The foreign exchange market, fondly known as Forex or FX, is an international marketplace where currencies are traded. India’s financial ecosystem heavily relies on the Forex market, which plays a critical role in international trade, investment, and tourism. To ensure the stability and integrity of this crucial market, the Reserve Bank of India (RBI) shoulders the responsibility of overseeing its activities through comprehensive audits.

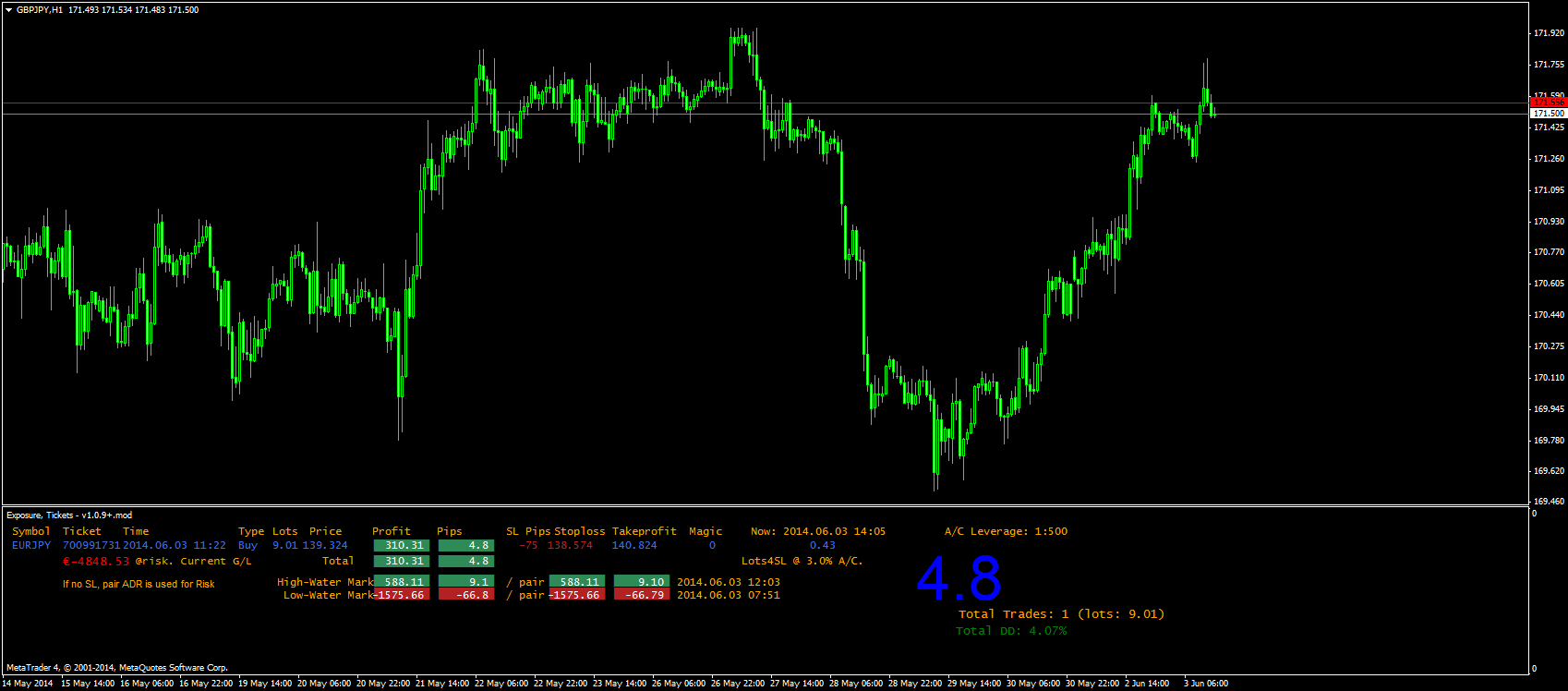

Image: dakoxok.web.fc2.com

Understanding Forex Audit Report Under RBI: A Path to Transparency

Forex audits are integral to RBI’s regulatory framework. They are thorough examinations of a Forex dealer’s operations to assess adherence to RBI guidelines, prescribed conditions, and prevailing norms. These audits provide valuable insights into the dealer’s financial health, compliance status, and adherence to ethical practices. Forex audit reports, the end products of these critical examinations, furnish a detailed analysis of the dealer’s activities, highlighting strengths, weaknesses, and areas for improvement.

