Image: howtotradeonforex.github.io

The world’s financial markets are a complex web of interconnected players, where the actions of one can ripple through others, influencing their movements and fortunes. Two of the most significant and closely intertwined markets are forex (foreign exchange) and stocks. understanding their relationship is crucial for investors seeking to navigate these dynamic markets.

Forex: A Global Currency Bazaar

Forex, the largest and most liquid market globally, facilitates the exchange of currencies between countries. Whether trading for commercial, investment, or speculation purposes, participants buy and sell different currencies, anticipating profit from fluctuations in exchange rates, driven by supply and demand, economic factors, and geopolitical events.

Stocks: Corporate Ownership and Market Value

The stock market represents ownership in publicly traded corporations. Shareholders, by investing in stocks, gain a fractional ownership stake in these companies and may receive returns through dividends and capital appreciation. Stock prices are influenced by company performance, industry trends, economic outlook, and investor sentiment.

The Interplay: Cause and Effect

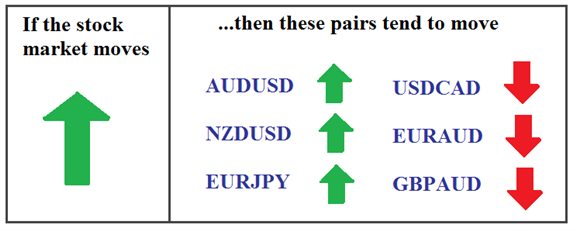

The relationship between forex and stocks is often bidirectional. Stronger economic growth in a country can lead to increased demand for its currency, appreciating its value in forex markets. This, in turn, can positively impact companies operating in that country, leading to higher stock prices.

Conversely, geopolitical or economic events that negatively affect a nation’s currency can have detrimental effects on its stock market. Weakening currencies can make exports less competitive, impact corporate earnings, and reduce investor confidence in the economy.

Currency Pairs as Market Influencers

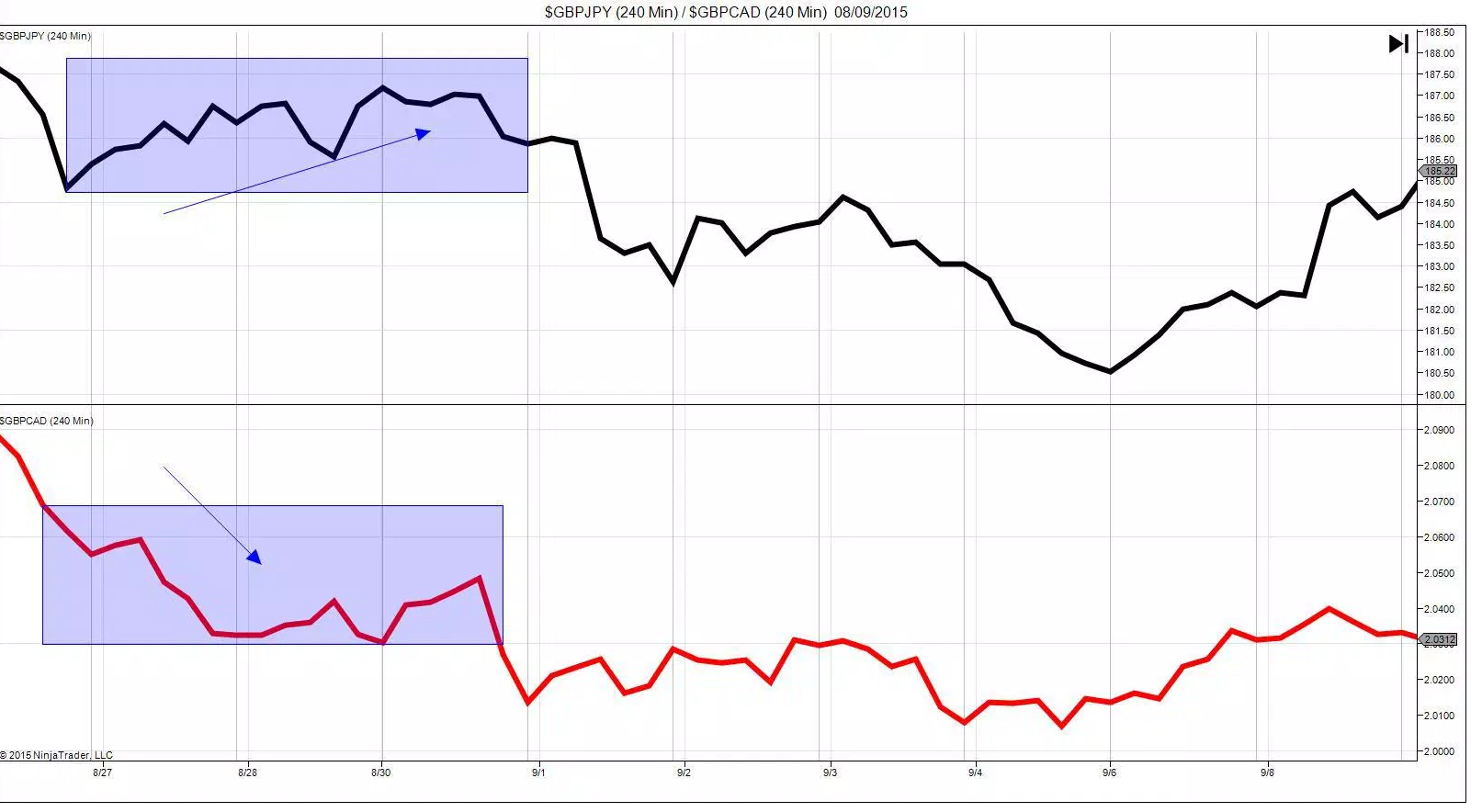

In forex markets, certain currency pairs, such as EUR/USD or GBP/JPY, serve as prominent indicators of sentiment towards different economies. The relative strength or weakness of these currencies influences investor perceptions of the Eurozone or the United Kingdom, affecting both currency and stock market valuations.

Interest Rates and Economic Policy

Interest rates and monetary policies adopted by central banks can have far-reaching impacts on both forex and stock markets. Changing interest rates can alter currency flows and affect corporate borrowing costs, ultimately influencing stock market valuations and economic growth.

Market Volatility and Correlation

During periods of heightened market volatility, the relationship between forex and stocks can become more pronounced. Investors may seek refuge in safe-haven currencies, such as the U.S. dollar or the Japanese yen, pushing their value upwards while adversely affecting the corresponding stock markets.

Hedging and Currency Risk Management

The interconnected nature of forex and stocks provides opportunities for hedging and managing currency risk. International investors can use forward contracts or other derivative instruments to mitigate the impact of foreign exchange fluctuations on their stock investments.

Conclusion

The forex and stock markets are intricately intertwined, forming a complex and ever-evolving financial landscape. Understanding the dynamic between these markets is essential for investors seeking to navigate market volatility, predict trends, and make informed decisions. By recognizing the factors that drive forex and stock market movements, investors can stay ahead of the curve and seize opportunities for growth while minimizing risk in their portfolios.

Image: www.dailyfx.com

Forex And Stock Market Relationship