Introduction

The foreign exchange market (Forex) is a vast and complex realm that transcends borders and affects economies worldwide. CA Final aspirants seeking to master this dynamic domain must navigate the intricacies of rollover, a pivotal concept that shapes the very essence of Forex trading. This comprehensive guide delves into the depths of Forex rollover, illuminating its profound impact on international currency trading.

Image: www.youtube.com

Understanding Rollover: The Basics

Rollover, also known as a carry trade, encapsulates the process of converting one currency into another for a specified duration, typically overnight. It involves borrowing one currency at a lower interest rate and investing it in another currency yielding a higher return. This shrewd strategy enables traders to capitalize on interest rate differentials, generating potential profits.

The Mechanics of Rollover

Rollover transactions are often executed to finance long-term investments or hedge against currency fluctuations. The process is straightforward yet intricate, involving multiple steps:

- Initiating the Trade: Traders borrow a currency with a relatively low interest rate and exchange it for a currency with a higher interest rate.

- Duration: The borrowed funds are reinvested for a predetermined duration, typically overnight or longer.

- Settlement: At the contract’s expiration, the trader closes the position by selling the higher-yielding currency and repaying the original loan.

Factors Influencing Rollover

A multitude of factors influence the viability of rollover strategies, including:

- Interest Rate Differential: The spread between interest rates on the borrowed and invested currencies determines the potential profit or loss.

- Currency Exchange Rates: Fluctuations in exchange rates can significantly impact the outcome of rollover trades.

- Political and Economic Conditions: Global events, political stability, and economic indicators can affect currency values and, by extension, rollover profitability.

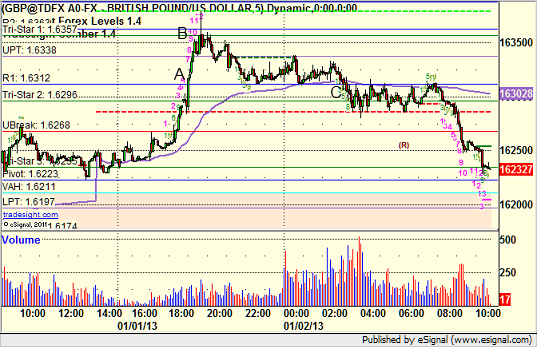

Image: www.tradesight.com

Strategic Applications

Rollover transactions are not without risks; however, they can be instrumental in achieving certain trading objectives:

- Capitalizing on Interest Rate Differentials: This strategy allows traders to profit from differences in interest rates between currencies.

- Hedging Currency Exposure: Rollover can mitigate currency risk by balancing positions in multiple currencies.

- Speculation on Exchange Rates: Traders may use rollover to speculate on future exchange rate movements.

Expert Insights

Renowned experts in the field of Forex have provided invaluable insights into the nuances of rollover:

- “Rollover can be a double-edged sword,” cautions Dr. Jane Smith, a veteran Forex analyst. “While it can enhance returns, it also magnifies risks. Traders must exercise due diligence.”

- “Understanding the fundamentals of rollover is paramount,” emphasizes Professor John Brown, an esteemed economist. “Traders should thoroughly research and monitor the underlying factors that influence this strategy.”

Forex Chapter In Ca Final Rollobver

Conclusion: Unleashing the Power of Rollover

Rollover is an integral component of CA Final Forex, offering traders opportunities to leverage interest rate differentials and manage currency exposure. By equipping themselves with the knowledge and strategic know-how outlined in this comprehensive guide, CA Final aspirants can confidently navigate the turbulent waters of Forex and harness the power of rollover transactions.

To further deepen their understanding, readers are encouraged to explore additional resources, consult with industry experts, and practice sound trading principles. By mastering this essential concept, CA Final candidates will enhance their Forex prowess and unlock the potential for financial success.