Benefits of Forex Audit Reports: A Cornerstone of Trust and Reliability

-

Strengthens Confidence: Forex audit reports foster confidence among market participants, serving as testaments to a dealer’s adherence to ethical practices and regulatory guidelines. It assures clients, investors, and other stakeholders of the reliability and integrity of the dealer’s operations.

-

Enhances Risk Management: Audits meticulously review a dealer’s risk management mechanisms, evaluating their capabilities to identify, assess, and manage risks effectively. Robust risk management practices safeguard dealers from potential financial losses, safeguarding the financial ecosystem.

-

Detects Malpractices: Forex audit reports act as vigilant watchdogs, unearthing any irregularities or non-compliance in a dealer’s operations. Promptly identifying and rectifying these malpractices protect market integrity and ensures fair play for all participants.

Diving into the Anatomy of Forex Audit Reports Under RBI

Forex audit reports are meticulously crafted documents that encompass a range of elements:

-

Dealer’s Compliance Status: Reports comprehensively evaluate a dealer’s adherence to RBI regulations, highlighting instances of compliance and non-compliance. They serve as valuable tools for identifying areas where dealers may need to rectify their practices and align with the prescribed norms.

-

Financial Review: Audits delve into the financial aspects of a Forex dealer’s operations, analyzing their financial performance, profitability, and solvency. A thorough understanding of their financial health ensures the stability and sustainability of the dealer’s business.

-

Internal Controls: Auditors carefully assess the effectiveness of a dealer’s internal control systems, evaluating their ability to prevent fraudulent activities, errors, and operational deficiencies. Robust internal controls act as a shield, safeguarding dealers from potential risks.

-

Recommendations for Improvement: Forex audit reports often culminate in actionable recommendations, guiding dealers on areas where they can enhance their practices. These recommendations serve as valuable blueprints for improvement, empowering dealers to streamline operations, mitigate risks, and elevate their overall performance.

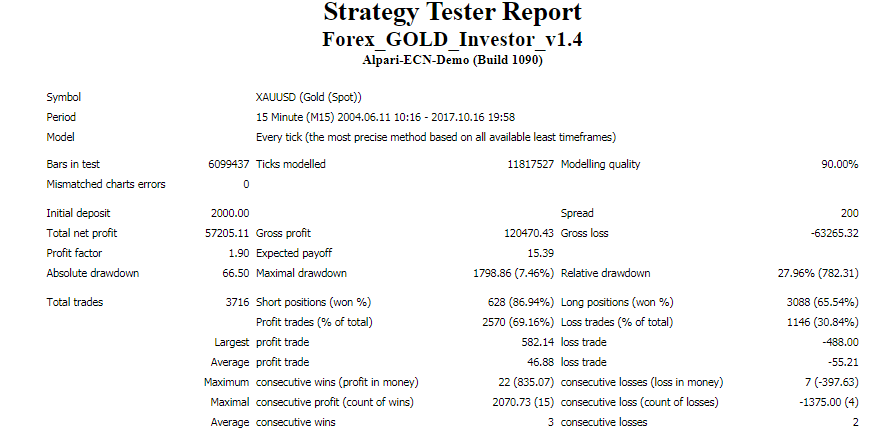

Image: fxtechlab.com

Forex Audit Report Under Rbi

Conclusion

Forex audit reports under RBI are indispensable tools in maintaining the stability, integrity, and transparency of India’s Forex market. They act as reliable barometers of a dealer’s compliance status, financial health, and operational efficiency. By providing insightful and actionable recommendations, these reports pave the way for continuous improvement and empower dealers to navigate the dynamic Forex market with confidence. Embracing the value of Forex audits is not merely a regulatory requirement but a strategic step towards ensuring the growth and prosperity of India’s Forex ecosystem.