In the interconnected world of today, seamless international financial transactions have become essential for individuals and businesses alike. SBI Forex Cards offer a convenient and secure solution for managing your finances abroad, bridging geographical boundaries and facilitating global endeavors.

Image: www.bankindia.org

SBI Forex Cards are prepaid cards linked to a foreign currency account, providing a hassle-free way to make payments, withdraw cash, and transfer funds across borders. These cards empower cardholders with the flexibility to avoid currency exchange losses and enjoy competitive rates compared to traditional banking channels.

Understanding the Benefits of SBI Forex Cards

Convenience and Flexibility: SBI Forex Cards eliminate the need for carrying large amounts of cash or travelers’ checks, reducing the risk of loss or theft. The cards can be used at millions of merchant outlets worldwide and for online purchases, offering unmatched convenience.

Competitive Exchange Rates: Avoid hidden charges and unfavorable exchange rates with SBI Forex Cards. The cards offer competitive rates, ensuring you get the most value for your money when making international transactions.

Global Acceptance: SBI Forex Cards are accepted at over 30 million merchant outlets and ATMs in over 200 countries, providing global accessibility for your financial needs.

Security and Protection: SBI Forex Cards incorporate advanced security measures to protect your funds. Chip-and-PIN technology and real-time transaction alerts ensure the safety of your transactions, giving you peace of mind.

Understanding the Functions of SBI Forex Cards

Making Payments: Use your SBI Forex Card to pay for goods and services at merchant outlets that accept international cards. This eliminates the need for currency conversion and saves you from unfavorable exchange rates.

Withdrawing Cash: Withdraw cash in foreign currency from ATMs that accept international cards. However, it’s essential to note that some ATMs may charge a withdrawal fee.

Transferring Funds: SBI Forex Cards allow you to transfer funds from your forex card account to other bank accounts swiftly and securely.

How to Obtain an SBI Forex Card

The process of obtaining an SBI Forex Card is straightforward. Visit your nearest SBI branch with valid identification documents, complete the application form, and provide supporting documentation. The card will be issued within a few days, and you can activate it by setting a PIN and loading the desired amount of foreign currency.

Image: www.forex.academy

Tips for Using SBI Forex Cards Effectively

Plan Your Currency Loading: Load multiple currencies onto your SBI Forex Card to avoid exchange rate losses and optimize your spending power.

Monitor Your Transactions: Keep track of your transactions through online banking or mobile banking apps to stay informed about your spending and balance.

Report Lost or Stolen Cards: In case of a lost or stolen SBI Forex Card, notify SBI immediately to block the card and prevent unauthorized access.

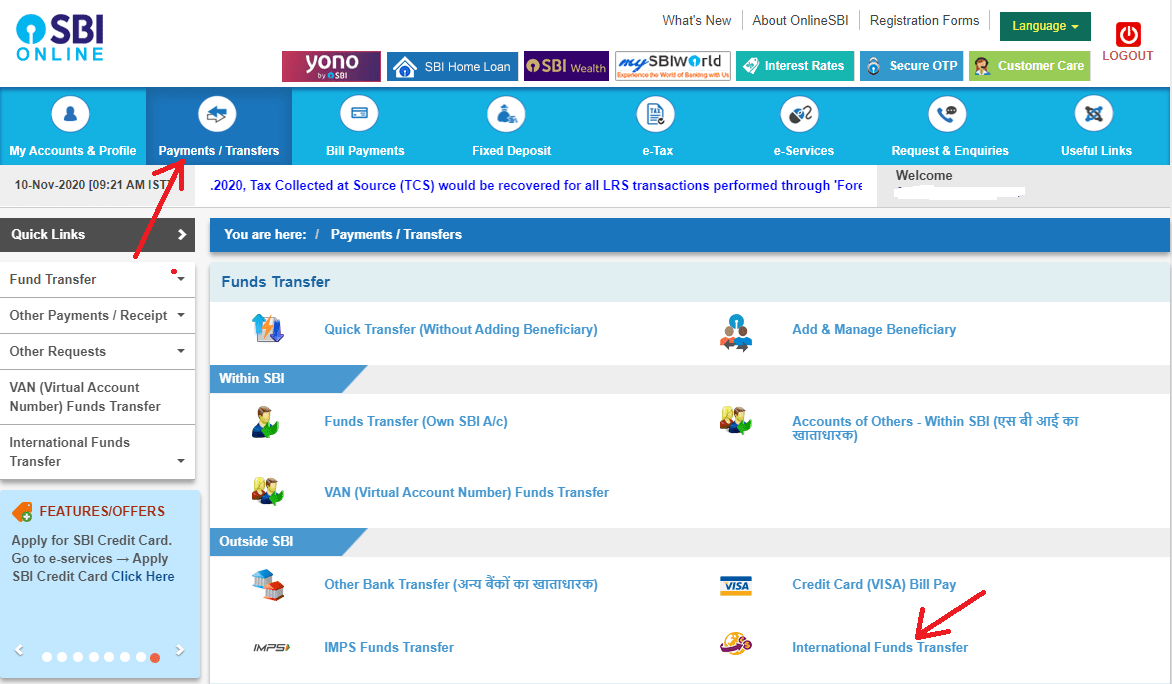

Forex Card Sbi Funds Transfer

Conclusion

SBI Forex Cards empower individuals and businesses with the ability to transact globally, eliminating geographical barriers and facilitating financial freedom. By understanding the benefits, functions, and usage of SBI Forex Cards, you can unlock the potential for seamless international transactions and embrace the world of global finance.