The intricate world of foreign exchange trading demands precision and understanding, especially when choosing a forex broker. In Australia, fixed spread forex brokers have emerged as a reliable option for traders seeking stability and predictability in their financial endeavors.

Image: www.freeforexrobot.com

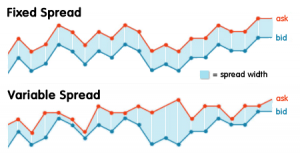

Fixed spread forex brokers provide traders with a consistent difference between the bid and ask prices, regardless of market conditions. Unlike variable spread brokers, whose spreads can fluctuate dramatically, fixed spread brokers offer peace of mind by maintaining stable spreads throughout trading sessions.

Understanding Fixed Spread Forex Brokers

To fully appreciate the benefits of fixed spread forex brokers, it’s essential to delve into their operational framework:

Stable Spreads: As mentioned earlier, fixed spread forex brokers maintain consistent spreads, which provides traders with a clear and reliable trading environment free from unpredictable spread fluctuations.

Transparency: Traders can instantly calculate their trading costs based on the fixed spread, ensuring transparency and clarity in every trade execution.

Predictability: Fixed spreads allow traders to plan their trades effectively by accurately estimating the potential costs involved. This predictability reduces the risk of unexpected costs that can affect trading profits.

Benefits of Fixed Spread Forex Brokers

The advantages of fixed spread forex brokers extend beyond the realm of stable spreads, providing numerous benefits to traders:

- Reduced Trading Costs: Fixed spreads eliminate the risk of excessive spread markups, enabling traders to save on trading costs and maximize their profits.

- Precise Execution: Stable spreads enable precise trade execution, as traders can confidently enter and exit positions knowing the exact spread.

- Risk Management: Predictable spreads facilitate effective risk management strategies, allowing traders to control their risk exposure and protect their capital.

Tips for Choosing a Fixed Spread Forex Broker

To make an informed decision when choosing a fixed spread forex broker, consider the following tips:

Regulation: Ensure the broker is regulated by reputable financial authorities, such as the Australian Securities and Investments Commission (ASIC).

Reputation: Research the broker’s online reviews, testimonials, and industry reputation to assess its reliability and trustworthiness.

Trading Conditions: Carefully examine the broker’s trading conditions, including spread levels, commission fees, and minimum deposit requirements.

Customer Support: Opt for a broker that provides responsive and knowledgeable customer support to address your queries promptly.

Image: www.sashares.co.za

FAQs on Fixed Spread Forex Brokers

Q: Are fixed spread forex brokers suitable for all traders?

A: Fixed spread forex brokers are ideal for traders who seek stability, predictability, and reduced trading costs.

Q: How can I ensure the fairness of the fixed spreads?

A: Choose a regulated broker with a transparent pricing policy and a proven track record of reliability.

Fixed Spread Forex Brokers Australia

Conclusion

Fixed spread forex brokers in Australia offer a compelling combination of stability and transparency, empowering traders with the tools they need to succeed in the ever-evolving forex market. By embracing the advantages of fixed spreads, traders can minimize trading costs, improve execution precision, and effectively manage risk. Remember to conduct thorough research and consider the tips outlined above when selecting a fixed spread forex broker that aligns with your trading goals. Let us know if you wish for further elaboration or assistance.