Introduction: What Makes the Forex Market Unique?

The foreign exchange (forex) market, where currencies are traded globally, is a trillion-dollar industry that stands out for its sheer size and unparalleled liquidity. However, beyond these headline figures, the forex market exhibits a constellation of peculiar characteristics that set it apart from other financial realms. In this in-depth exploration, we’ll venture into the labyrinth of forex quirks, uncovering their genesis and implications for traders.

Image: howtotradeonforex.github.io

Peculiarity #1: The Triangular Paradigm

Unlike traditional exchanges, where buy and sell orders converge at a central hub, the forex market operates as an over-the-counter (OTC) network. This decentralized structure gives rise to the “triangular paradigm,” where currency pairs are exchanged directly between counterparties. Consequently, the forex market lacks central pricing mechanisms, leading to variations in quotes across different brokers.

Peculiarity #2: The Invisible Market

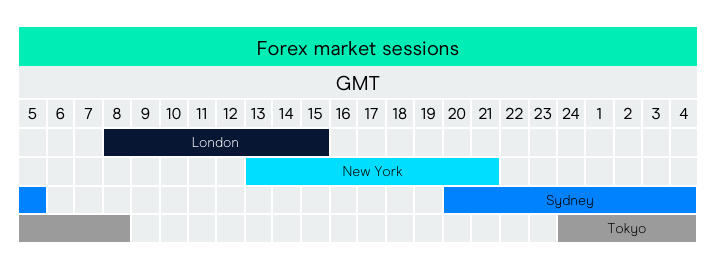

Operating round-the-clock in various time zones, the forex market is often referred to as the “invisible market.” This moniker stems from its decentralized and electronic nature. Transactions occur exclusively through digital platforms, leaving no physical footprint. The lack of a central trading location contributes to its anonymity and vast accessibility.

Peculiarity #3: The Levered Landscape

Leverage, a double-edged sword in the forex market, amplifies both profits and losses. Traders can employ substantial leverage, allowing them to control positions worth multiples of their initial investment. While it increases trading potential, leverage also magnifies risks, emphasizing the importance of disciplined risk management.

Image: thewaverlyfl.com

Peculiarity #4: The Carry Trade Conundrum

The carry trade, a strategy that exploits interest rate differentials between currencies, is a unique feature of the forex market. Traders borrow low-yielding currencies and invest in higher-yielding ones, pocketing the interest rate spread. However, this strategy hinges on the stability of exchange rates, making it susceptible to sudden shifts in currency values.

Peculiarity #5: The High-Frequency Frenzy

The influx of technology and algorithmic trading has introduced a new breed of participants to the forex market—high-frequency traders (HFTs). These sophisticated algorithms execute lightning-fast transactions, exploiting microscopic price movements. While they add liquidity to the market, HFTs have also raised concerns about potential market manipulation.

Peculiarity #6: The Interventionist Interlude

Unlike other markets, central banks actively intervene in the forex market by buying or selling their respective currencies to influence exchange rates. This intervention aims to stabilize currencies, curb inflation, or stimulate economic growth. The unpredictable nature of these interventions can create market volatility for traders.

Peculiarity #7: The Geopolitical Tapestry

The forex market is not immune to geopolitical events. Wars, natural disasters, and political turmoil can trigger significant currency fluctuations. Traders must stay abreast of global events to anticipate and potentially capitalize on these market-moving catalysts.

Peculiarity #8: The Hedging Haven

The forex market plays a critical role in risk management for multinational corporations and institutional investors. They use currency hedging strategies to mitigate the impact of exchange rate fluctuations on their global operations. For example, companies with overseas subsidiaries can hedge against potential losses by locking in favorable exchange rates.

Peculiarity #9: The Technical Mecca

Technical analysis, a popular trading technique based on historical price patterns, finds fertile ground in the forex market. The absence of central price feeds and the decentralized nature of the market make technical indicators particularly relevant for traders seeking to identify trading opportunities.

Peculiarity #10: The Psychological Crucible

Trading in the forex market involves a relentless battle against emotions. Traders must navigate the psychological minefield of fear, greed, and overconfidence. Understanding and controlling one’s psychological biases is paramount for long-term success.

Feature Peculiar With The Forex Market

Conclusion: Embracing the Forex Market’s Eccentricities

While these peculiar characteristics may present challenges, they also unveil the unique opportunities inherent in the forex market. By embracing its complexities and leveraging its strengths, traders can navigate these financial waters with greater confidence and potentially reap the rewards that lie within. The forex market’s quirks serve as a constant reminder that knowledge, adaptability, and risk management are the cornerstones of successful trading. As traders delve deeper into this dynamic and ever-evolving market, these peculiarities become less anomalies and more a testament to the forex market’s boundless fascination.