Peering into the Crystal Ball: Forecasting Global Economic Conditions

The forex market, a global financial hub where currencies are traded, serves as a bellwether of economic health. The recent 2018-19 Eco Survey conducted by the Forex Association gauges the perspectives of forex professionals, providing valuable insights into the global economic landscape. This article delves into the survey’s findings, shedding light on the latest trends and developments shaping the world economy.

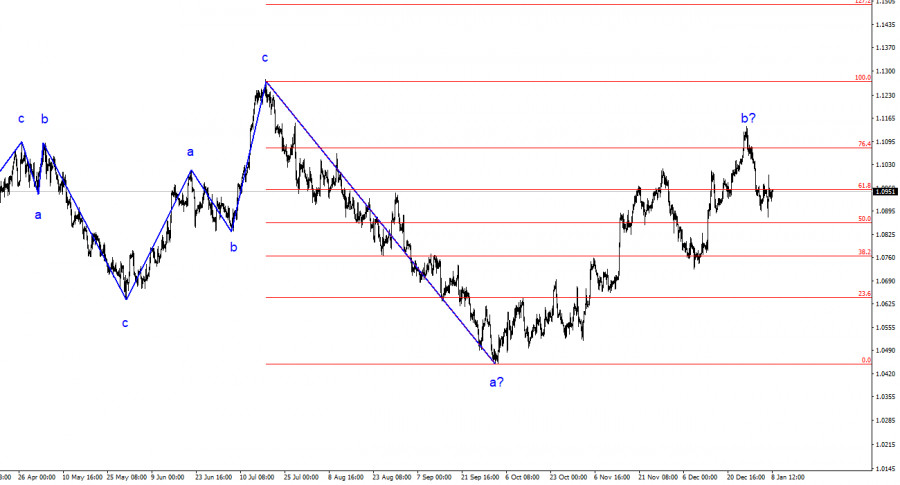

Image: www.instaforex.eu

Navigating Uncertain Waters: Challenges and Opportunities

The forex market, operating in a dynamic and interconnected global economy, is exposed to a myriad of challenges and opportunities. Factors such as geopolitical events, trade dynamics, and central bank policies exert a significant influence on currency markets. The Eco Survey offers a valuable lens through which to assess these variables and their potential impact on the global economy.

Examining Global Economic Health: A Tapestry of Perspectives

The survey gathered input from a diverse group of forex professionals, encompassing traders, brokers, and analysts from across the globe. This broad representation provides a comprehensive snapshot of market sentiment and expectations regarding economic conditions in various regions.

Unlocking the Data: Key Takeaways and Implications

The Eco Survey highlights several notable findings that have profound implications for global economic prospects. Forex professionals expressed cautious optimism about the overall economic outlook, anticipating moderate growth in the coming year. However, they also identified pockets of risk and uncertainty, particularly surrounding geopolitical tensions and trade disputes.

Image: www.youtube.com

A Deeper Dive into the Findings

- Forecast for Economic Growth: The survey revealed that forex professionals anticipate a modest 2.5% global economic growth in 2019, mirroring the International Monetary Fund’s projections.

- Impact of Geopolitical Risks: Respondents cited escalating trade tensions, Brexit uncertainties, and political instability in certain regions as key factors influencing economic outlook.

- Central Bank Policies in Focus: Expectations surrounding central bank decisions, particularly in the United States and eurozone, played a significant role in currency market sentiment.

- Emerging Market Dynamics: The survey highlighted potential vulnerabilities in some emerging markets, warranting close monitoring of their economic health and risk profiles.

- Commodity Market Influence: Fluctuations in commodity prices, especially oil, were identified as potential sources of volatility for currency markets.

Expert Insights: Navigating the Forex Maze

Based on the survey findings and insights from forex professionals, several tips emerge for investors and traders:

- Exercise Prudence: Maintain a balanced approach, diversifying investments across various asset classes and currencies.

- Monitor Geopolitical Developments: Keep abreast of global events with the potential to impact financial markets.

- Pay Attention to Central Bank Policy Shifts: Monitor announcements and speeches from key central banks to gauge their stance on monetary policy.

- Be Aware of Emerging Market Risks: Assess the economic profiles and political stability of emerging markets before investing.

- Stay Informed: Follow market news and analysis to stay informed about the latest developments and their potential impact on currency markets.

Common Questions Unraveled: A Guiding Light

Q: How can the forex market predict economic conditions?

A: Forex market activity reflects the collective expectations of participants, providing insights into the perceived strength or weakness of various economies.

Q: What are the potential risks to economic growth in 2019?

A: Geopolitical tensions, trade disputes, and policy uncertainty pose potential risks to global economic growth.

Q: How can investors prepare for potential market volatility?

A: Diversify investments, monitor geopolitical events, and assess central bank policies to mitigate risk and seize opportunities.

Forex 2018-19 Eco Survey

Looking Ahead: A Path Lit by Insights

The Forex 2018-19 Eco Survey provides a valuable roadmap for navigating the global economic landscape. Its findings empower market participants with insights into the challenges and opportunities shaping the world economy. By embracing expert advice, investors and traders can position themselves to navigate market volatility and capitalize on potential gains in the year ahead.

Are you intrigued by the insights offered in this article? If so, explore our website for further analysis and expert commentary on the intricacies of forex trading.