In today’s dynamic financial landscape, navigating the complexities of investing can feel overwhelming. The sheer number of options available, from forex to mutual funds, can leave you uncertain about where to start. Fear not, this comprehensive guide will illuminate the intricacies of these investment avenues, empowering you to make informed decisions that resonate with your financial goals.

Image: marlysrivillarral.blogspot.com

Navigating the Landscape of Investment

Investing is the key to securing your financial future, but it requires knowledge and understanding. This guide will delve into the world of forex, commodities, stocks, bonds, and mutual funds, providing you with the tools to confidently navigate this labyrinthine landscape. By delving into the intricacies of each investment option, we aim to guide you towards making informed choices that align with your financial aspirations.

1. Forex: The Currency Market

The foreign exchange market, or forex, is the world’s largest financial market, where currencies are bought, sold, and traded. Unlike other investment options, forex trading involves predicting currency movements rather than purchasing specific assets. Understanding the factors that influence currency fluctuations, such as economic data, political events, and central bank policies, is crucial for successful forex trading.

2. Commodities: The Raw Materials

Commodities are raw materials, such as gold, oil, and wheat, that are traded in physical form or as futures contracts. Investing in commodities can provide diversification and potential inflation protection. However, it’s essential to comprehend the supply and demand dynamics, geopolitical influences, and storage costs associated with commodities.

Image: keon-blogfrey.blogspot.com

3. Stocks: Ownership in Companies

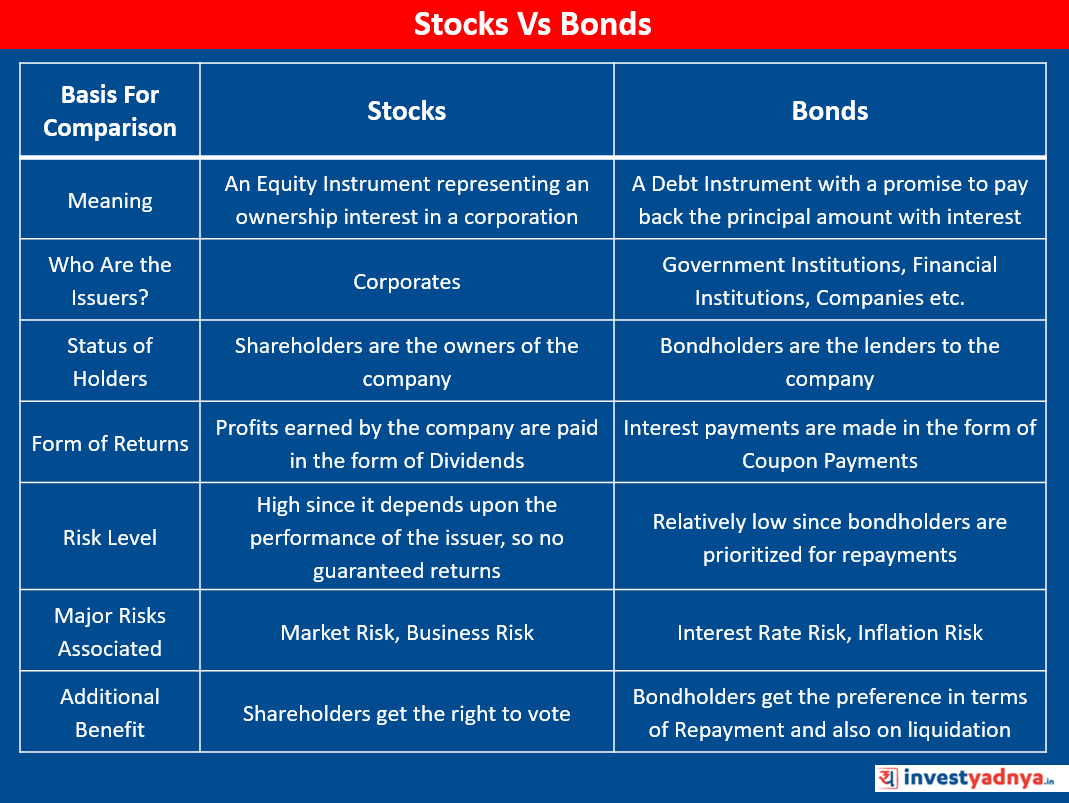

Stocks represent ownership stakes in publicly traded companies. When you purchase a stock, you become a shareholder and participate in the company’s profits and losses. Stocks offer the potential for capital appreciation and dividends but also carry the risk of value fluctuations based on company performance and market conditions.

4. Bonds: Lending to Governments and Companies

Bonds are loans made to governments or companies, offering fixed interest payments over a specified period in return for the principal amount being repaid at maturity. Bonds provide a steady stream of income and are considered less risky than stocks, but their returns are typically lower, and their value can be affected by interest rate changes.

5. Mutual Funds: Diversification at Your Fingertips

Mutual funds are investment vehicles that pool money from multiple investors and invest it in a diversified portfolio of stocks, bonds, or other assets. Mutual funds offer diversification, professional management, and lower transaction costs compared to investing directly in individual securities.

Expert Insights for a Successful Investment Journey

“Investing is not a one-size-fits-all approach. It requires careful consideration of your financial goals, risk tolerance, and time horizon,” advises financial expert Lisa Peters. To embark on a successful investment journey, she recommends:

- Define your financial goals and objectives.

- Determine your risk tolerance and investment horizon.

- Understand the different investment options and their risk-return profiles.

- Diversify your portfolio to mitigate risks.

- Seek professional advice when necessary.

Forex Commodity Stocks Bonds Mutual Funds

Conclusion: Empowering Your Investment Decisions

Understanding the intricacies of forex, commodities, stocks, bonds, and mutual funds is paramount for informed investment decisions. This guide has shed light on the nuances of each investment option, empowering you to create a tailored investment strategy that aligns with your financial aspirations. Remember, the key to successful investing lies in continuous learning, prudent decision-making, and a long-term perspective. As you embark on this investment journey, keep in mind that the financial landscape is ever-evolving, and it’s essential to stay attuned to the latest trends and developments to make informed choices that secure your financial future.