Navigating Currency Exchanges with Ease and Savings

In the ever-evolving landscape of global trade and travel, managing currency exchanges can be a daunting task. However, with the Standard Chartered Credit Card, you can embark on your international adventures with unparalleled ease, convenience, and savings. The forex charge feature empowers you to convert currencies effortlessly, freeing you to focus on the experiences that truly matter.

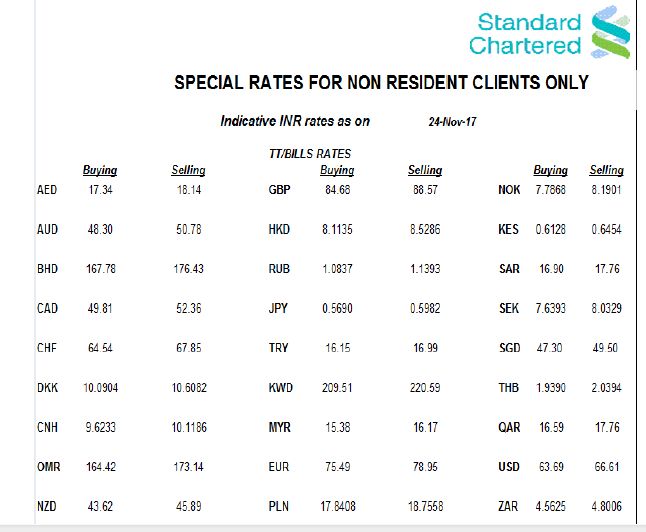

Image: www.creditcard.co.in

Understanding Forex Charges

Forex, or foreign exchange, refers to the process of exchanging one currency for another. When using your Standard Chartered Credit Card abroad, the bank converts the local currency into your home currency at a competitive rate. This eliminates the need for carrying multiple currencies or relying on often less favorable exchange rates offered by exchange bureaus.

Benefits of Using the Standard Chartered Credit Card for Forex Charges

- Competitive Exchange Rates: Enjoy exchange rates that are typically better than those offered at airports or exchange bureaus.

- Zero Transaction Fees: Take advantage of no transaction fees on all forex charges, saving you money on every international transaction.

- Real-Time Conversion: Currency conversions are processed instantaneously, providing you with up-to-the-minute exchange rates.

- Convenience and Security: Make payments and withdraw cash with ease, knowing that your card is backed by Standard Chartered’s world-class security measures.

Tips for Maximizing Forex Savings

- Inform the Bank of Your Travel Plans: Notify Standard Chartered about your upcoming international trip to ensure smooth and timely transaction processing.

- Use ATMs Wisely: Opt for Standard Chartered ATMs or partner bank ATMs for cost-efficient cash withdrawals.

- Consider a Foreign Currency Account: To enhance savings further, consider opening a foreign currency account with Standard Chartered to hold local currencies.

Image: eduvark.com

FAQs

Q: Are there any limits on forex charge transactions?

A: Standard Chartered may impose transaction limits based on your account type and spending habits.

Q: How can I track my forex charges?

A: Detailed statements and mobile banking services provide real-time updates on all your forex transactions.

Q: What if I have concerns about fraud or unauthorized transactions?

A: Standard Chartered’s advanced fraud detection systems monitor all transactions, and you can report fraudulent activity promptly.

Forex Charge Standard Chartered Credit Card

Conclusion

By harnessing the power of the Standard Chartered Credit Card and its forex charge feature, you can conquer currency exchanges effortlessly. Embrace the convenience, savings, and global opportunities that await you. Whether you’re planning a business trip or an unforgettable vacation, your Standard Chartered Credit Card is the key to unlocking a world of seamless financial experiences.

Is this topic interesting to you? Share your thoughts and experiences in the comments section below.