In the global financial landscape, the foreign exchange (forex) market reigns supreme as the world’s most liquid and dynamic marketplace. With trillions of dollars traded daily, the forex market offers traders and investors countless opportunities and challenges. Understanding the intricate tapestry of factors influencing market movements is crucial for success in this fast-paced arena. One such factor, often overlooked but immensely influential, is the market’s daily closing time at 21:00 GMT.

Image: www.dolphintrader.com

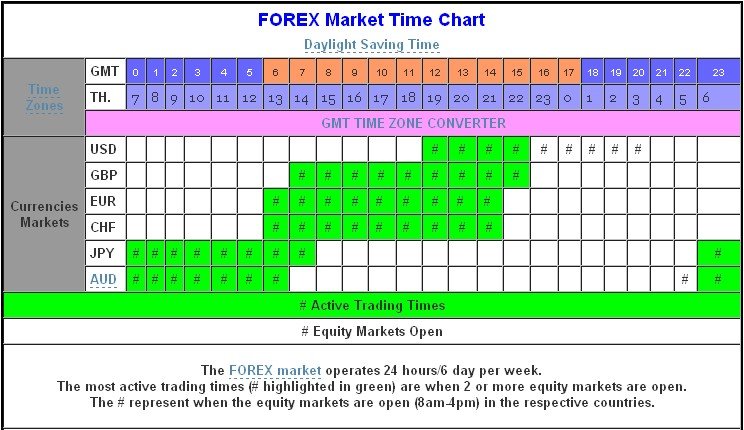

The forex market, unlike traditional stock exchanges, operates 24 hours a day, five days a week. However, each trading day officially concludes at 21:00 Greenwich Mean Time (GMT). This synchronized closing time ensures a seamless transition between trading sessions and provides traders with a benchmark against which to measure their performance and adjust their strategies accordingly.

Unveiling the Significance of 21:00 GMT Close

The 21:00 GMT close serves as a pivotal juncture in the forex market’s daily cycle. It marks the end of the New York trading session, which typically coincides with the highest trading volume and volatility. As the New York session draws to a close, traders from around the world begin to assess their positions and make adjustments based on the day’s market performance.

This closing time holds particular importance for traders who employ day trading or scalping strategies. These strategies rely on exploiting short-term market fluctuations for profit. As the market nears its close, day traders often unwind their positions to secure profits or mitigate losses accumulated during the day. This concentration of trading activity around the closing time can lead to increased volatility and market movements.

Moreover, the 21:00 GMT close coincides with the release of significant economic data in various regions. Economic indicators such as employment figures, inflation rates, and central bank announcements can significantly impact currency prices. Traders closely monitor these data releases and adjust their trading strategies accordingly.

Navigating Market Movements After the 21:00 GMT Close

While the forex market’s official trading day ends at 21:00 GMT, market activity doesn’t cease entirely. The interbank market, where large financial institutions trade directly with each other, remains active beyond the official closing time. These trades can influence currency prices and create opportunities for traders willing to stay engaged after the primary trading sessions.

For traders who prefer to avoid the potential volatility surrounding the closing time, it’s prudent to scale back their trading activity or close their positions before the 21:00 GMT mark. This allows them to lock in their profits or minimize their risks before the market’s more unpredictable post-closing behavior.

Leveraging the 21:00 GMT Close to Enhance Trading Strategies

Understanding the implications of the forex market’s 21:00 GMT close empowers traders with a strategic advantage. By aligning their trading plans with the market’s natural rhythms, traders can optimize their performance and mitigate risks. Here are some valuable insights for traders to consider:

-

Maximize Activity During Peak Trading Hours: The hours leading up to the 21:00 GMT close are often the most active and volatile in the forex market. Traders should concentrate their trading efforts during this time to capitalize on the increased market liquidity.

-

Beware of Post-Closing Volatility: The post-closing period can be characterized by unpredictable price movements and lower liquidity. Traders should exercise caution or avoid trading during this time to prevent unexpected losses.

-

Monitor Economic Data Releases: Stay abreast of economic data releases scheduled around the 21:00 GMT close. These announcements can trigger significant market reactions and influence trading decisions.

-

Plan Exit Strategies: Develop a clear exit strategy before placing any trades. Determine the desired profit targets and stop-loss levels to manage risk and secure profits effectively.

-

Utilize Market Sentiment Indicators: Leverage market sentiment indicators like the Relative Strength Index (RSI) or the Stochastic Oscillator to gauge market sentiment near the closing time. These indicators can help traders identify potential areas of support and resistance.

Image: tradingsitus.blogspot.com

Forex Close At 21 00 Gmt

Conclusion

The forex market’s daily close at 21:00 GMT stands as a pivotal marker with far-reaching implications for traders. By comprehending the influence of this closing time and adjusting their strategies accordingly, traders can harness the market’s rhythms to their advantage, navigate volatility effectively, and elevate their trading performance. Whether you’re a seasoned veteran or a budding trader, mastering the intricacies of the 21:00 GMT close will empower you to make informed decisions and achieve greater success in the fast-paced world of forex trading.