Step into the world of currency exchange, where volatility dances and risk is an ever-present specter. As a seasoned trader, I’ve witnessed firsthand the relentless pursuit of a strategy that can effectively mitigate the blows of currency fluctuations. And amidst the labyrinth of options, direct hedging has emerged as a beacon of hope, offering a lifeline in the choppy waters of Forex.

Image: www.forexsoutheast.asia

Direct Hedging: A Safeguard Against Currency Swings

In essence, direct hedging is a proactive measure by which traders counteract the risk inherent in holding opposing positions in different currencies. It involves simultaneously buying and selling currency pairs, thus offsetting the potential losses incurred by one position with the gains of the other. Imagine a scenario where you’re long on the EUR/USD pair, anticipating a rise in the value of the euro. To hedge against the possibility of a downward shift, you could simultaneously short the USD/EUR pair. With this tactic, you’re essentially securing a zero-sum trade, isolating yourself from market movements and safeguarding your profits.

Types of Direct Hedging

The realm of direct hedging encompasses a diverse range of strategies, each tailored to different risk profiles and market conditions. Among the most common approaches are:

- Perfect Hedge: This strategy matches the size and direction of opposing positions, completely eliminating exposure to currency fluctuations.

- Partial Hedge: As the name suggests, this approach involves hedging only a portion of the exposed risk, allowing for some potential gain or loss from currency movements.

Benefits of Direct Hedging

Embrace the benefits of direct hedging and navigate the Forex market with newfound confidence:

- Risk Mitigation: Direct hedging provides a safety net, shielding your portfolio from the vagaries of exchange rates.

- Capital Preservation: By offsetting potential losses, direct hedging helps preserve your hard-earned capital, reducing the risk of significant drawdowns.

- Profit Enhancement: While direct hedging may limit potential gains from favorable currency movements, it also caps potential losses, resulting in more consistent returns.

Image: www.topfxbrokersreview.com

Expert Insights: Tips for Effective Direct Hedging

Master the art of direct hedging with these expert tips:

- Plan Strategically: Define your risk tolerance and hedging objectives before executing any trades.

- Choose Liquid Currency Pairs: Opt for currency pairs with high trading volume to ensure ample market liquidity, facilitating quick and seamless trade execution.

- Monitor Market Movements: Keep an eagle eye on economic events and data releases that may impact exchange rates, adjusting your hedging positions accordingly.

- Review Regularly: Periodically assess the effectiveness of your hedging strategy and make necessary adjustments based on changing market conditions.

FAQs: Unraveling Your Direct Hedging Queries

Q: What are the potential drawbacks of direct hedging?

A: Direct hedging may limit profit potential by offsetting gains, and it requires meticulous monitoring to avoid locking in losses during favorable market conditions.

Q: How do I choose the appropriate hedge ratio?

A: The optimal hedge ratio depends on your risk tolerance and the correlation between the currency pairs being hedged. Consider seeking professional guidance for personalized advice.

Q: Can direct hedging be used for long-term investments?

A: While direct hedging is primarily employed for short-term currency exposure, it can be adapted for long-term investments by incorporating hedging strategies into your overall investment portfolio.

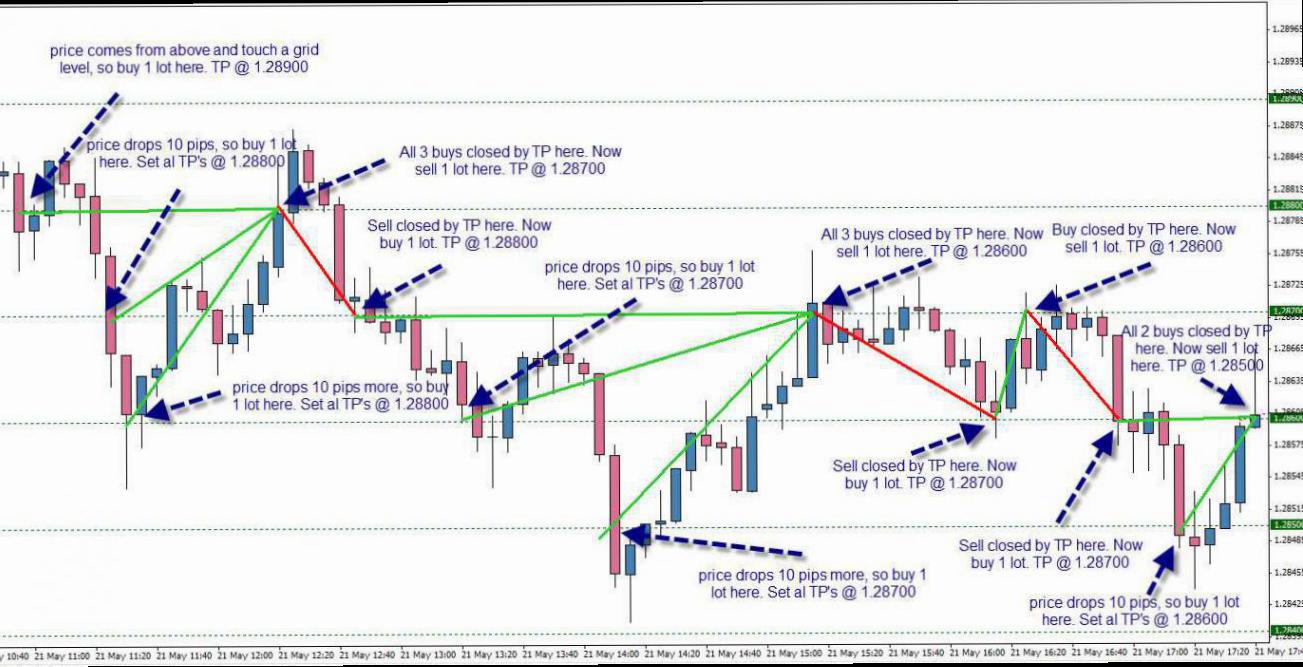

Forex Best Direct Hedging System

Conclusion

Embrace the power of direct hedging and conquer the Forex market. Remember, while it offers a lifeline against currency risks, it should be deployed thoughtfully and in conjunction with a comprehensive trading strategy. Master the art of direct hedging, navigate the choppy waters with confidence, and unlock the true potential of your Forex trading endeavors. Are you ready to embark on the path to Forex mastery? Share your thoughts and insights, and join the vibrant community of Forex traders exploring the transformative power of direct hedging.