Introduction

Navigating the ever-changing landscape of foreign exchange (forex) markets requires understanding the complexities of exchange rate fluctuations. For traders, investors, and individuals involved in cross-border transactions, predicting currency exchange rates is crucial for informed decision-making. This article delves into the expected forex rate calculation formula, providing a comprehensive guide to forecasting exchange rate movements.

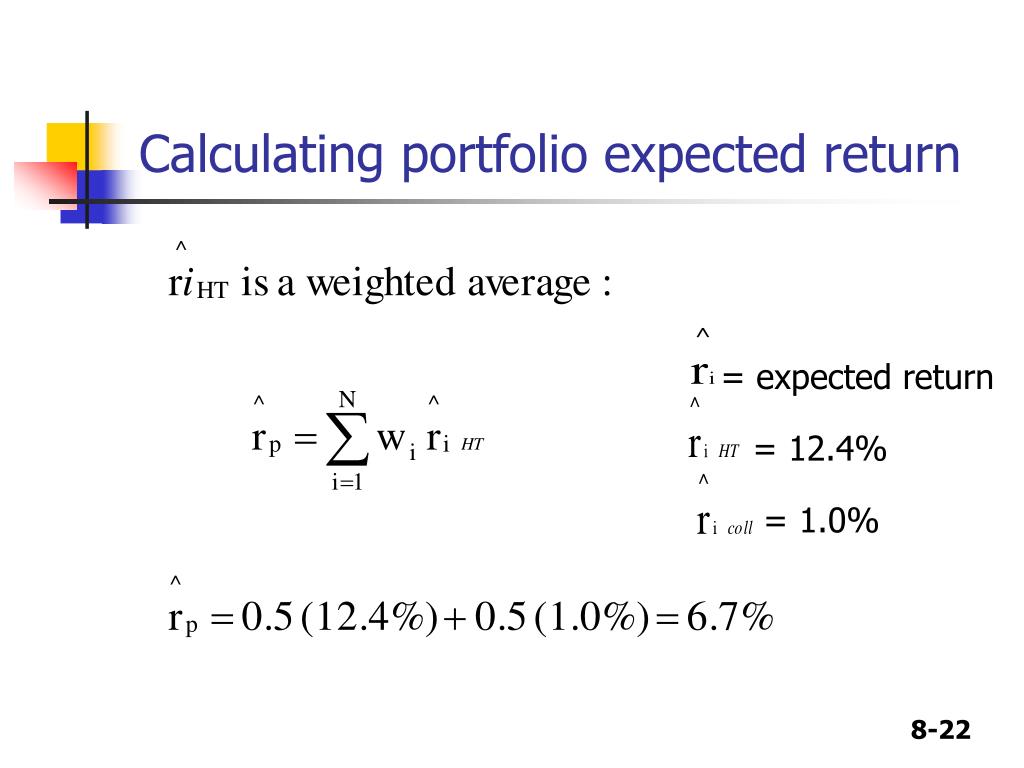

Image: www.slideserve.com

Understanding Expected Forex Rates

Expected forex rates represent the projected exchange rate between two currencies at a specific future date. These rates are based on a combination of fundamental and technical factors that influence currency fluctuations. Fundamental factors include economic indicators such as GDP growth, inflation, and interest rates, while technical factors encompass historical data, chart patterns, and market sentiment.

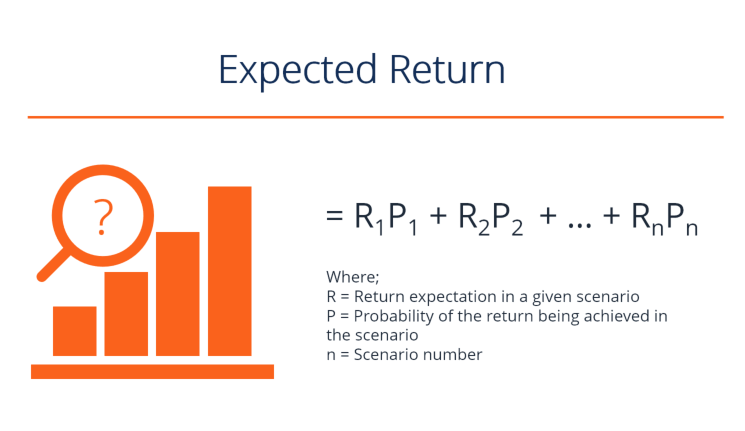

Calculating Expected Forex Rates

The formula for calculating expected forex rates involves the use of forward exchange rates. Forward rates reflect the market’s expectations of future spot exchange rates. Mathematically, the expected spot exchange rate (St+1) at time t is calculated as:

<em>S<sub>t+1</sub></em> = <em>F<sub>t</sub></em> - <em>(i<sub>d</sub> - i<sub>f</sub>)t</em>where:

- Ft is the forward rate at time t

- id is the domestic interest rate

- if is the foreign interest rate

- t is the number of periods between t and t+1

Factors Influencing Expected Forex Rates

Numerous factors contribute to the formation of expected forex rates. Some of the key influences include:

- Economic Performance: Strong economic performance, indicated by factors like high GDP growth and low unemployment, typically attracts foreign investors, leading to an appreciation of the currency.

- Interest Rates: Higher interest rates in one country relative to another make that currency more attractive to investors, causing its value to rise.

- Political Stability: Countries with political stability and a favorable investment climate generally experience higher demand for their currencies, leading to stronger exchange rates.

- Trade Flows: Countries with large trade surpluses tend to see an appreciation of their currencies due to the influx of foreign currency used in purchasing their exports.

- Risk Appetite: Economic uncertainty and global risk aversion can increase demand for perceived safe-haven currencies, such as the US dollar.

Image: xanderkameron.blogspot.com

Tips for Predicting Expected Forex Rates

Predicting expected forex rates accurately requires a combination of technical and fundamental analysis:

- Technical Analysis: Analyzing historical price charts and patterns can help identify trends and potential turning points in exchange rates.

- Fundamental Analysis: Monitoring economic indicators, political events, and central bank announcements provides insights into factors that may influence future currency movements.

- Market Sentiment: Gauging market sentiment through sentiment indicators or social media monitoring can reveal market biases and potential turning points.

- Stay Updated: Regularly following financial news and developments related to forex markets is crucial for staying informed about potential factors influencing exchange rates.

FAQs

- Why are expected forex rates important?

Expected forex rates provide a basis for informed decision-making for traders, investors, and individuals involved in cross-border transactions. - What factors should be considered when predicting exchange rate changes?

Factors to consider include economic performance, interest rates, political stability, trade flows, and risk appetite. - How can I stay updated on forex market developments?

Regularly following financial news, reading industry publications, and monitoring financial websites can help you stay informed about the latest developments in forex markets. - What are the limitations of exchange rate forecasting?

Forecasting exchange rates is complex and uncertain, as it involves many factors that are difficult to predict accurately.

Expected Forex Rate Calculation Formula

https://youtube.com/watch?v=NEwDxqx0JOg

Conclusion

Understanding the calculation of expected forex rates and the factors that influence them empowers individuals to make informed decisions. By combining technical and fundamental analysis, traders and investors can improve their ability to predict currency fluctuations and navigate the ever-shifting foreign exchange markets.

Would you like to learn more about expected forex rate calculation? Let us know in the comments below.