The Correlation Enigma

As a seasoned forex trader, I’ve often pondered the interconnectedness between currencies and commodities. After all, both markets are influenced by global economic factors and geopolitical events. So, I decided to embark on a data-driven journey to unravel the intricate web of correlations between forex and commodity data.

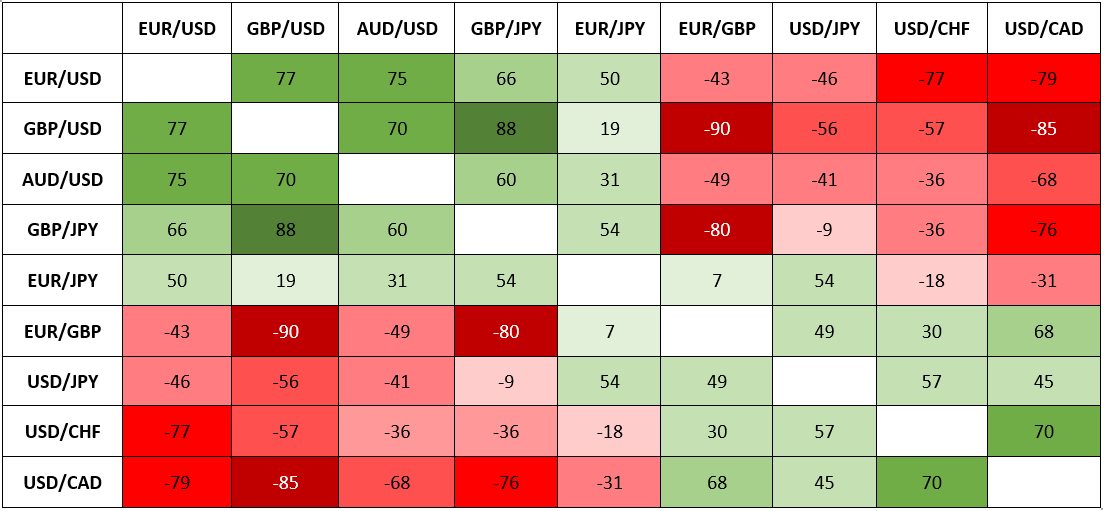

Image: www.cmcmarkets.com

Forex and Commodities: An Overview

Forex (foreign exchange) represents the global marketplace for trading currencies, while commodities encompass raw materials such as oil, gold, and agricultural products. Historically, certain currencies have exhibited strong correlations with specific commodities. For instance, the US dollar often tracks oil prices, as the former plays a dominant role in international oil transactions.

Correlation Analysis Methodology

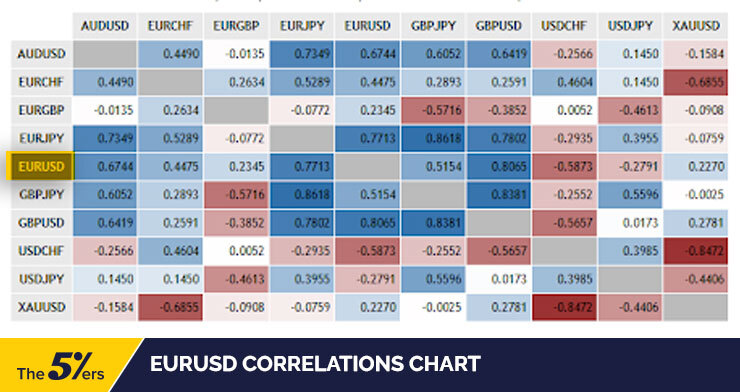

To quantify these correlations, I delved into statistical analysis. I collected historical data on multiple currency pairs (e.g., EUR/USD, GBP/JPY) and commodity indices (e.g., S&P GSCI, DJ UBS Commodity Index). Using regression techniques, I calculated the Pearson correlation coefficient, a statistical measure of the strength and direction of the relationship between two variables.

Key Correlations Observed

The analysis revealed significant correlations between certain currency pairs and commodities. Positive correlations indicated that currencies moved in tandem with commodity prices, while negative correlations suggested an inverse relationship. Here are some notable observations:

- USD/CAD: Positive Correlation with Oil – The Canadian dollar (CAD), often seen as a proxy for oil, showed a strong positive correlation with oil prices. This relationship arises due to Canada’s substantial oil reserves and exports.

- AUD/NZD: Negative Correlation with Gold – The Australian dollar (AUD) exhibited a negative correlation with gold prices. As a commodity-driven economy, Australia benefits from higher gold prices, which supports the AUD. Conversely, a stronger AUD makes gold less competitive in global markets, leading to a negative correlation.

- EUR/CHF: Positive Correlation with Swiss Franc (CHF) – The euro (EUR) displayed a positive correlation with the Swiss franc (CHF). This relationship stems from Switzerland’s role as a safe haven during market turmoil. Investors tend to seek refuge in CHF during market downturns, resulting in a higher demand for the currency.

Image: the5ers.com

Implications for Traders

Understanding the correlations between forex and commodity data can provide traders with valuable insights for decision-making. For example:

- Hedging Strategies: By diversifying their portfolios with both currencies and commodities that exhibit opposite correlations, traders can potentially reduce overall risk.

- Market Timing: Traders can use correlation analysis to identify potential entry and exit points in trades based on anticipated shifts in currency and commodity prices.

- Economic Outlook: Correlations between forex and commodities can reflect global economic trends. For instance, a strong positive correlation between USD and oil could indicate an economic recovery, fostering demand for both assets.

Expert Tips and Advice

Based on my research and experience, here are some practical tips for traders navigating the forex-commodity correlation landscape:

- Monitor Economic Data: Stay abreast of economic news and data releases that could impact currency and commodity markets.

- Use Correlation Charts: Visualize and track correlations using correlation charts or trading platforms.

- Consider Correlation Direction: Understand whether the correlation is positive or negative to determine the potential impact on your trades.

- Do Your Due Diligence: Conduct thorough market research before making trading decisions based on correlations.

Frequently Asked Questions

Q: Can correlations between forex and commodities change over time?

A: Yes, correlations can change depending on market conditions and economic events.

Q: Are there any additional factors that influence correlation?

A: Factors such as geopolitical events, central bank policies, and seasonal demand can also impact correlations.

Forex And Commodity Data Correlation Analysis

Conclusion

The correlation analysis between forex and commodity data unveils valuable insights into market dynamics. By understanding these relationships, traders can enhance their decision-making, implement effective hedging strategies, and gain a competitive edge in the global financial markets.

Are you eager to delve deeper into the fascinating world of forex-commodity correlations? Join our community of traders and experts for exclusive updates and discussions on this captivating topic.