Investing in foreign exchange (forex) has become a popular way to diversify portfolios and tap into global currency markets. However, navigating the complexities of forex trading can be daunting, especially for those new to the scene. That’s where exchange brokerages step in, offering a vital bridge between you and the forex market. In this comprehensive guide, we’ll delve into the world of exchange brokerage for forex options purchase, empowering you with the knowledge and strategies to make informed decisions.

Image: lobang.guru.sg

Exchange Brokerage Unveiled: The Key to Forex Options Mastery

An exchange brokerage serves as an intermediary between you and the forex market, facilitating the execution of forex trades. When you purchase forex options – financial contracts that give you the right, but not the obligation, to buy or sell a specified amount of a currency at a specific price on a future date – an exchange brokerage bridges the gap between you and the wider market. By acting as a central hub, exchange brokerages provide access to a vast pool of liquidity, ensuring that your trades are executed swiftly and efficiently.

Forex Options: A Gateway to Calculated Risk and Potential Returns

Forex options offer a unique advantage over traditional forex spot trading. Unlike spot trades, which require you to buy or sell currency outright, options give you the flexibility to take calculated risks. With a forex option, you can pay a premium upfront to secure the right to buy or sell a currency at a predetermined price in the future. This flexibility allows you to potentially profit from favorable market movements while limiting your losses if the market moves against you.

Choosing the Right Exchange Brokerage: Key Considerations

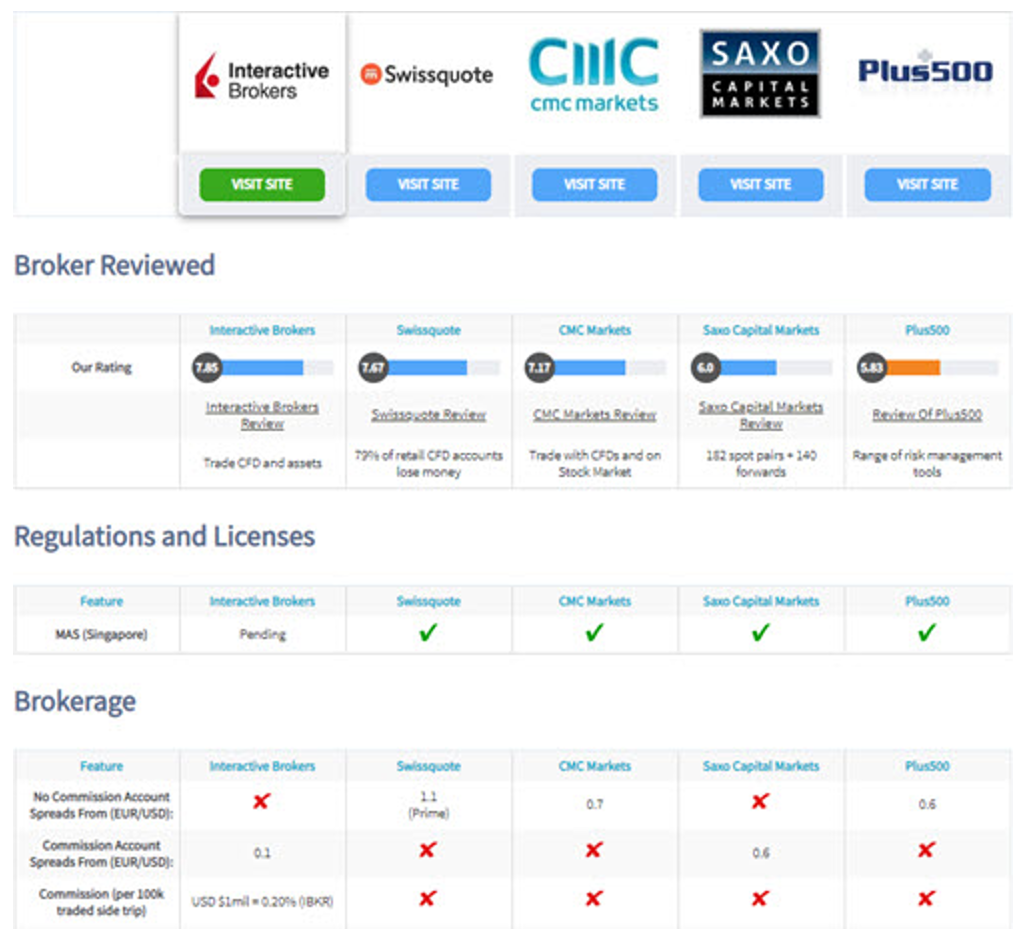

Selecting the right exchange brokerage is crucial to your forex options trading success. Key factors to consider include:

-

Image: www.worldfinance.comReputation and Regulation:

Choose brokerages that are regulated by reputable financial authorities, ensuring compliance with industry standards and client protection.

-

Trading Platform:

Evaluate the user-friendliness, reliability, and analytical tools available on the brokerage’s trading platform.

-

Fees and Commissions:

Compare the brokerages’ fee structures, including spreads, commissions, and other charges, to optimize your trading costs.

-

Customer Support:

Opt for brokerages with responsive and knowledgeable customer support teams to assist you promptly with any queries or issues.

Getting Started with Forex Options Purchase: A Step-by-Step Guide

- Open a Trading Account: Register with a reputable exchange brokerage and complete the account opening process.

- Fund Your Account: Deposit funds into your trading account using a convenient payment method supported by the brokerage.

- Assess Market Conditions: Analyze market trends, news events, and technical indicators to identify potential trading opportunities.

- Research Currency Options: Explore the available currency options and their underlying currencies, leverage, and expiration dates.

- Purchase Forex Options: Execute your trades by purchasing the forex options that align with your trading strategy.

Forex Options Strategies: Enhancing Your Trading Skills

-

Buying Call Options:

Grant the right to buy a currency at a higher price in the future, capitalizing on anticipated currency appreciation.

-

Buying Put Options:

Secure the right to sell a currency at a lower price in the future, benefiting from a forecasted currency devaluation.

-

Writing Call Options:

Sell the right to someone else to buy a currency at a higher price, earning a premium in return.

-

Writing Put Options:

Grant the right to someone else to sell a currency at a lower price, potentially generating income when the currency value rises.

The Future of Exchange Brokerage in Forex Options Trading

Technological advancements and evolving regulatory landscapes are continuously shaping the world of exchange brokerage. Expect continued enhancements in trading platforms, mobile trading capabilities, and risk management tools. Brokerages that embrace these innovations will remain at the forefront of the industry, empowering traders with cutting-edge solutions.

Exchange Brokerage For Forex Options Purchase

Conclusion: Empowering Traders and Unveiling Market Opportunities

Exchange brokerage plays a pivotal role in the realm of forex options trading. By providing access to a global market and facilitating the execution of trades, exchange brokerages empower traders with the tools they need to participate in the exciting world of forex. Whether you’re a seasoned professional or a novice, understanding the dynamics of exchange brokerage is essential to unlock the potential of forex options and make informed trading decisions.