In the ever-dynamic realm of foreign exchange (forex), understanding the market’s average daily trading range (ATR) is crucial for traders seeking profitable outcomes. The ATR measures the volatility of a currency pair over a specific timeframe, providing valuable insights into its price movements and potential risks. Delving into the nuances of ATR can empower traders to make informed decisions, navigate market fluctuations, and maximize their trading strategies.

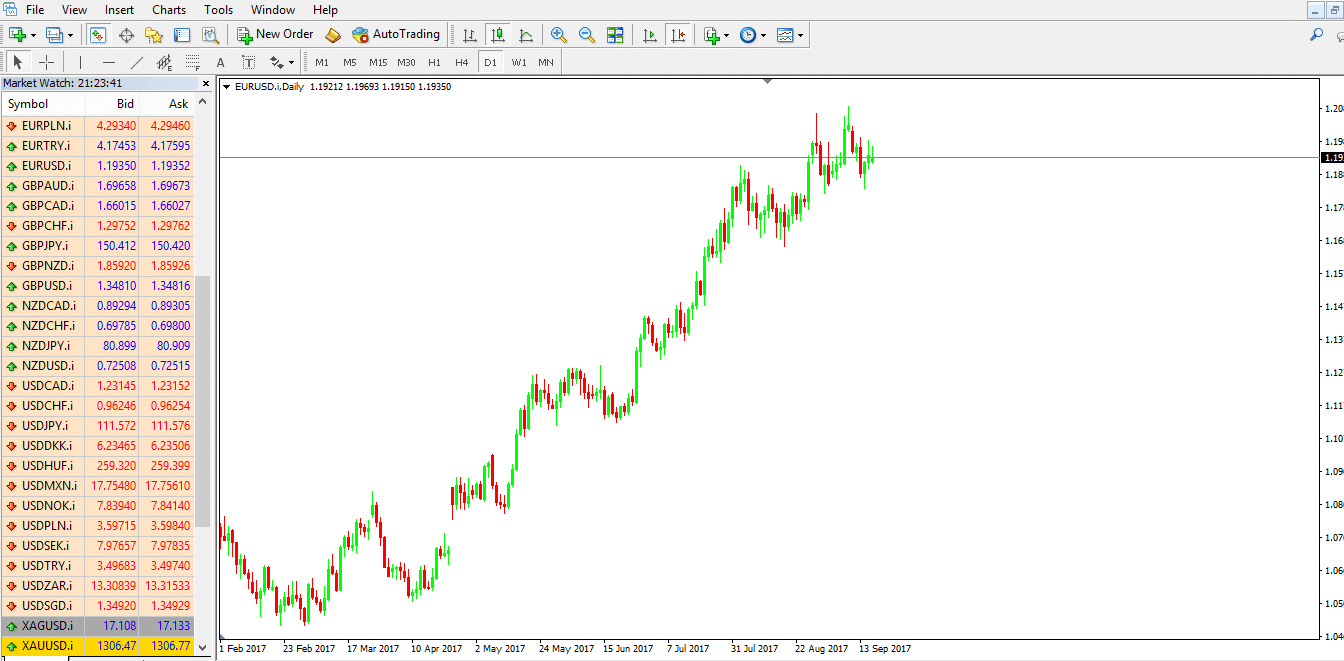

Image: www.forexboat.com

Understanding the Average Daily Trading Range

The ATR is a technical indicator that quantifies the average range of price fluctuations in a currency pair for a given time period. By analyzing historical data, traders can determine the typical daily movement of a currency pair, providing essential information for risk management, position sizing, and stop-loss placement. The ATR is calculated using the following formula:

ATR = (Pmax - Pmin) / RangeWhere:

- Pmax = Maximum price of the day

- Pmin = Minimum price of the day

- Range = Number of periods (for example, 14 for a 14-day period)

Significance of ATR in Forex Trading

For forex traders, understanding the ATR has several significant implications:

- Measuring Volatility: The ATR provides an objective measure of market volatility, helping traders gauge the risk associated with different currency pairs. High ATR values indicate volatile markets, while low values suggest more stable conditions.

