Introduction

In the realm of forex trading, understanding how to calculate profit and loss is paramount to success. When trading cross currency pairs, this calculation can become slightly more complex due to the involvement of multiple currencies. However, with a clear understanding of the process, you can navigate the intricacies of cross pair trading with confidence. This guide will delve deep into the world of cross currency pairs, empowering you with the knowledge to calculate profit and loss accurately.

Image: ar.inspiredpencil.com

Understanding Cross Currency Pairs

Cross currency pairs are currency pairs that do not involve the US dollar. For instance, the Euro-British Pound (EUR/GBP) is a cross currency pair. Unlike major currency pairs like EUR/USD, cross pairs are not as widely traded, leading to wider bid-ask spreads and increased volatility. Nonetheless, they offer traders unique opportunities to capitalize on exchange rate fluctuations between non-US dollar currencies.

Formula for Calculating Profit and Loss

The formula for calculating profit and loss in cross currency pairs is as follows:

Profit/Loss = (Closing Rate – Opening Rate) Contract Size Number of Units

Let’s break down this formula:

- Closing Rate: The exchange rate at which the position is closed.

- Opening Rate: The exchange rate at which the position was opened.

- Contract Size: The standard contract size for the currency pair being traded.

- Number of Units: The number of units traded.

Example Calculation

Suppose you open a long position (buy) on EUR/GBP at a rate of 0.8800 with a contract size of 100,000 units. If you close the position at a rate of 0.8820, your profit would be:

Profit = (0.8820 – 0.8800) 100,000 1

Profit = 200 GBP

Conversely, if the closing rate had been 0.8780, your loss would have been:

Loss = (0.8800 – 0.8780) 100,000 1

Loss = 200 GBP

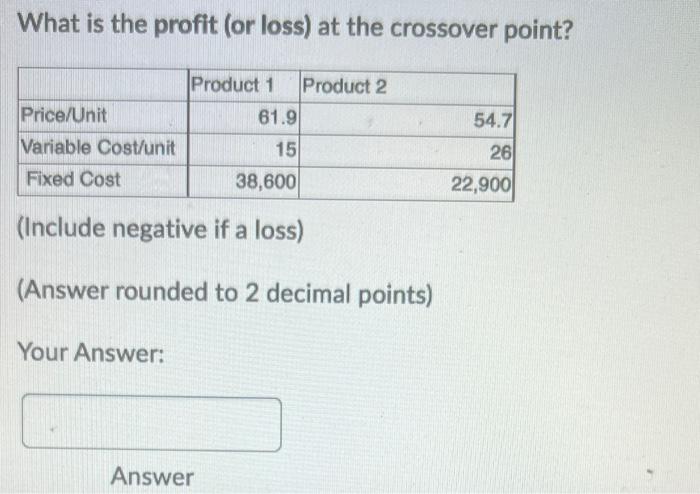

Image: www.chegg.com

Factors Affecting Profit and Loss

Several factors can impact the profit or loss in cross currency pair trading, including:

- Market Volatility: Higher volatility leads to wider bid-ask spreads, increasing the risk of slippage and reducing potential profits.

- Correlation: Cross currency pairs often exhibit positive or negative correlation, meaning their prices move in sync or in opposite directions. Understanding correlation is crucial for effective risk management.

- Leverage: Using leverage can amplify both profits and losses. It’s essential to manage leverage cautiously to avoid excessive risk exposure.

Tips for Profitable Cross Pair Trading

Here are some tips to help you make informed decisions and enhance your chances of profitability:

- Technical Analysis: Conducting thorough technical analysis can provide valuable insights into potential market trends and trading opportunities.

- Risk Management: Implement a robust risk management strategy to limit potential losses and protect your trading capital.

- Stay Informed: Keep yourself updated with the latest economic news and geopolitical events that can influence currency exchange rates.

- Trade with a Reputable Broker: Choose a forex broker with a strong reputation, reliable trading platform, and competitive trading conditions.

Forex Calculaate Profit Loss For Cross Pairs

Conclusion

Understanding how to calculate profit and loss in cross currency pairs is essential for success in forex trading. By carefully considering the factors that influence profitability and implementing sound trading practices, you can navigate the complexities of cross pair trading and increase your chances of achieving your financial goals. Remember, forex trading involves risk, and it’s crucial to approach it with caution, proper research, and a well-defined trading plan.