Image: www.compareforexbrokers.com

Introduction

Welcome to the world of currency trading, where understanding the concept of spreads is crucial for success. Forex brokers play a vital role in facilitating these trades, and in Australia, choosing the right broker with the most competitive spreads can significantly impact your profitability. This comprehensive guide will delve into the intricacies of Forex broker spreads in Australia, helping you make informed decisions and maximize your trading potential.

What is a Forex Spread?

In Forex trading, a spread refers to the difference between the bid and ask price of a currency pair. The bid price represents the price at which you can sell a currency, while the ask price indicates the price at which you can buy it. The spread is the profit margin earned by the broker for facilitating the trade.

Types of Spreads

There are two main types of spreads in Forex trading:

- Fixed Spreads: These spreads remain constant regardless of market conditions and provide traders with a predictable trading environment.

- Variable Spreads: These spreads fluctuate with market volatility and can be narrower or wider depending on supply and demand.

Image: brokerchooser.com

Factors Influencing Spreads

Several factors can influence the spreads offered by Forex brokers in Australia:

- Market Volatility: Higher market volatility can lead to wider spreads as brokers adjust to the increased risk.

- Account Type: Some brokers offer different spread rates based on the account type, with premium accounts typically receiving tighter spreads.

- Trading Volume: Lower trading volume can result in wider spreads due to the reduced liquidity in the market.

Choosing the Right Forex Broker

Selecting the right Forex broker with competitive spreads is essential for maximizing profitability. Here are some tips:

- Compare Spreads: Research and compare spreads offered by different brokers, considering both fixed and variable spreads.

- Check Account Tiers: Understand the different account types offered by the broker and the spread rates associated with each.

- Consider Market Volatility: Choose a broker that offers competitive spreads during periods of high market volatility.

Tips and Expert Advice

- Negotiate Spreads: Some brokers are willing to negotiate spreads, especially for high-volume traders or those with a proven track record.

- Use Low Spread Platforms: Take advantage of trading platforms that offer low spreads, such as MetaTrader 4 or MetaTrader 5.

- Avoid Hidden Fees: Carefully review the broker’s fee structure to avoid additional charges that can impact your spread costs.

FAQs

- Q: Why are spreads important in Forex trading?

A: Spreads impact profitability by determining the amount you pay to enter or exit a trade. - Q: What are the different types of spread accounts?

A: There are fixed spread accounts, which provide consistent spreads, and variable spread accounts, where spreads vary with market conditions. - Q: How can I minimize my spread costs?

A: Choose a broker with low spreads, consider premium account options, and trade during periods of lower market volatility.

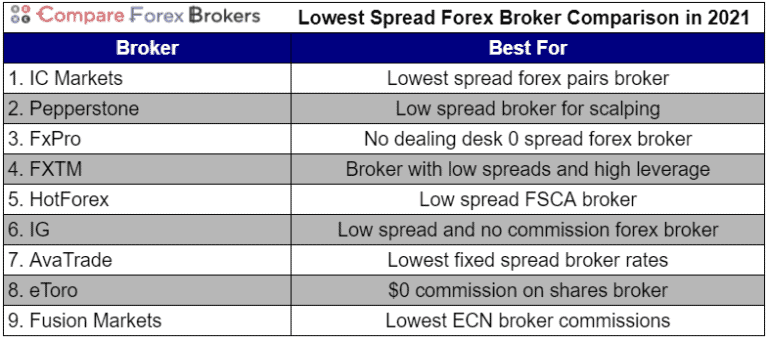

Forex Broker Reviews Spreads Australia

Conclusion

Understanding Forex broker spreads in Australia is crucial for successful currency trading. By comparing spreads, choosing the right broker, and utilizing tips and expert advice, you can optimize your trading strategies and maximize your profitability. Whether you are a seasoned trader or a novice, this guide provides invaluable insights to help you navigate the complexities of Forex broker spreads and make informed decisions. Are you ready to delve into the exciting world of Forex trading and unleash your financial potential?