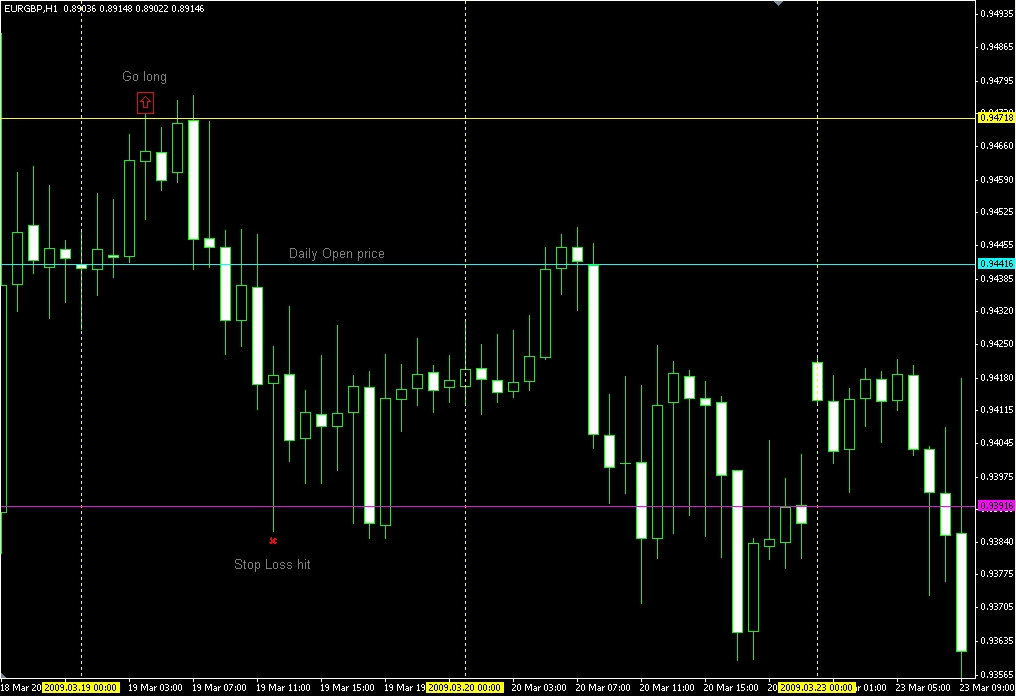

- Stop-Loss Placement: The ATR can guide traders in setting appropriate stop-loss orders. By placing stops a predetermined distance above or below the current price, based on the ATR, traders can minimize the risk of premature exits due to market fluctuations.

- Position Sizing: The ATR assists traders in determining an appropriate trade size by assessing the potential range of price movements. Larger ATR values warrant smaller position sizes to mitigate losses.

- Trend Confirmation: When a strong trend develops, the ATR typically expands, capturing the increased volatility of the market. This expansion can serve as a confirmation of the prevailing trend, providing additional confidence in trading decisions.

Exploring the Dynamic Nature of ATR

The ATR is not a static measure but rather evolves constantly in response to market conditions. Factors influencing the ATR’s variability include:

- News and Events: Significant economic releases, geopolitical events, and other news items can trigger sharp price movements and expand the ATR.

- Market Participants: The actions of large market participants, such as central banks and institutional investors, can introduce increased volatility and widen the ATR.

- Market Sentiment: Shifts in market sentiment can alter the expected price range of a currency pair, leading to changes in the ATR.

Image: wealthynickel.com

Forex Average Daily Trading Range In Pips Forex360

https://youtube.com/watch?v=-BlfQcoVOBs

Conclusion

Mastering the concept of the average daily trading range is an indispensable skill for forex traders seeking success in the dynamic and often unpredictable currency markets. By incorporating the ATR into their trading strategies, traders gain a valuable tool for managing risk, determining position sizes, and navigating market fluctuations with confidence. Understanding the ATR’s significance and dynamic nature empowers traders to make informed decisions, mitigate losses, and maximize their trading potential.