In the ever-evolving financial landscape, forex, Bitcoin (BTC), and commodity trading have emerged as captivating avenues for wealth creation. These dynamic markets offer investors and traders the opportunity to leverage global trends, speculate on price fluctuations, and grow their capital. This comprehensive guide will delve into the intricacies of these markets, exploring their history, basic principles, and real-world applications. Whether you’re a seasoned pro or a curious newcomer, this article will illuminate the ins and outs of forex, BTC, and commodity trading, empowering you to harness their potential.

Image: news.bitcoin.com

Navigating the Forex Market: A Currency Trading Odyssey

Foreign exchange (forex) trading, also known as currency trading, involves the exchange of one currency for another at agreed-upon rates. This global market operates 24 hours a day, 5 days a week, making it accessible to traders worldwide. The forex market is driven by supply and demand, as traders speculate on exchange rate fluctuations influenced by economic data, geopolitical events, and central bank policies. Understanding currency pairs, exchange rates, and spread is crucial for successful forex trading.

The Rise of Bitcoin: A Cryptocurrency Revolution

Bitcoin, a decentralized digital currency, has taken the world by storm since its inception in 2009. Unlike traditional fiat currencies, Bitcoin operates independently of central banks and is secured by blockchain technology, a distributed ledger system that records transactions immutably. The BTC market presents traders with unique opportunities, characterized by high volatility and potential for exponential returns. However, it also comes with risks, including price swings and regulatory uncertainties.

Venturing into Commodity Trading: Harnessing the Power of Resources

Commodity trading involves buying and selling raw materials, such as oil, gas, precious metals, and agricultural products. Commodities serve as essential inputs for various industries and are subject to supply and demand dynamics. Commodities trading provides investors with diversification opportunities and the potential to hedge against inflation. Understanding supply chains, production levels, and geopolitical factors is key to successful commodity trading.

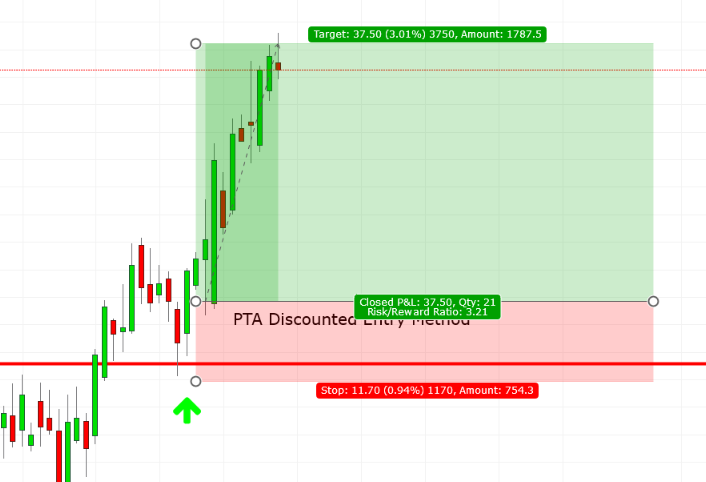

Image: www.persiantechnicalanalyst.com

Forex Btc And Commodities Trading

Conclusion: Unveiling the World of Trading

Forex, BTC, and commodity trading offer compelling avenues for investors and traders seeking financial growth. These markets present opportunities to leverage global trends, capitalize on price fluctuations, and diversify portfolios. However, it’s essential to approach these markets with caution and a thirst for knowledge. By mastering the nuances of each market and employing sound trading strategies, you can navigate these dynamic landscapes and unlock the potential for financial success.