The world of Forex trading can be both lucrative and daunting, especially for beginners. Navigating the complexities of currency exchange rates, market trends, and analytical tools can seem like an uphill battle. However, with the advent of advanced trading software and platforms, Forex trading has become more accessible than ever. One such innovation that’s revolutionizing the industry is the Forex account with no Expert Advisor (EA) program.

Image: www.youtube.com

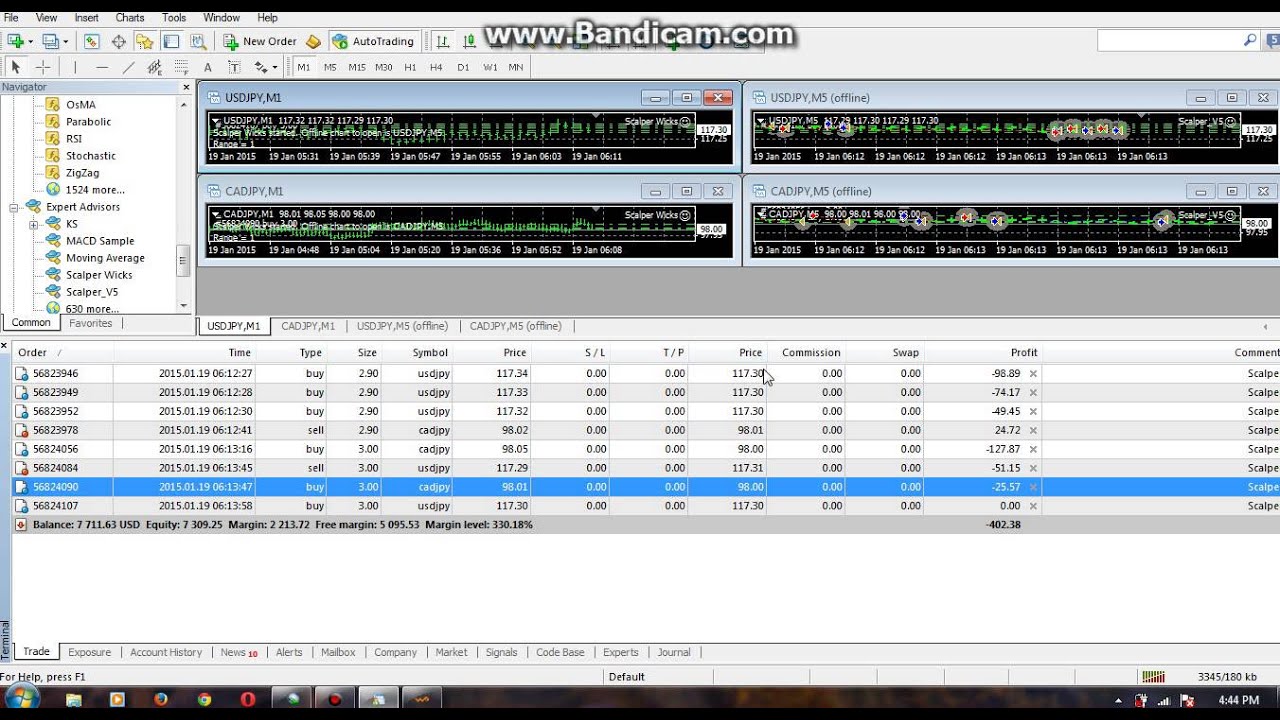

An EA program, often referred to as a “trading bot,” is an automated system designed to execute trades on behalf of a trader. While EAs can offer the allure of hands-off trading and the potential for enhanced profits, they also come with inherent risks. Beginners may be tempted to rely heavily on EAs, but it’s crucial to understand their limitations and potential drawbacks.

Demystifying Forex Accounts with No EA Program

Unlike traditional Forex accounts that support the use of EA programs, a Forex account with no EA program offers a different approach. Instead of relying on automated algorithms, this type of account empowers traders to take full control over their trading decisions. By eliminating the reliance on EAs, traders gain the freedom to develop and execute their own trading strategies based on their unique market insights and risk tolerance.

Advantages of Forex Accounts with No EA Program

-

Enhanced Learning Curve: By actively participating in every aspect of the trading process, traders gain a deeper understanding of market dynamics, fundamental analysis, and technical analysis. This hands-on approach fosters a more profound learning experience, allowing traders to develop their skills and make informed decisions.

-

Customized Trading Strategies: Without the constraints of an EA program, traders have the flexibility to tailor their trading strategies to match their individual risk appetite and financial goals. By manually executing trades, they can respond to market changes and adjust their positions in real-time, maximizing potential profits.

-

Reduced Financial Risks: Automated trading systems often involve setting complex parameters and risk management settings. Beginners who aren’t fully aware of these complexities may face increased financial risks. Forex accounts with no EA program promote responsible trading, as traders have complete control over the entry and exit points of their trades, minimizing potential losses.

Tips for Success with Forex Accounts with No EA Program

-

Develop a Sound Trading Strategy: A well-defined trading strategy is the cornerstone of successful Forex trading. Take time to study market trends, identify potential opportunities, and establish clear entry and exit strategies.

-

Master Fundamental and Technical Analysis: Enhance your understanding of Forex trading by mastering fundamental analysis, which involves studying economic indicators and news events, and technical analysis, which analyzes historical price patterns to predict future trends.

-

Manage Your Risk: Forex trading involves inherent risks. Establish a comprehensive risk management plan that includes setting loss limits, position sizing strategies, and adapting your trading to market conditions.

Image: theforexgeek.com

Forex Account No Add Ea Program

Conclusion

Forex accounts with no EA program are gaining popularity among aspiring Forex traders. By eliminating the reliance on automated trading bots, these accounts empower traders to take ownership of their trading decisions, fostering a deeper understanding of market dynamics and promoting responsible trading practices. Embrace the freedom and control offered by these accounts, and equip yourself with the necessary knowledge and skills to navigate the Forex market with confidence and discipline.