Navigating the Regulatory Landscape

The foreign exchange (forex) market, a vast and dynamic global marketplace, plays a pivotal role in facilitating international trade and investment. However, to ensure the integrity and stability of this market, regulatory bodies have established guidelines to govern retail forex transactions. In this article, we delve into the FEMA guidelines that govern transaction limits for retail forex traders in India, providing a comprehensive understanding of these regulations.

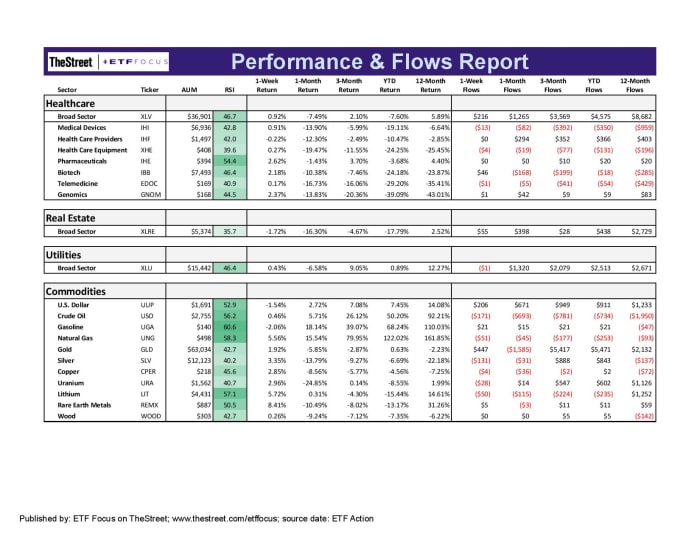

Image: www.thestreet.com

Definition and Scope

The Foreign Exchange Management Act (FEMA) of 1999 empowers the Reserve Bank of India (RBI) to regulate and monitor foreign exchange transactions within the country. Under FEMA, “retail forex transactions” refer to any transaction involving the buying or selling of foreign exchange by individuals or entities other than authorized dealers or banks. These guidelines aim to safeguard the Indian economy by preventing illicit financial flows and maintaining currency stability.

Transaction Limit

As per FEMA regulations, the maximum transaction limit for retail forex trades is USD 250,000 per financial year. This limit is applicable to all transactions combined, including spot, forward, and options contracts. It’s crucial to note that these limits apply solely to transactions conducted through authorized dealers, such as banks or brokers licensed by the RBI.

Significance and Implications

The transaction limit imposed by FEMA serves several critical purposes. It helps curb excessive speculation in the forex market, which can lead to market volatility and instability. Moreover, it prevents individuals or entities from amassing large foreign exchange reserves, potentially destabilizing the Indian rupee’s value against foreign currencies. Additionally, these regulations encourage responsible trading practices and prevent potential financial abuse.

Image: money.usnews.com

Latest Trends and Developments

The forex market is constantly evolving, with new regulations and trends emerging. One notable development is the increasing popularity of online forex trading platforms. While these platforms offer convenience and accessibility, traders must remain vigilant and ensure that they only use licensed brokers regulated by the RBI.

Tips and Expert Advice

To navigate the regulatory landscape successfully, retail forex traders should consider the following tips and expert advice:

- Familiarize yourself with FEMA guidelines and adhere to the transaction limits.

- Choose a reputable and RBI-licensed broker for your forex trades.

- Understand the risks associated with forex trading and trade prudently.

- Keep detailed records of all your transactions for regulatory compliance.

FAQ

Q: What is the purpose of FEMA guidelines on retail forex transactions?

A: To ensure market stability, prevent illicit financial flows, and promote responsible trading practices.

Q: What is the maximum transaction limit under FEMA for retail forex trades?

A: USD 250,000 per financial year.

Q: Who is responsible for enforcing FEMA regulations?

A: The RBI.

Fema Guidelines For Transaction Limit For Retail Forex

Conclusion

FEMA guidelines play a vital role in regulating retail forex transactions in India. By understanding these regulations, traders can ensure compliance and safeguard their financial interests. Whether you’re a seasoned trader or new to the forex market, staying informed about FEMA guidelines is imperative. If you have any further questions, please consult the official RBI website or seek professional guidance to gain a deeper understanding of these regulations.