Unveiling institutional forex open positions holds immense significance for the savvy trader. These positions, often executed by hedge funds, investment banks, and other financial heavyweights, can serve as valuable market indicators, offering precious insights into the potential direction of currency pairs.

Image: www.youtube.com

Institutional Dominance in Forex Markets

Institutional players wield a substantial influence in the forex market, accounting for a staggering majority of trading volume. Their intricate transactions and sophisticated strategies can shape currency market dynamics and provide valuable cues for retail traders.

Comprehending the underlying motivations and positioning of these titans allows retail traders to make informed decisions, anticipating market shifts and capitalizing on potential profit opportunities. By decoding institutional sentiment through their open positions, traders can gain a competitive edge and navigate the complexities of the forex market with greater precision.

Window into Insider Insights

Benefits of Tracking Institutional Positions

- Early Detection of Market Trends: Institutional traders often react swiftly to emerging market conditions, initiating positions that can foreshadow potential price movements. Tracking their open positions enables retail traders to identify these emerging trends frühzeitig, gaining a temporal advantage in executing profitable trades.

- Confirmation of Existing Analysis: By comparing institutional positions with personal analysis, retail traders can validate their own trading strategies. If institutional positions align with retail traders’ perspectives, it provides increased confidence in the accuracy of their predictions.

- Identifying Potential Reversals: Institutions often adjust their positions to ride market momentum or anticipate reversals. By monitoring these adjustments, retail traders can gain insights into potential turning points in the market, allowing them to exit or enter trades at opportune moments.

Image: 178.248.238.87

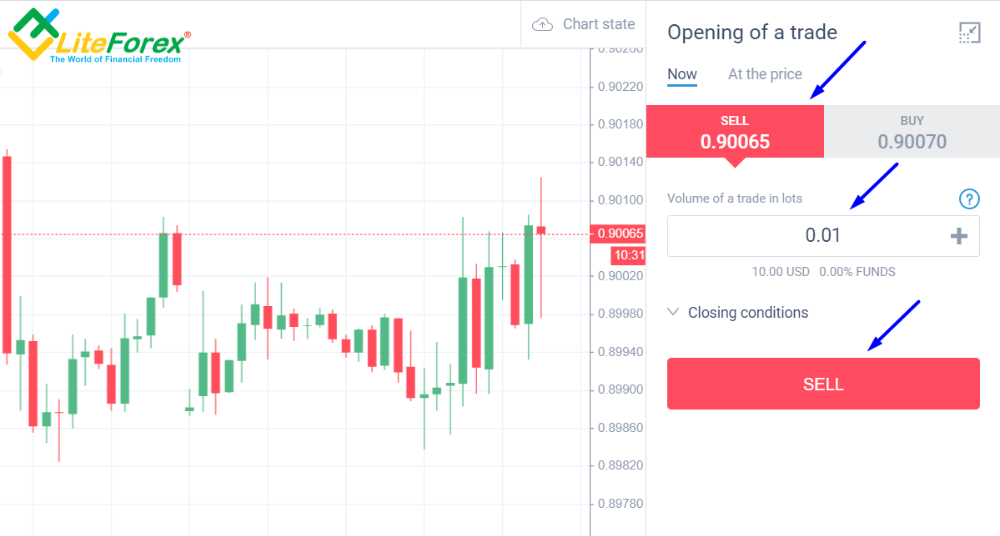

Detailed Overview of Open Positions

Institutional forex open positions can be broadly classified into two types:

- Buy Positions: Institutional players purchase a currency pair (Base currency [BC] > Quote currency [QC]), expecting the value of the base currency to rise relative to the quote currency. For instance, if an institution buys EUR/USD, they anticipate the euro to appreciate against the US dollar.

- Sell Positions: When an institution sells a currency pair (QC > BC), it implies they believe the value of the quote currency will increase compared to the base currency. For example, if an institution sells GBP/JPY, they expect the British Pound to depreciate against the Japanese Yen.

Accessing Institutional Positions

There are multiple platforms that provide access to institutional forex open positions, either through paid subscriptions or free of charge:

- Commercial Data Vendors: Companies like Refinitiv (formerly Reuters) and Bloomberg offer comprehensive data feeds that include institutional order flow and open positions.

- Social Media: Twitter and specialized forex forums often host discussions and insights shared by institutional traders, providing valuable glimpses into their market sentiment.

- Free Data Sources: Websites such as Forex Factory and DailyFX offer limited but valuable information on institutional open positions and market sentiment.

Expert Tips and Advice

Professional Insights for Trading Success

- Interpretation Context: When analyzing institutional positions, consider the broader market context, including economic news, technical indicators, and geopolitical events.

- Distinguish Speculation from Hedging: Institutions engage in both speculative and hedging strategies. Identify the primary reason behind their positions to accurately gauge market sentiment.

- Avoid Overreliance: Institutional open positions are valuable, but they should not be the sole basis for trading decisions. Combine them with personal анализ and risk management strategies.

FAQs on Institutional Forex Positions

Q: Why are institutional forex positions important for retail traders?

A: Institutional positions provide valuable insights into the market’s potential direction, allowing traders to make informed decisions and capitalize on profit opportunities.

Q: How can I access institutional forex positions?

A: Data vendors, social media, and free data sources offer various platforms to access institutional order flow information.

Q: Should I rely solely on institutional positions when making trading decisions?

A: No, while institutional positions are valuable, they should be considered in conjunction with personal анализ and risk management strategies.

Find Institutional Forex Open Positions

Conclusion

Unveiling institutional forex open positions empowers retail traders with an invaluable market intelligence tool. By gaining insights into the positioning and sentiment of institutional players, traders can navigate market fluctuations with greater clarity and confidence. Whether you’re seeking validation for your trading strategies or anticipating market reversals, monitoring institutional positions provides a crucial edge in the fast-paced world of forex trading.

Are you ready to leverage this exceptional opportunity to enhance your trading prowess? Share your thoughts on the significance of institutional forex open positions in the comments below!