Unlock the Secrets of Technical Analysis in Tamil

Are you ready to unlock the secrets to successful Forex trading? Look no further than our comprehensive guide to Forex candlestick patterns, now available in Tamil. In this article, we’ll delve into the fascinating world of technical analysis and empower you with the knowledge to spot trends, identify reversal points, and maximize your profits.

Image: id.pinterest.com

Embrace the Art of Technical Analysis

Technical analysis is an indispensable tool for Forex traders, allowing them to interpret market movements by studying price charts. Candlestick patterns emerge as reliable indicators, providing valuable insights into market sentiment and upcoming price trends.

Understanding Forex Candlesticks

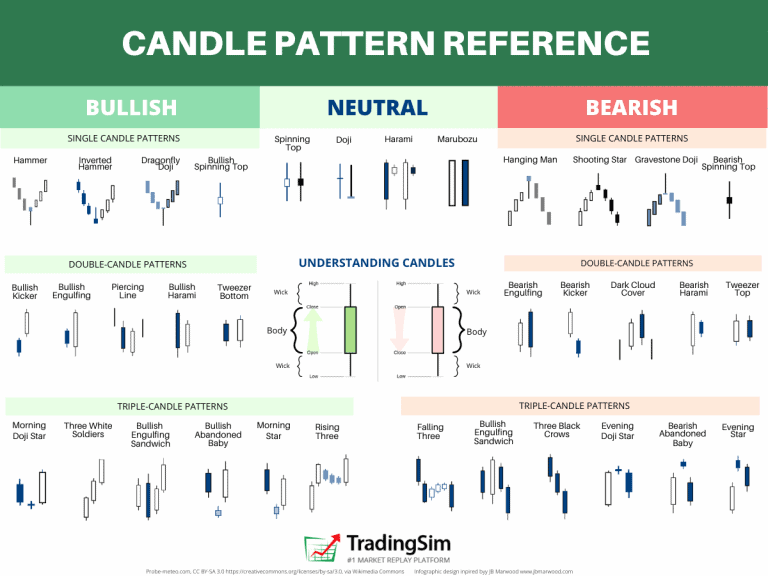

Forex candlesticks represent the price action within a specific time interval. Each candlestick consists of four components: the high and low prices, as well as the opening and closing prices. The body of the candlestick is formed by the difference between the open and close prices, while the shadows (aka wicks) extend beyond the body, indicating the highest and lowest prices reached during the interval.

Uncover Hidden Patterns in Price Action

By analyzing the shape, color, and position of candlestick patterns, traders can uncover significant clues about market sentiment. These patterns can be classified into bullish (upward trend) and bearish (downward trend) formations. Some of the most common and effective candlestick patterns include the Doji, Hammer, Shooting Star, Engulfing patterns, and Harami formations.

Image: vsamuslim.weebly.com

Mastering Forex Candlestick Patterns

To master Forex candlestick patterns, it’s crucial to understand their formation, reversal signals, and implications for future price movements. Each pattern carries its unique significance and provides valuable information to traders. By interpreting these patterns effectively, you can make informed decisions and execute profitable trades.

Tips for Enhancing Trading Strategies

- Analyze Multiple Candlesticks: Don’t rely on a single pattern alone. Consider the context of the surrounding candlesticks to confirm a trend or reversal.

- Combine with Other Indicators: Enhance the reliability of your trading decisions by combining candlestick patterns with other technical indicators like moving averages or support and resistance levels.

- Practice on Demo Accounts: Test and refine your strategies before risking real capital. Demo accounts provide a safe environment for experimentation.

Leveraging Candlestick Patterns for Success

Forex candlestick patterns offer a multitude of benefits for traders. They help traders:

- Identify market trends and reversal points

- Predict future price movements with greater accuracy

- Minimize losses and maximize profits

- Enhance trading confidence and decision-making

- Gain a competitive edge in the Forex markets

Frequently Asked Questions

Q: What is a Forex candlestick pattern?

A: Forex candlestick patterns are graphical representations of price action within a specific time interval, depicting the opening, high, low, and closing prices.

Q: How do I identify a bullish candlestick pattern?

A: Bullish patterns, like the Hammer or Engulfing patterns, indicate an upward trend and typically have a long lower shadow and a small or nonexistent upper shadow.

Q: Can I combine candlestick patterns with other trading indicators?

A: Yes, combining candlestick patterns with indicators like moving averages or support and resistance levels can improve the accuracy of your trading strategies.

Forex Candlestick Patterns Strategy In Tamil

Call to Action

Unlock the power of Forex candlestick patterns today and gain a significant advantage in the markets. Put these strategies into practice and watch your trading performance soar to new heights. Are you ready to revolutionize your Forex trading experience? Start implementing these patterns and witness the remarkable difference!