Introduction

In today’s globalized economy, foreign exchange (Forex) transactions have become increasingly common. Whether you’re a seasoned traveler, an online shopper, or a global investor, it’s essential to be aware of the potential charges associated with using credit cards for Forex payments. This comprehensive guide will delve into the intricacies of Forex charges and help you navigate the complexities of cross-border transactions. By the end of this article, you’ll be equipped with valuable insights and strategies to minimize the financial impact of Forex charges on your credit card payments.

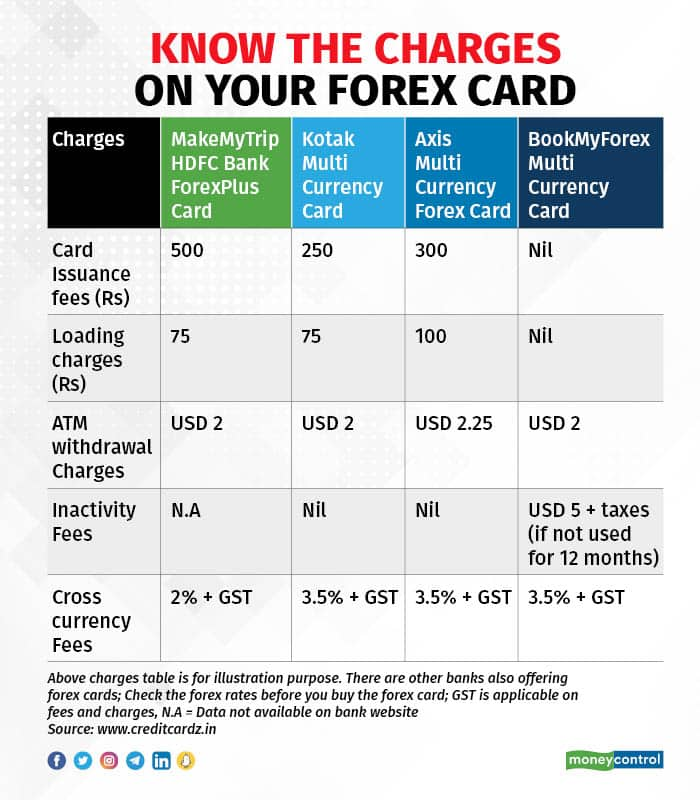

Image: www.moneycontrol.com

Understanding Forex Charges

Whenever you use a credit card to make a purchase in a foreign currency, your card issuer converts the transaction amount from the foreign currency into your home currency. This conversion process often incurs a currency conversion fee, which can vary depending on your card issuer. In addition, some credit card issuers also charge a foreign transaction fee, a percentage-based charge applied to all transactions made outside of your home country. These charges can add up quickly, especially for frequent travelers or those who make large international purchases.

Factors Influencing Forex Charges

The amount of Forex charges you incur can vary depending on several factors:

- Card Issuer: Different credit card issuers have varying fee structures for Forex transactions. It’s crucial to compare the fees charged by different issuers before choosing a card.

- Transaction Amount: The larger the transaction amount, the higher the potential Forex charges.

- Currency Conversion Rate: The currency conversion rate at the time of the transaction can impact the amount of fees you incur.

Navigating Forex Charges with Credit Cards

Despite the potential charges, using credit cards for Forex transactions can still be convenient and beneficial. Here are some strategies to navigate Forex charges effectively:

- Choose a Credit Card with Low Fees: Opt for a credit card that offers competitive Forex rates and minimal transaction fees.

- Utilize Currency Conversion Services: Consider using currency conversion services like XE or CurrencyFair that often provide more favorable exchange rates than credit card issuers.

- Make Large Purchases at Home: If possible, make significant purchases in your home currency to avoid Forex charges.

- Use Cash or Local Debit Cards: In some cases, using cash or local debit cards can be more cost-effective than using credit cards.

Image: themisterfinance.com

Expert Insights and Actionable Tips

“Understanding the dynamics of Forex charges is crucial for minimizing their impact on your finances,” says financial advisor Mark Jenkins. “By researching different credit card options and utilizing alternative currency conversion services, you can save significant amounts of money in the long run.”

Here are some additional tips to empower you further:

- Keep Track of Your Expenses: Monitor your credit card statements closely to track Forex charges and identify any discrepancies.

- Negotiate with Your Credit Card Issuer: In some cases, you may be able to negotiate with your credit card issuer to reduce or waive Forex charges.

- Consider Forex Prepaid Cards: These cards offer locked-in exchange rates and often charge lower fees than traditional credit cards.

Forex Charges For Credit Payment Amex

Conclusion

Forex charges can add an unexpected layer of expense to your credit card transactions. However, by understanding the factors that influence these charges and employing the strategies outlined in this guide, you can effectively mitigate their impact. Whether you’re planning an international trip or making online purchases across borders, being informed about Forex charges will empower you to make informed financial decisions and optimize your currency conversions. Remember, knowledge is the key to unlocking financial freedom and navigating the complexities of the global marketplace.