Introduction

Image: fusion.werindia.com

When embarking on international travels, equipping oneself with the appropriate financial tools is paramount. Among these essential tools is a forex card, a highly convenient and secure payment option that allows travelers to make purchases and withdraw cash without incurring exorbitant fees associated with traditional currency exchange. In this comprehensive guide, we delve into the realm of SBI forex cards, specifically addressing the timeframes involved in the application and acquisition process.

Understanding SBI Forex Cards

State Bank of India (SBI) is a leading financial institution in India, offering a range of forex card options tailored to meet the diverse needs of international travelers. SBI forex cards are prepaid cards that can be loaded with multiple foreign currencies, eliminating the need for carrying large amounts of cash or exchanging currencies at unfavorable rates. These cards offer a host of benefits, including:

-

Competitive exchange rates

-

Wide acceptance at merchants and ATMs worldwide

-

PIN-based security and EMV chip technology for heightened protection

-

Easy online account management and transaction tracking

Application Process

Applying for an SBI forex card is a straightforward process that can be completed online or through any SBI branch. The following steps outline the application procedure:

-

Online Application: Visit the SBI website and select the ‘Forex Card’ option. Fill out the online application form, providing personal and travel details.

-

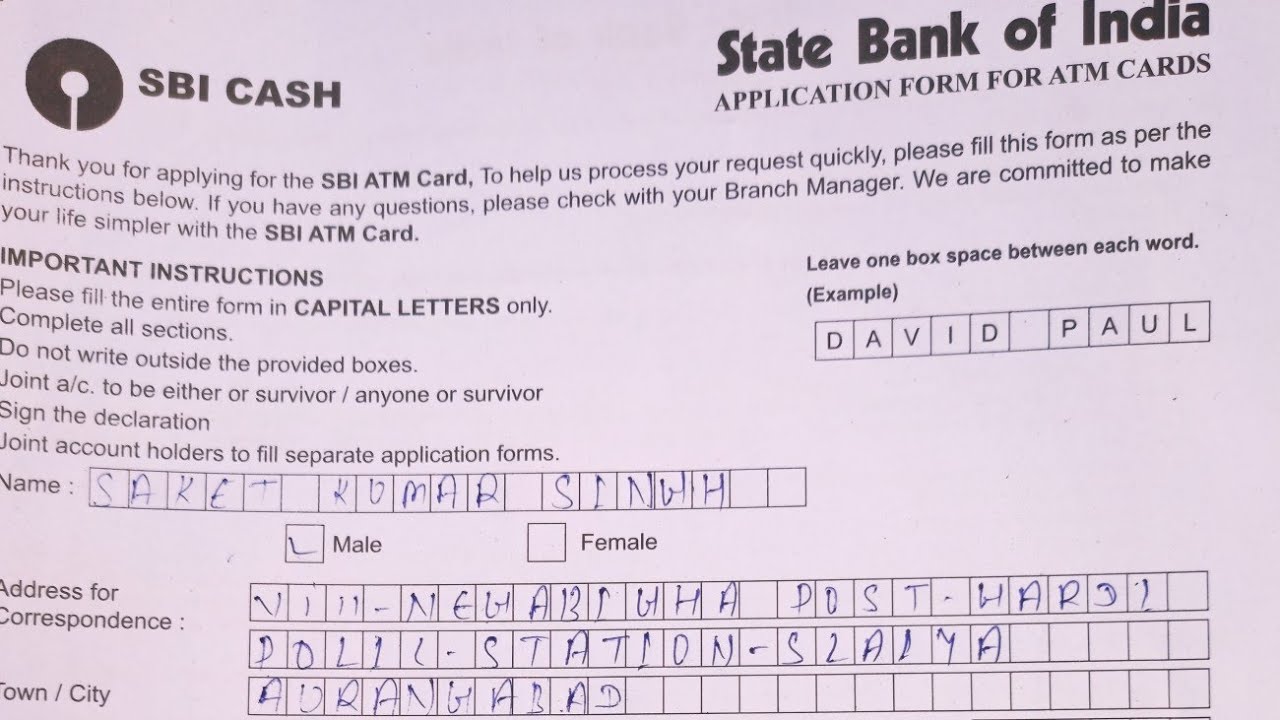

Branch Application: Visit your nearest SBI branch and collect an application form. Submit the completed form along with the required documents, including proof of identity, proof of address, and a passport-sized photograph.

-

Document Verification: Once your application is submitted, SBI will verify your documents and conduct a credit check, if necessary. This verification process may take a few days.

-

Approval and Issuance: Upon successful verification, your forex card will be approved and issued within 2-3 working days. You will receive an SMS notification and an email confirming the issuance of your card.

Acquisition Timelines

The time taken to obtain your SBI forex card can vary depending on the application method and the volume of applications being processed. Typically, the acquisition timelines are as follows:

-

Online Application: If you apply for your forex card online, you can expect to receive it within 5-7 working days from the date of approval.

-

Branch Application: For applications submitted at SBI branches, the acquisition time may be slightly longer, usually within 7-10 working days from the approval date.

It is advisable to apply for your forex card well in advance of your intended travel date to ensure that you receive it in a timely manner.

Conclusion

SBI forex cards offer a convenient and secure payment option for international travelers. The application and acquisition process is straightforward, with approval and issuance typically taking a few working days. By understanding the application procedures and timelines, you can ensure that you have your SBI forex card in hand before embarking on your journey.

Image: www.aiohotzgirl.com

Forex Card Sbi Time Tak3n To Obtain