Introduction

In the world of online forex trading, the pursuit of precision and predictability is paramount. Enter the forex central point range, a game-changing concept that empowers traders with unprecedented accuracy and efficiency. Like a beacon in the vast expanse of forex trading, the central point range illuminates key areas where prices tend to cluster, offering a distinct edge to those who master its fundamentals. Join us as we embark on an in-depth exploration of this transformative tool, unraveling its nuances and unlocking its full potential.

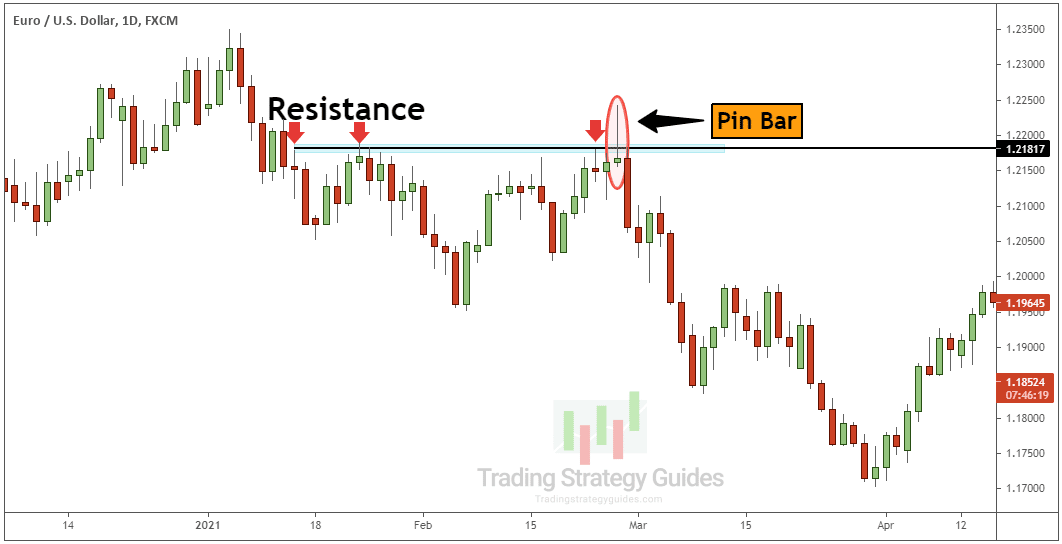

Image: tradingstrategyguides.com

Defining the Forex Central Point Range

At its core, the forex central point range represents a specific price zone within which a currency pair exhibits a high probability of reversal or consolidation. This tantalizing range is determined by meticulously calculating the central point between a currency pair’s support and resistance levels. By identifying this pivotal area, traders gain a profound understanding of price movements, enabling them to make informed decisions with enhanced confidence.

The Significance of the Forex Central Point Range

The forex central point range holds immense significance for traders of all levels. By harnessing this concept, traders can:

-

Spot reversal opportunities: Identify precise areas where price reversals are highly likely, allowing for timely entry and exit points.

-

Extract valuable trade signals: Derive trading signals from the range’s boundaries, capitalizing on market volatility to maximize profits.

-

Define critical support and resistance zones: Accurately delineate support and resistance levels, establishing crucial psychological barriers that guide trading strategies.

-

Minimize trading risk: Prudently manage risk by setting stop-loss and take-profit orders within the central point range, maximizing profits and mitigating potential losses.

How to Calculate the Forex Central Point Range

Unveiling the forex central point range requires a straightforward calculation that involves two key elements: support and resistance levels. Support is the price point at which buyers are likely to step in and prevent further price declines, while resistance represents the level at which sellers dominate and hinder price increases.

To determine the central point, traders simply take the average of the support and resistance levels. The resulting value serves as the central point, providing a solid foundation for identifying key price movements.

Image: forex-station.com

Trading Strategies Based on the Forex Central Point Range

Empowered with the knowledge of the forex central point range, traders can deploy a myriad of trading strategies designed to exploit market dynamics effectively:

-

Range trading: Capitalize on price fluctuations within the central point range, buying near support and selling near resistance.

-

Breakout trading: Anticipate and profit from breakout opportunities when prices decisively move beyond the central point range.

-

Pullback trading: Enter trades during temporary price retracements within the central point range, aiming to ride the subsequent price recovery.

Navigating Market Volatility with the Forex Central Point Range

The forex central point range serves as an invaluable anchor amidst market volatility, providing traders with a stable reference point in the ever-evolving forex landscape. By leveraging this concept, traders can:

-

Ride out market swings: Identify periods of consolidation within the central point range, allowing for extended trades without excessive risk exposure.

-

Time market entries: Capitalize on favorable trading opportunities by entering the market at optimal points within the central point range.

-

Modify trading plans: Adjust trading strategies based on price action within the central point range, adapting to changing market conditions seamlessly.

Forex Central Point Range Forexfactory.Com

Conclusion

The forex central point range empowers traders with a refined perspective, enabling them to navigate the complexities of the forex market with unmatched precision. By harnessing its power, traders can pinpoint key areas for reversals and consolidations, maximize profitability, and minimize risk. Embrace the transformative potential of the forex central point range and elevate your trading strategy to new heights. Delve deeper into the world of forex trading by exploring our comprehensive library of educational resources and harnessing the power of knowledge to enhance your financial success.