Introduction

Image: www.investorgreg.net

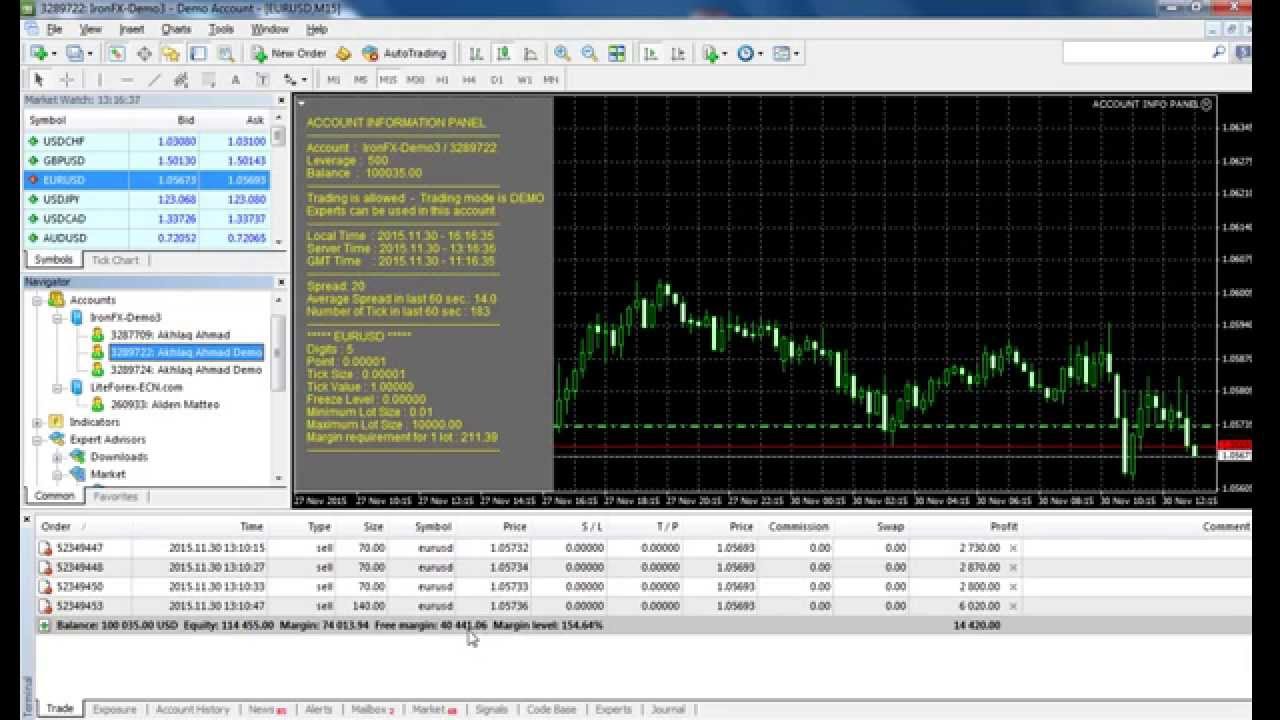

In the realm of foreign exchange trading, leverage plays a pivotal role in magnifying the potential profits and risks associated with each trade. Forex brokers offering 1:200 leverage present traders with an unparalleled opportunity to amplify their returns and harness the market’s volatility. This article aims to unravel the concept of forex brokers with 1:200 leverage, providing traders with an in-depth guide to its benefits, pitfalls, and usage strategies.

Understanding Leverage: The Power of Amplification

Leverage, in its essence, is a tool employed by traders to increase their trading capital and, consequently, their potential profits. It’s a loan provided by forex brokers that allows traders to control a larger position size than their initial investment. For instance, with 1:200 leverage, a trader with a capital of $1,000 can effectively control a position worth $200,000, magnifying their returns by 200 times.

Benefits of Forex Brokers with 1:200 Leverage

-

Increased Profit Potential: The primary advantage of 1:200 leverage lies in its ability to amplify profits. By controlling a larger position size, traders can potentially generate substantial returns on even relatively small market movements.

-

Enhanced Market Exposure: With 1:200 leverage, traders gain access to a broader range of trading instruments and larger market exposure. They can diversify their portfolios and spread their risk across multiple positions.

-

Flexibility and Scalability: Leveraged trading allows traders to adapt their trading strategies to changing market conditions. They can increase or decrease their leverage levels based on their risk appetite and market outlook.

Risks Associated with 1:200 Leverage

-

Magnified Losses: While leverage enhances profit potential, it also amplifies potential losses. Traders must exercise caution and manage their risk effectively. Excessive leverage can lead to catastrophic losses that may wipe out their entire trading capital.

-

Margin Calls: Forex brokers typically set margin levels, which represent the maximum amount of leverage a trader can utilize. If market movements cause the trader’s capital to fall below the margin level, the broker may issue a margin call, requiring the trader to deposit additional funds or face liquidation of their position.

-

Psychological Strain: Trading with high leverage can induce emotional distress and mental strain. Traders must be mentally prepared for the increased risks and potential volatility associated with leveraged trading.

Choosing a Forex Broker: Key Considerations

Selecting a reputable and reliable forex broker is crucial for successful leveraged trading. Traders should consider the following factors:

-

Regulation and Licensing: Choose brokers licensed by reputable regulatory bodies such as the FCA, NFA, or ASIC, ensuring they operate ethically and meet strict trading standards.

-

Leverage Offering: Verify that the broker provides 1:200 leverage or higher if that’s your preferred level of magnification.

-

Trading Platform: Assess the broker’s trading platform for user-friendliness, functionality, and the availability of tools that support leveraged trading strategies.

Leverage Trading Strategies

To maximize the benefits and mitigate the risks associated with 1:200 leverage, traders are advised to employ prudent trading strategies:

-

Position Sizing: Carefully calculate and manage the size of each trade based on your risk tolerance and account balance. Avoid overleveraging, which can lead to excessive losses.

-

Risk Management: Employ risk management tools such as stop-loss orders and take-profit orders to limit potential losses and secure profits.

-

Market Analysis: Conduct thorough market analysis, taking into account fundamental and technical indicators, before entering trades. Avoid making impulsive decisions under emotional or psychological pressure.

Conclusion

Forex brokers with 1:200 leverage provide traders with a powerful tool to amplify their returns and access the global financial markets on a larger scale. However, it’s imperative to approach leveraged trading with caution, recognizing its potential benefits and risks. By understanding the concept, selecting a reputable broker, and adopting sound trading strategies, traders can harness the power of 1:200 leverage to maximize their trading potential while managing risks effectively.

Image: www.youtube.com

Forex Broker With 1 200 Leverage