Introduction:

In the captivating realm of forex trading, there exists a highly acclaimed strategy employed by savvy traders worldwide—the “10 Pips After Open” approach. This ingenious strategy hinges upon capitalizing on the market’s initial volatility following the session’s commencement, thereby enabling traders to secure consistent profits with remarkable efficiency. Throughout this comprehensive guide, we will delve into the intricacies of this remarkable strategy, equipping you with the knowledge and techniques to harness its potential.

Image: www.forextrading200.com

At the dawn of each trading session, the forex market exhibits a characteristic surge in volatility, creating a fertile ground for discerning traders to exploit. The “10 Pips After Open” strategy seeks to capture this inherent market behavior, capitalizing on the predictable price movements that typically occur within the initial ten pips after the session’s opening.

Harnessing the Market’s Predictability:

The “10 Pips After Open” strategy revolves around the concept of exploiting the market’s tendency to establish a clear direction shortly after the session’s commencement. By promptly identifying this directional bias and executing trades in accordance with it, traders can significantly increase their chances of capturing profitable market moves.

To effectively implement this strategy, traders must possess a keen understanding of market dynamics and be able to rapidly assess the market’s sentiment. This entails monitoring key economic indicators, news events, and technical analysis to discern the prevailing market bias with precision.

Implementing the 10 Pips After Open Strategy:

Executing trades using the “10 Pips After Open” strategy requires adherence to a specific set of guidelines:

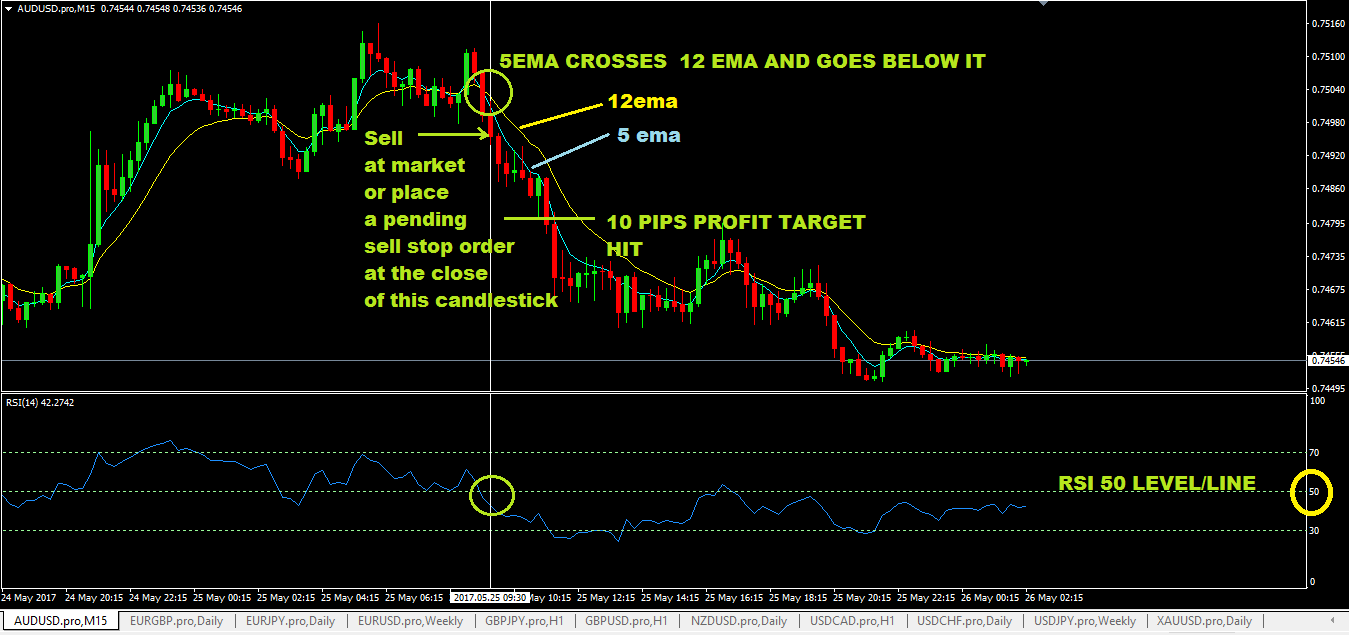

- Identify the market’s direction: Conduct thorough technical analysis or consult reliable market sentiment indicators to determine the market’s likely direction.

- Place pending orders: Position buy stop or sell stop orders ten pips above or below the current market price, depending on the anticipated market direction.

- Execute trade: Once the market triggers your pending order, enter the trade with a predetermined lot size and profit target.

- Manage risk: Employ stringent risk management practices, including stop-loss orders and position sizing strategies, to safeguard your capital.

Tips for Maximizing Success:

To optimize the effectiveness of the “10 Pips After Open” strategy, consider incorporating the following tips into your trading:

Choose liquid currency pairs: Focus on trading highly liquid currency pairs, such as EUR/USD or GBP/USD, to ensure sufficient market depth and minimize slippage.

Trade during high-volatility periods: Identify trading sessions that typically exhibit elevated volatility, such as the London or New York sessions, to increase the probability of profitable trades.

Test and refine strategy: Before deploying the “10 Pips After Open” strategy in a live trading environment, meticulously test and refine it using a demo account to optimize its parameters.

Image: www.forexstrategiesresources.com

Frequently Asked Questions (FAQs):

Q: Is the “10 Pips After Open” strategy suitable for all traders?

A: While this strategy has been successful for many traders, its effectiveness is contingent upon individual trading styles, risk tolerance, and market conditions.

Q: What is the average profit potential of the “10 Pips After Open” strategy?

A: Profitability varies significantly depending on factors such as market conditions, traded currency pairs, and risk management practices.

Q: Can the “10 Pips After Open” strategy be automated?

A: With the advancement of trading technology, it is possible to automate the execution of this strategy using expert advisors or trading bots.

Forex 10-Pips-After-Open

Conclusion:

The “10 Pips After Open” strategy stands as a testament to the ingenuity and resilience of the forex trading community. By harnessing the market’s inherent volatility and employing a disciplined approach, traders can consistently capture profitable market moves. Remember, mastering any trading strategy requires patience, discipline, and a commitment to continuous learning. Are you ready to unlock the potential of the “10 Pips After Open” strategy and elevate your forex trading to new heights? Embrace the challenge, and let the markets be your canvas.