Navigate Forex Price Movements with Precision

In the dynamic world of forex trading, understanding price movements and volatility is crucial for making informed decisions. The average daily range (ADR) is a powerful tool that provides insights into price fluctuations, helping traders identify potential trading opportunities. This article delves into the 2016 forex ADR, its history, key concepts, and strategies for harnessing its power.

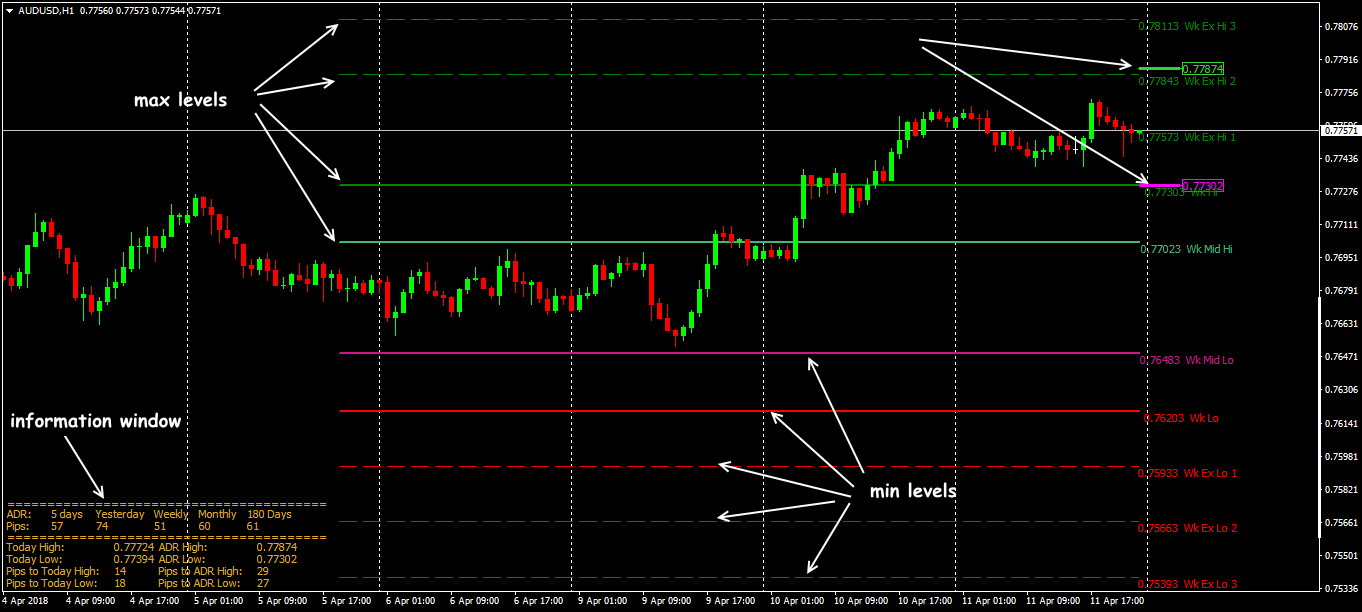

Image: kumarspold1985.blogspot.com

The Enigma of the Forex Average Daily Range

The average daily range is a statistical measure that encapsulates the typical price range of a currency pair over a specific period, typically 24 hours. It quantifies the average distance between a currency pair’s daily high and low prices. A high ADR indicates high volatility, while a low ADR suggests a relatively stable and predictable market.

Historical Context of Forex ADR

In 2016, the forex market experienced significant volatility due to macroeconomic factors, geopolitical events, and monetary policy shifts. Currency pairs like EUR/USD, GBP/USD, and USD/JPY exhibited notable ADRs, influencing trading strategies and risk management practices.

Unlocking the Potential of ADR in Forex Trading

ADR provides valuable insights into market volatility and can serve as a foundation for effective trading strategies. Traders can:

- Assess Market Conditions: High ADR indicates heightened volatility, requiring cautious trading approaches. Conversely, low ADR signals stability, favoring breakout strategies.

