Image: www.mql5.com

In the realm of forex trading, where volatility reigns supreme, traders are constantly seeking an edge. The Fibonacci process stands as a beacon of hope, illuminating pathways to profit amidst the market’s chaos. This ancient sequence, discovered centuries ago by the Italian mathematician Leonardo Fibonacci, has captivated traders worldwide with its uncanny ability to predict price movements.

Unveiling the Fibonacci Enigma

The Fibonacci sequence captivates with its simplicity and elegance. Each number in the sequence is the sum of the two preceding numbers. Thus, the sequence begins as 0, 1, 1, 2, 3, 5, 8, 13, and so on. When applied to forex charts, the Fibonacci ratios emerge as crucial landmarks that guide traders’ decisions. These ratios include 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

Decoding the Charting Canvas

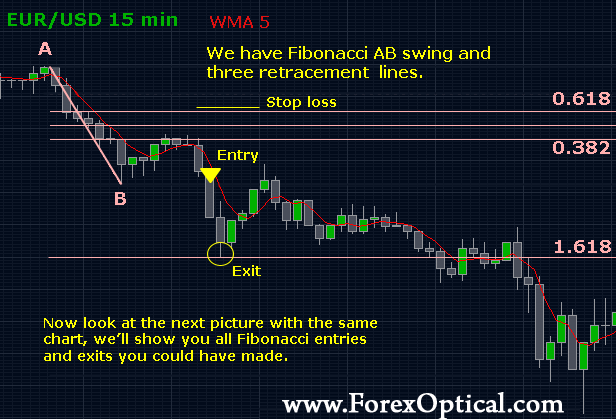

Traders employ the Fibonacci ratios to identify potential support and resistance levels. Support levels represent points where the price is likely to bounce back from a decline, while resistance levels indicate areas where a price rally may encounter resistance. By overlaying Fibonacci ratios on a forex chart, traders gain insights into past, present, and future price behavior.

A Window into Future Price Movements

The Fibonacci sequence unveils glimpses into the future price trajectory. Traders plot Fibonacci retracement and extension levels to predict price targets. Retracement levels indicate areas where a price reversal may occur, while extension levels project potential price breakouts. This foresight empowers traders to make informed decisions and potentially capitalize on profitable opportunities.

Expert Insights: Forecasting Success

-

David H. Weis, Fibonacci expert and author: “Fibonacci retracements are a powerful tool for identifying potential trading zones. When combined with support and resistance levels, they can significantly improve trade execution.”

-

Scott Carney, FXCM Market Strategist: “The Fibonacci process provides a systematic approach to market analysis. By applying these ratios, traders can anticipate potential price movements with greater precision.”

Actionable Tips: Harnessing Fibonacci Wisdom

- Identify Fibonacci retracement levels: Calculate these levels using the Fibonacci ratios (23.6%, 38.2%, etc.) applied to recent price swings.

- Plot Fibonacci extension levels: Extend the Fibonacci ratios beyond the retracement levels to project potential price targets.

- Combine with other technical indicators: Fibonacci analysis complements other trading tools like moving averages and chart patterns, enhancing overall market analysis.

Beyond the Mystique: A Proven Forecasting Tool

The Fibonacci process has withstood the test of time, transcending trading theories and becoming an integral part of forex forecasting. Traders who harness the power of Fibonacci sequences gain a unique advantage, navigating market volatility with greater confidence and profitability.

Conclusion: Unraveling Forex’s Enigma

The Fibonacci process invites traders to embark on a journey into the mysterious realm of forex forecasting. By embracing this ancient wisdom and combining it with modern charting techniques, traders unveil hidden patterns and gain a competitive edge. As Leonardo Fibonacci once said, “Numbers hold the secrets of the universe,” and in the world of forex, the Fibonacci sequence unveils a path to financial empowerment.

Image: admiralmarkets.sc

Fibonacci Process To Calculate Forecast Of Forex