For globetrotters and business travelers alike, currency conversion charges can add up quickly, dampening the joy of exploring new destinations. Enter the forex card, a game-changer that eliminates the exorbitant fees associated with traditional currency exchange methods. In this comprehensive guide, we unravel the intricacies of forex cards, highlighting their benefits, exploring their usage, and empowering you to make informed decisions for your next adventure.

Image: www.forex.academy

Unlocking the Benefits of Forex Cards: A Path to Savings

Forex cards, also known as multi-currency cards, offer a plethora of advantages that make them an indispensable tool for cost-conscious travelers. Here’s a closer look at their key benefits:

-

Eliminate Currency Conversion Charges: The most significant advantage of forex cards lies in their ability to save you money by eliminating currency conversion fees. These fees can range from 2% to 5%, adding up to substantial amounts, especially for extended trips or large purchases.

-

Competitive Exchange Rates: Forex cards offer competitive exchange rates, often at par with interbank rates. Unlike traditional exchange bureaus or banks, forex cards typically do not mark up their rates, ensuring you receive the best value for your money.

-

Convenience and Accessibility: Forex cards are widely accepted at ATMs, point-of-sale terminals, and online marketplaces worldwide, providing you with convenient access to local currencies. No more fumbling with multiple currencies or searching for exchange bureaus.

-

Security and Peace of Mind: Forex cards are equipped with advanced security features, such as chip-and-PIN technology and fraud protection, safeguarding your funds against unauthorized access. They also eliminate the risk of carrying large amounts of cash, providing peace of mind during your travels.

-

Ease of Use: Using a forex card is straightforward and hassle-free. Simply load your card with multiple currencies, and you’re ready to make purchases or withdraw cash with minimal effort.

Understanding the Nuances: Types and Usage of Forex Cards

Forex cards come in various types, each tailored to specific needs. Here’s a closer look at the common options:

1. Prepaid Forex Cards:

Prepaid forex cards are pre-loaded with a specific amount of foreign currency. They are a great option for travelers who prefer to budget their expenses in advance. Once the funds are depleted, you can reload the card as needed.

Image: www.moneycontrol.com

2. Reloadable Forex Cards:

Reloadable forex cards allow you to add funds in multiple currencies and withdraw cash or make purchases. They are suitable for travelers who need flexibility in managing their currency needs.

3. Travel Money Cards:**

Some forex cards are specifically designed for business or leisure travel. They may offer additional benefits, such as travel insurance or airport lounge access.

Using Your Forex Card: A Step-by-Step Guide

Using a forex card is effortless:

-

Choose a reputable forex provider and select the card that best meets your needs.

-

Load your card with the desired currency or currencies.

-

When making a purchase, select the appropriate currency from your forex card.

-

Enjoy the convenience of swiping or inserting your card at payment terminals.

-

For cash withdrawals, insert your card into an ATM and follow the prompts to withdraw the desired amount in local currency.

Choosing the Right Forex Card: A Tailored Approach

Selecting the right forex card depends on your individual travel style and currency needs. Consider the following factors:

1. Destination and Currency:**

Determine the currencies you’ll need on your trip and choose a forex card that supports those currencies.

2. Usage Pattern:**

Estimate your spending patterns and select a card that suits your usage frequency.

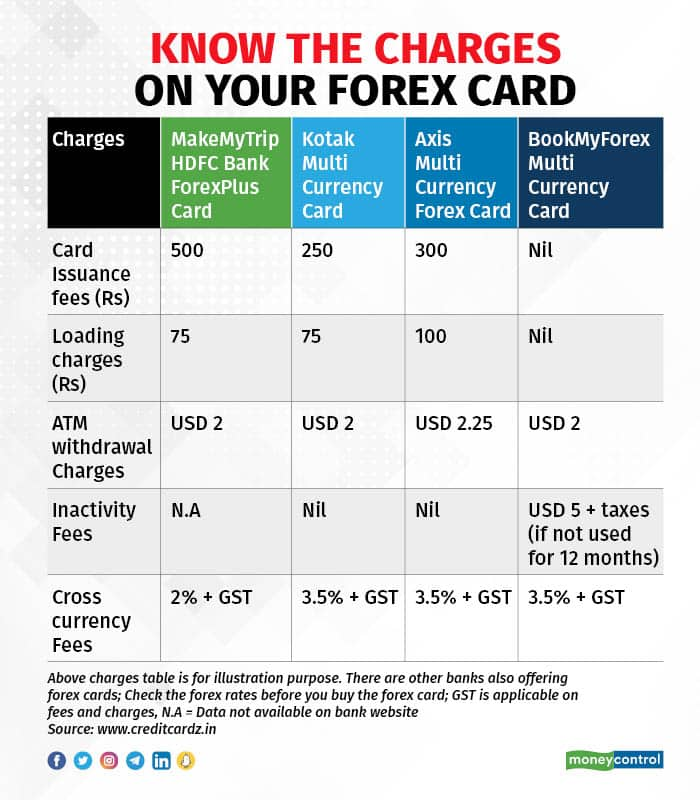

3. Fees and Charges:**

Compare the fees and charges associated with different forex cards to avoid unnecessary expenses.

4. Security Features:**

Ensure the forex card you choose offers robust security measures to protect your funds.

- Customer Support:** Look for forex providers with reliable customer support in case of any queries or issues.

By carefully evaluating these factors, you can select the forex card that aligns seamlessly with your travel needs.

Forex Card To Save Currency Conversion Charges

Latest Trends in Forex Cards: Innovation at Your Fingertips

-

Virtual Forex Cards: These cards exist digitally, allowing for virtual transactions and eliminating the need for a physical card.

-

Mobile-Integrated Forex Cards: Some forex providers offer mobile apps that integrate with your forex card, providing convenient account management and real-time tracking of expenses.

-

Currency Exchange Apps: These apps enable you to exchange currencies on the go, offering flexibility and competitive exchange rates.

Staying abreast of these latest trends ensures you have the most up-to-date tools for managing your currency needs.

Conclusion: Embrace the Forex Card Revolution and Save on Currency Conversions

Forex cards are a savvy traveler’s secret weapon for saving money on currency conversion charges while enjoying convenience, security, and peace of mind. By understanding the benefits, usage, and types of forex cards, you can make informed decisions and choose the card that best aligns with your travel style and currency needs. Embrace the forex card revolution and start exploring the world without the burden of exorbitant currency conversion fees.