- Set Stop-Loss and Take-Profit Levels: ADR helps determine appropriate stop-loss and take-profit levels, reducing the risk of unexpected market movements.

- Identify Trading Opportunities: Currency pairs with high ADR often present greater opportunities for profit but also increased risk.

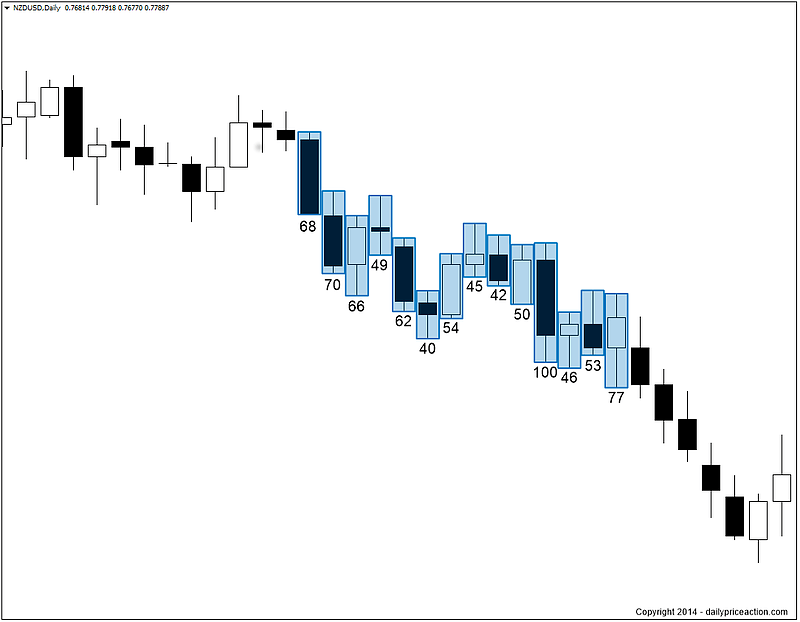

Image: dailypriceaction.com

Expert Insights and Strategies for Utilizing Forex ADR

Seasoned forex traders recommend employing these strategies to maximize the potential of ADR:

Utilizing Recent Price Action and Technical Analysis

Examining current price action and applying technical analysis tools like resistance and support levels can enhance ADR usage. Traders can identify potential trading ranges and anticipate price movements within the ADR.

Monitoring Market News and Economic Indicators

Staying abreast of market news, economic indicators, and geopolitical events can provide context for ADR fluctuations. Significant events can abruptly alter market volatility, requiring traders to adjust their strategies accordingly.

FAQs on Forex Average Daily Range (ADR)

Q: How is ADR calculated?

A: ADR is calculated as the absolute difference between the high and low prices of a currency pair over a specified period, typically 24 hours.

Q: What factors influence ADR?

A: Economic data, geopolitical events, monetary policy shifts, and market sentiment are the primary determinants of ADR.

Q: How can I use ADR in my trading?

A: ADR can guide stop-loss and take-profit levels, assess market volatility, and identify potential trading opportunities.

Q: Can ADR predict future price movements?

A: While ADR provides a statistical measure of past volatility, it cannot precisely predict future price movements due to the dynamic nature of the forex market.

Forex Average Daily Range 2016

Conclusion: Embracing Volatility for Trading Success

Harnessing the power of forex average daily range empowers traders to navigate market volatility with greater confidence and precision. By understanding ADR, its history, and its practical implications, traders can unlock opportunities and navigate the complexities of the forex market effectively. However, it is essential to recognize that no strategy or tool can guarantee success in trading. Responsible risk management and a comprehensive understanding of market dynamics remain paramount.

Would you like to explore more insights into mastering forex market volatility? Let us know, and let’s unlock the world of forex trading together!