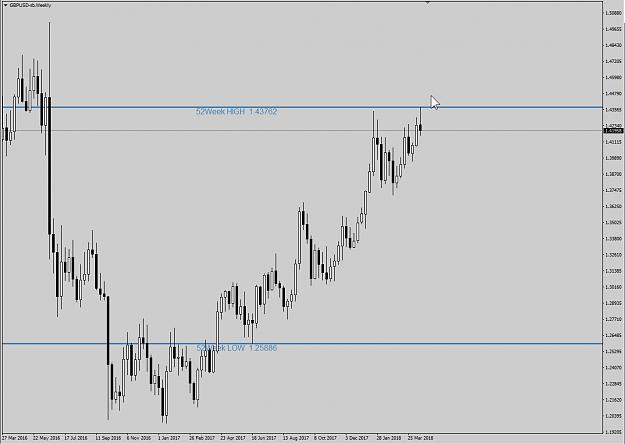

Forex, the world’s largest financial market, offers traders a dynamic and potentially lucrative landscape. Understanding the nuances of the market is crucial for success, and one important aspect is identifying 52-week high/low levels. These extreme price points provide valuable insights into market sentiment and can aid in making informed trading decisions.

Image: www.tradingview.com

Delving into 52-Week High/Low Trading

In the ever-fluctuating forex market, the 52-week high and low represent the highest and lowest prices an asset has traded at over the past year. These extreme values serve as technical indicators, reflecting market psychology and potentially signaling potential trading opportunities.

When a currency pair reaches a new 52-week high, it can indicate an uptrend and increasing bullish sentiment. Conversely, a 52-week low may suggest a downtrend and waning confidence. These levels often act as zones of support or resistance, with traders monitoring them closely for potential price reversals.

Historical Significance and Market Sentiment

Historical analysis shows that 52-week highs often coincide with market tops, while lows tend to align with market bottoms. This is because these extreme values represent areas where buyers or sellers reach a saturation point. At a 52-week high, buyers may be reluctant to push prices higher due to diminishing marginal returns, while sellers may see it as an opportune time to take profits. Similarly, at a 52-week low, sellers may exhaust their supply, while buyers may perceive a value buying opportunity.

However, it’s important to note that 52-week highs and lows are not foolproof indicators. They should be used in conjunction with other technical analysis tools and market context to form a comprehensive trading strategy.

Trading Strategies Using 52-Week Highs/Lows

Traders can devise various trading strategies based on 52-week high/low levels. One common approach is to buy near 52-week lows in anticipation of a market reversal and profit from the upward price movement. Conversely, traders may consider selling near 52-week highs, betting on a retracement towards lower prices.

Another strategy involves setting stop-loss orders just below 52-week lows or above 52-week highs. This helps traders limit potential losses if the market moves against their position. Alternatively, traders may use these levels as a confirmation signal, entering a trade only after a clean breakout or breakdown past these extreme values.

Image: www.forexfactory.com

Common Pitfalls in 52-Week High/Low Trading

While 52-week highs and lows can be valuable trading aids, traders should be aware of certain pitfalls. One is the potential for false breakouts or breakdowns, especially when the market is volatile. A failed breakout past a 52-week high or breakdown below a 52-week low can result in significant losses.

Another pitfall is ignoring market fundamentals. While technical analysis can provide insights into market psychology, it should not be the sole basis for making trading decisions. Traders should also consider economic data, political events, and other macro factors that can impact currency prices.

Forex 52 Week High Low

https://youtube.com/watch?v=52p83mHTTls

Conclusion

Understanding 52-week high/low levels is an essential aspect of forex trading. These extreme values provide valuable insights into market sentiment and potential price turning points. By incorporating these levels into their trading strategies and avoiding common pitfalls, traders can enhance their decision-making process and increase their chances of success in the dynamic world of forex.