Navigating the complex world of foreign exchange (forex) trading can be a daunting task. It’s a global marketplace where currencies are exchanged and involve central banks, commercial banks, and individuals alike. Central banks, such as the Reserve Bank of India (RBI), play a crucial role in this market, acting as custodians and regulators of the financial system. This article delves into the intricacies of the forex business handled by the Central Bank of India and its profound impact on the economy.

Image: management.ind.in

Understanding Forex: A Realm of Exchange

Foreign exchange, also known as forex, is the trading of currencies between countries. It serves as a means of facilitating international trade and investment, allowing businesses and individuals to exchange currencies at prevailing market rates. The forex market is decentralized, operating 24 hours a day, 5 days a week, with participants ranging from central banks to commercial banks and retail traders.

Central Bank’s Role: Guardians of Monetary Policy

Central banks, like the Reserve Bank of India (RBI), play a pivotal role in the forex market by implementing monetary policy. Monetary policy refers to the tools and measures used by central banks to control the money supply and interest rates within an economy. Through open market operations, changes in bank reserve requirements, and interest rate adjustments, central banks aim to maintain price stability, promote economic growth, and manage external imbalances.

Forex Intervention: Stabilizing Exchange Rates

One of the key functions of central banks in the forex market is to intervene in the exchange rate. Exchange rate fluctuations can significantly impact a country’s economy, affecting trade, investment, and inflation. By buying or selling foreign currencies, central banks can influence the value of their own currency against others, thereby stabilizing exchange rates and minimizing volatility in the market.

Managing Foreign Currency Reserves

Central banks also manage the country’s foreign currency reserves, which are stockpile of foreign currencies and assets held by the central bank. These reserves serve several purposes: providing liquidity during times of financial stress, supporting the stability of the exchange rate, and facilitating international trade. The RBI manages India’s foreign currency reserves through various investment strategies, diversifying across different asset classes and currencies to optimize returns.

Regulation and Oversight: Ensuring Market Integrity

Central banks also assume a regulatory role in the forex market. They establish guidelines and regulations to ensure the smooth functioning and integrity of the market. This includes setting prudential limits on forex trading, monitoring market participants, and enforcing measures to prevent market manipulation and fraud. The RBI, for instance, has implemented specific regulations to regulate forex trading in India, covering areas such as margin requirements, permissible transactions, and reporting obligations for participants.

Enhancing Financial Stability: Responding to Crises

In times of financial crises or market disruptions, central banks play a crucial role in restoring stability and confidence in the forex market. They can intervene by providing liquidity, stabilizing exchange rates, and coordinating with other central banks to mitigate systemic risks and prevent contagion. During the 2008 financial crisis, the RBI implemented a range of measures, including forex swaps and dollar auctions, to maintain financial stability and support the domestic economy.

Conclusion: Guiding the Forex Landscape

The forex business of the Central Bank of India is a multifaceted and intricate realm that plays a vital role in managing the country’s economy and financial stability. Through monetary policy, forex intervention, foreign reserve management, regulation, and crisis management, the RBI ensures the smooth functioning of the forex market, facilitates international trade, and safeguards the financial system. Understanding the central bank’s involvement in forex trading provides a deeper appreciation of its significance in the global financial architecture and its impact on businesses, individuals, and the economy as a whole.

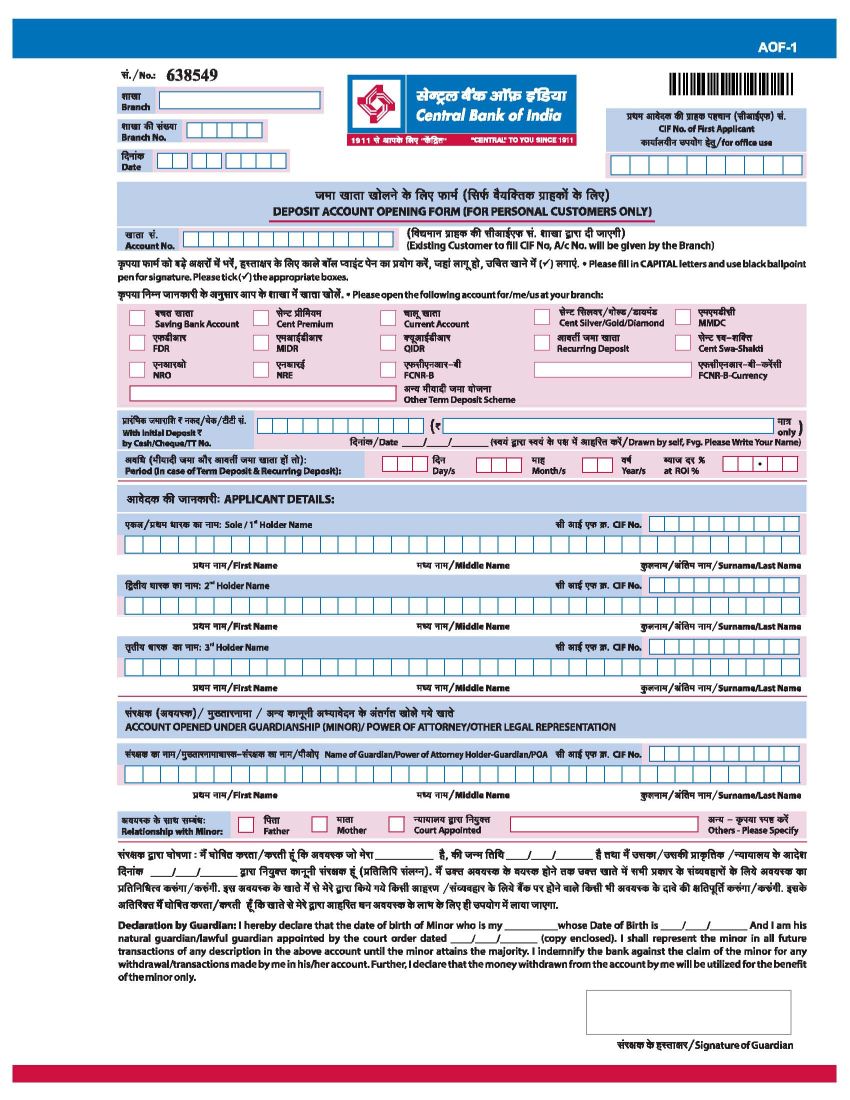

Image: eduvark.com

Forex Busibess Of Central Bank Of India