In today’s interconnected global economy, managing cross-border payments and accessing funds abroad has become a ubiquitous necessity for businesses and travelers alike. Forex cards, offered by leading financial institutions like Standard Chartered India, have emerged as the preferred tool for navigating the complexities of foreign exchange transactions.

Image: howtotradeonforex.github.io

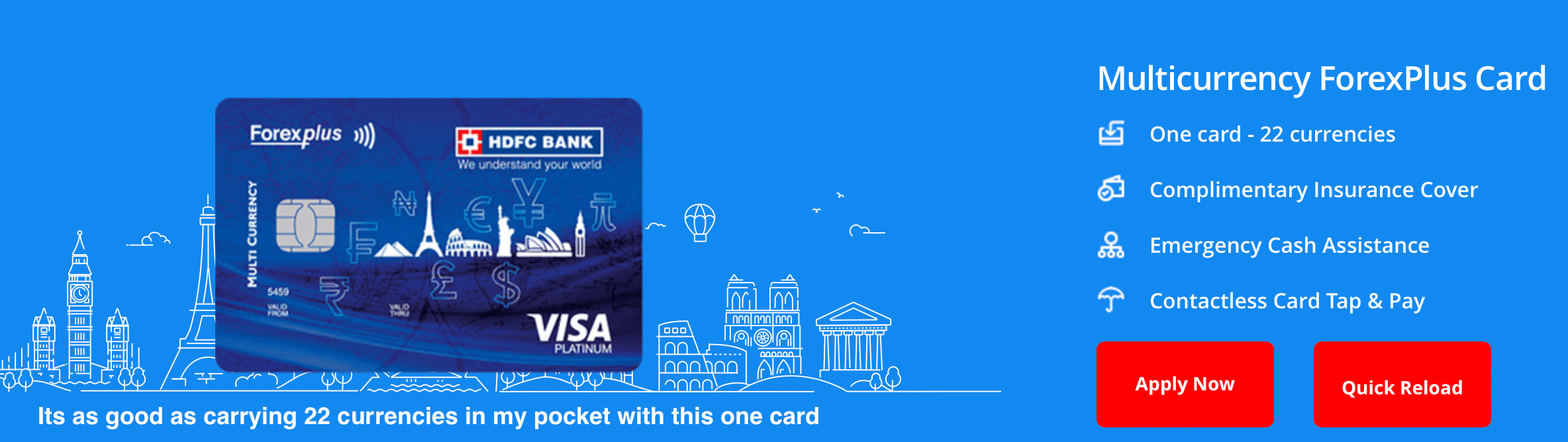

A Forex Card, often referred to as a multi-currency card, is a prepaid card used for making payments and withdrawing cash in foreign currencies. It provides a secure, convenient, and cost-effective way to manage your finances while traveling or conducting business abroad. With a Standard Chartered Forex Card, you gain access to a world of financial flexibility, empowering you to make purchases in over 200 countries and withdraw cash from millions of ATMs worldwide.

Embrace Seamless Global Transactions with Forex Cards

Forex cards have revolutionized the way we handle international payments. Unlike traditional credit cards, forex cards do not incur foreign transaction fees, allowing you to save significantly on exchange rates and transaction charges. This feature is particularly advantageous for frequent travelers and individuals who regularly conduct business across borders.

Standard Chartered’s Forex Card offers competitive exchange rates, ensuring that you get the most out of your money when exchanging currencies. The card also provides real-time tracking of your transactions through online and mobile banking platforms, giving you complete control over your spending.

Explore Worldly Delights with Forex Card Convenience

Whether you’re a seasoned traveler or a business professional venturing into new markets, a Forex Card from Standard Chartered opens up a world of possibilities. No longer will you be constrained by the limitations of carrying cash or relying on unreliable exchange bureaus.

With your Standard Chartered Forex Card, you can experience the freedom and security of cashless transactions in foreign lands. Pay for souvenirs, dining experiences, or accommodation expenses with ease, knowing that you are getting the best possible exchange rates.

Discover the Benefits that Elevate Your Travels

Standard Chartered’s Forex Card is not just a financial tool; it’s your companion on every global adventure. Enjoy exclusive benefits and privileges that enhance your travel experience, such as:

- Priority Pass membership, granting you access to over 1,300 airport lounges worldwide

- Travel and purchase protection insurance, providing peace of mind during your journeys

- Emergency cash assistance, ensuring you have access to funds in case of unforeseen circumstances

Image: moneymint.com

Forex Card Standard Chartered India

Unlock the Future of International Finances

As the world continues to shrink and globalization accelerates, forex cards are poised to play an even more pivotal role in our financial lives. With the Standard Chartered Forex Card, you gain the power to manage your cross-border transactions effortlessly and cost-effectively. Whether you’re a seasoned globetrotter, a business executive, or an individual seeking financial flexibility, a Forex Card is the key to unlocking the boundless opportunities that lie beyond borders.