In the world of forex trading, scalping is a popular strategy for capturing small price movements. One of the most effective scalping techniques involves combining the Commodity Channel Index (CCI) with the Supertrend indicator. In this comprehensive guide, we’ll delve deep into the intricacies of this strategy, exploring its potential benefits in the forex market.

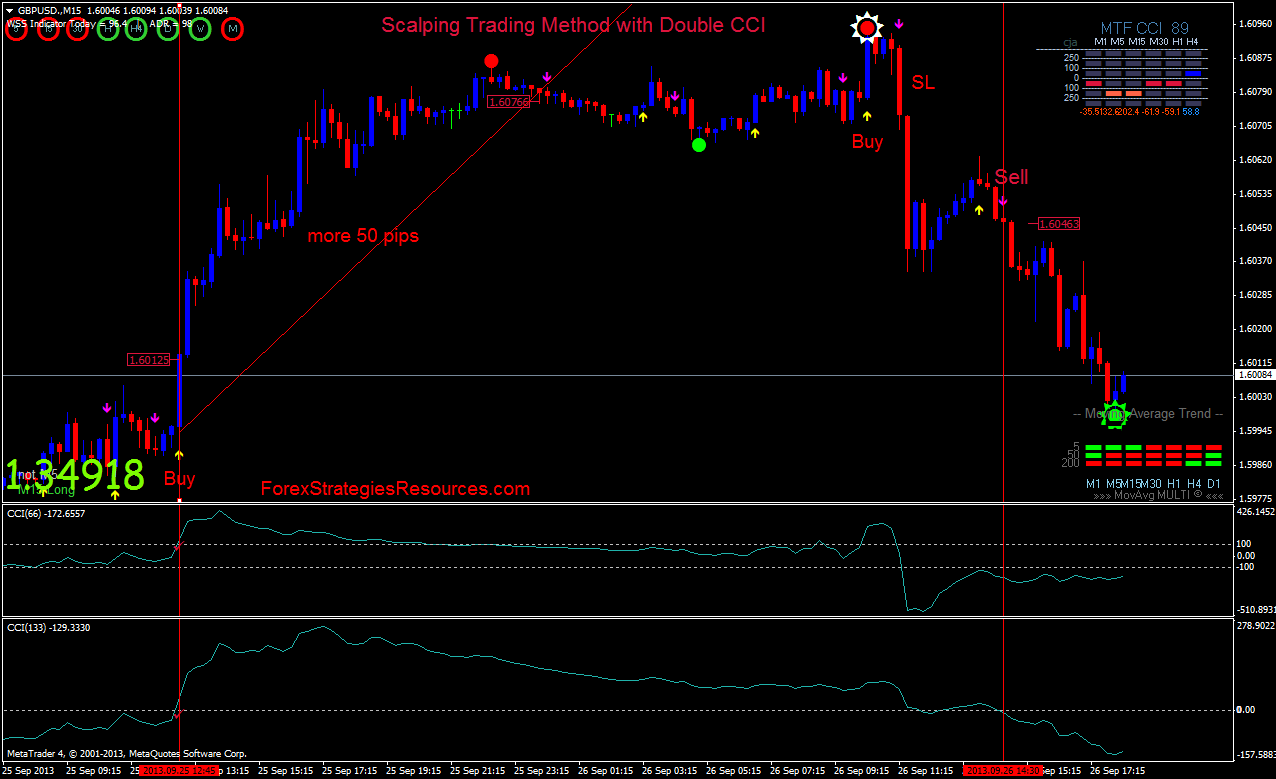

Image: www.forexstrategiesresources.com

Understanding the Forex CCI Supertrend Scalping Strategy

The CCI Supertrend scalping strategy is a technical analysis approach based on the combination of the Commodity Channel Index (CCI) and the Supertrend oscillator. The CCI measures the deviation of an asset’s price from its average, indicating overbought and oversold conditions, while the Supertrend highlights price trends and identifies potential reversals.

Trading Rules and Execution

Buy signals:

1. Wait for the CCI to move above +100.

2. Identify a bullish Supertrend indicator, which is green in color.

3. Enter a buy position with a pending order slightly above the current market price.

Sell signals:

1. Observe the CCI dropping below -100.

2. Confirm a bearish Supertrend indicator, which is red in color.

3. Place a sell order slightly below the current market price.

Risk Management and Position Sizing

Managing risk is crucial in any trading strategy. When utilizing the CCI Supertrend scalping strategy, it’s essential to:

- Maintain a low risk-to-reward ratio, setting a profit target at least twice the size of your stop loss.

- Limit your position size in accordance with your account balance and risk tolerance.

- Consider using a trailing stop to protect profits and limit potential losses.

Image: bestforexmt4indicators.com

Tips for Enhanced Trading

Experienced traders have accumulated invaluable insights over time, and by incorporating their expertise, you can refine your CCI Supertrend scalping strategy.

- Trade during volatile market conditions: The strategy excels when price movements are more rapid and frequent.

- Stay disciplined: Adhere to the trading rules and avoid impulsive decision-making.

- Manage emotions: Trading can be emotionally taxing, but staying composed is vital for success.

Frequently Asked Questions

Q: What currency pairs are best suited for the CCI Supertrend scalping strategy?

A: The strategy is versatile and can be applied to various currency pairs. However, focusing on major pairs like EUR/USD and GBP/USD is recommended.

Q: What is the optimal timeframe for trading with this strategy?

A: Scalping involves quick trades, so short timeframes like 5-minute or 15-minute charts are optimal.

Forex Cci Supertrend Scalping Strategy

Conclusion

The CCI Supertrend scalping strategy is a powerful approach for capturing price movements in the forex market. By combining the strengths of the CCI and Supertrend indicators, traders can identify high-probability trades with precise entries and exits. Implementing the trading rules, risk management techniques, and expert tips outlined in this guide can significantly enhance your chances of success in forex scalping. Are you ready to explore the exciting world of forex scalping with the CCI Supertrend strategy?