Navigating the world of foreign exchange can be a daunting task, especially when it comes to predicting the ever-fluctuating values of currencies. Understanding the key factors that influence exchange rates is crucial for businesses, investors, and travelers alike.

Image: capital.com

In this article, we will delve into the dynamics of forecasting the forex rate between the euro (EUR) and the Indian rupee (INR). We will analyze the historical trends, economic indicators, and market sentiments that shape the relationship between these two currencies.

Historical Trends

Over the past decade, the euro has generally appreciated against the INR, with a few notable periods of depreciation. The most significant appreciation occurred during the global financial crisis of 2008-2009, when investors sought refuge in the perceived safety of the euro. Conversely, the INR weakened significantly due to India’s high exposure to global economic uncertainty.

Economic Indicators

Macroeconomic indicators play a significant role in determining currency values. For the euro, key indicators include:

- Gross domestic product (GDP) growth rate

- Inflation rate

- Interest rates

For the INR, important indicators comprise:

- GDP growth rate

- Current account deficit

- Foreign direct investment

Market Sentiments

In addition to economic fundamentals, market sentiments can also influence exchange rates. Positive investor sentiment towards the eurozone or negative sentiment towards India can lead to a rise in the EUR/INR rate. Conversely, positive sentiment towards India or negative sentiment towards the eurozone can cause the INR to appreciate against the euro.

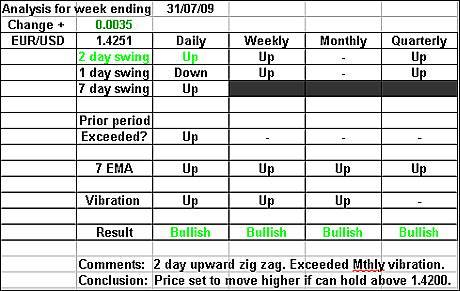

Image: www.brainyforex.com

Latest Trends and Developments

In recent months, the EUR/INR rate has been relatively stable, with the euro trading around 85.00-86.00 against the INR. However, there are several factors that could potentially impact the exchange rate in the near future:

- The ongoing COVID-19 pandemic

- Monetary policy decisions by the European Central Bank (ECB) and the Reserve Bank of India (RBI)

- Fiscal stimulus measures by governments in the eurozone and India

Tips for Forecasting

Forecasting currency rates is not an exact science, but there are some tips that can help you make informed predictions:

- Monitor economic indicators and market sentiments regularly.

- Use technical analysis to identify trends in the exchange rate.

- Consider the historical performance of the EUR/INR rate.

- Consult with financial experts for their insights.

Remember that currency markets are volatile, and forecasts can change rapidly. It is important to regularly review and adjust your predictions based on new information.

FAQ

Q: What are some factors that can affect the EUR/INR exchange rate?

A: Economic indicators, market sentiments, and geopolitical events can all impact the EUR/INR exchange rate.

Q: Which economic indicators are most important to consider when forecasting the EUR/INR rate?

A: GDP growth rate, inflation rate, interest rates, current account deficit, and foreign direct investment are key economic indicators to watch.

Q: How can I use technical analysis to forecast the EUR/INR rate?

A: Technical analysis involves studying historical price charts to identify patterns and trends. Traders use technical indicators to predict future price movements.

Q: What is the best way to stay informed about the latest trends and developments in the EUR/INR market?

A: Reading financial news, following financial analysts on social media, and using reputable currency forecasting services can help you stay up-to-date.

Forecast Forex Rate Euro Inr

Conclusion

Forecasting the forex rate between the euro and the Indian rupee requires a comprehensive understanding of economic fundamentals, market sentiments, and historical trends. While predicting currency movements with certainty is impossible, by following the tips outlined in this article, you can improve the accuracy of your forecasts and make informed decisions in the currency markets.

If you are interested in learning more about forex forecasting or have specific questions about the EUR/INR rate, feel free to contact a financial expert or consult reputable sources of information.