However, the following steps provide a general framework:

-

Determination of Jurisdiction: Identify the jurisdiction in which you intend to operate and familiarize yourself with its regulatory framework.

-

Registration as a Legal Entity: Register your company as a legal entity in the chosen jurisdiction, ensuring that it meets the criteria for a forex company.

-

Compilation of Required Documents: Gather all necessary documents, such as business plans, financial statements, and proof of ownership, as per the specific requirements of the regulator.

-

Submission of Application: Submit your meticulously prepared application package to the relevant regulatory authority.

-

Background Checks and Due Diligence: The regulator will conduct thorough background checks on the company’s directors and shareholders.

-

Scrutiny of Business Plan and Risk Management Framework: The regulator will scrutinize your business plan and risk management framework, ensuring they align with regulatory expectations.

-

Capital Adequacy Assessment: The regulator will assess your company’s financial standing, evaluating its ability to meet capital adequacy requirements.

-

Licensing Approval or Denial: Following a comprehensive review, the regulatory authority will either grant or deny the license application.

Harnessing the Power of Expert Insights

As you navigate this intricate process, it is invaluable to seek guidance from experienced forex industry professionals:

-

Consult Regulatory Experts: Reach out to regulatory experts who possess deep knowledge of the licensing requirements and can provide tailored advice.

-

Network with Experienced Brokers: Connect with seasoned forex brokers who have successfully obtained licenses and can share insights into best practices.

-

Engage Legal Counsel: Consider engaging legal counsel specializing in forex regulations for sound legal advice and representation.

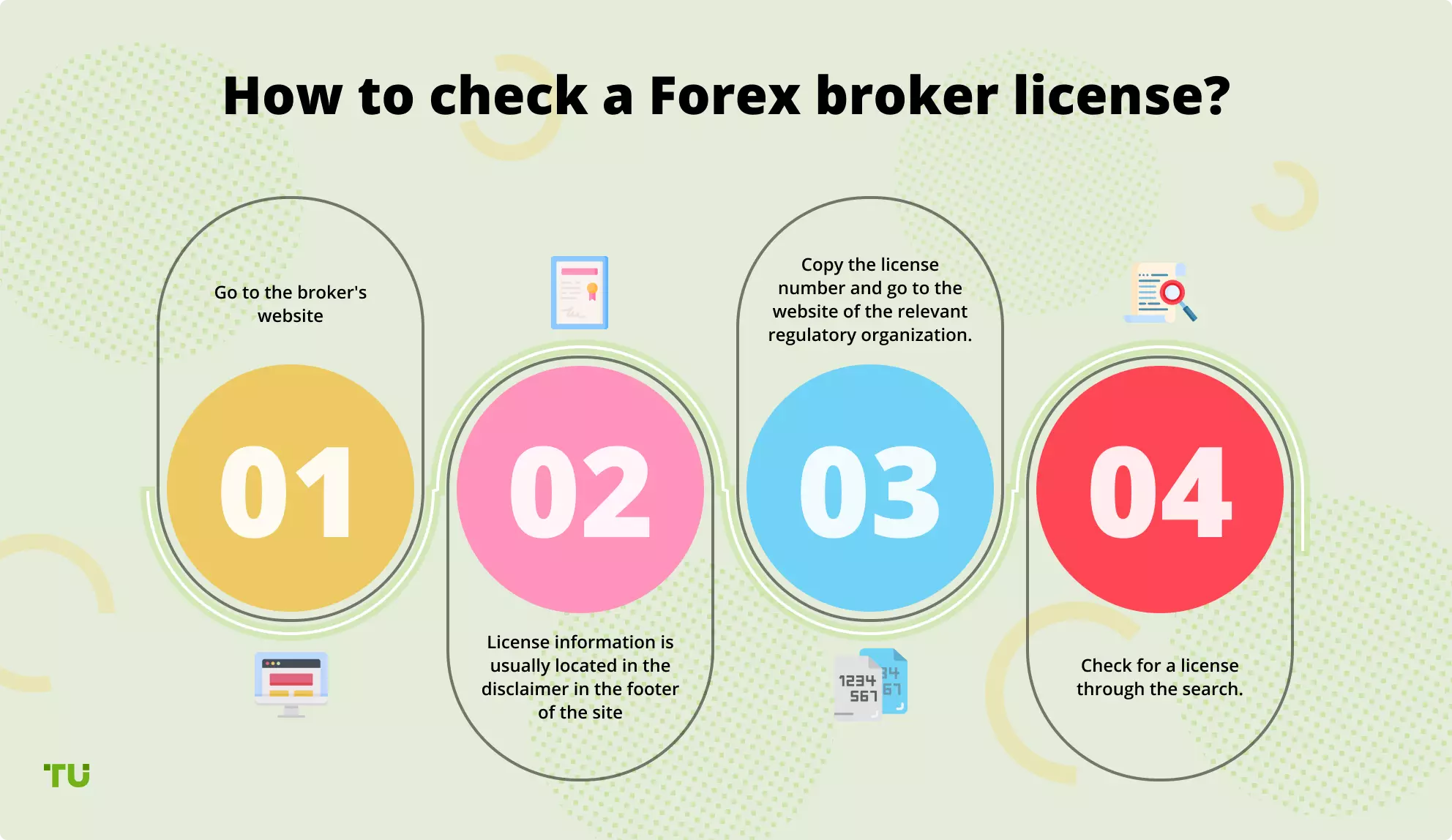

Image: tradersunion.com

Forex Company Licnence How Process

Conclusion

Navigating the complexities of forex company licensing can be a daunting task, but with perseverance and expert guidance, it is an attainable goal. By arming yourself with the knowledge outlined in this comprehensive guide, you can confidently embark on this transformative journey towards unlocking success in the forex industry. Remember, every labyrinth has a path through it, and with determination and the right tools, you can emerge as a licensed and trusted forex provider.