Understanding Excel Formula for Commodity Calculation

In the realm of foreign exchange trading, commodities play a pivotal role, influencing market sentiment and traders’ decisions. Precise calculation of commodity values is crucial for effective trading strategies. Forex Factory, a renowned online forum for forex traders, provides an accessible platform for sharing valuable information and resources. Among these resources, Excel-based commodity calculation tools empower traders with the ability to determine potential profit or loss in commodity trades.

Image: www.youtube.com

Essentials of Commodity Calculation

Commodities are raw materials or primary agricultural products that are traded on exchanges or over-the-counter. Their value is determined by supply and demand dynamics, making it crucial to consider market fluctuations when calculating profit or loss. Several factors influence commodity prices, including production costs, geopolitical events, and economic conditions. Forex Factory users often utilize Excel formulas to incorporate these factors into their calculations.

Unveiling the Excel Formula

The Excel formula for commodity calculation includes the following components:

- Spot price: The current market price of the commodity

- Contract size: The number of units in one standard contract

- Pip value: The value of a point in price movement

- Position size: The number of contracts being traded

- Swap rate: The cost of rolling over a position from one contract to the next

These variables are combined in a formula to determine the potential profit or loss. For example, the following formula calculates the profit if the spot price increases:

Profit = (Spot price 2 - Spot price 1) * Contract size * Pip value * Position size * MultiplierConversely, the loss is calculated if the spot price decreases.

Tips and Expert Advice for Effective Calculation

- Accurate Data: Ensure that the spot price, contract size, and pip value used in the formula are sourced from reliable sources.

- Consider Swap Rates: Account for swap rates, which can significantly impact profits or losses when holding positions overnight or over weekends.

- Monitor Market Trends: Stay informed about market news, geopolitical events, and economic indicators that can affect commodity prices.

- Test Your Calculations: Validate your results by using different scenarios and comparing them to online calculators or other sources.

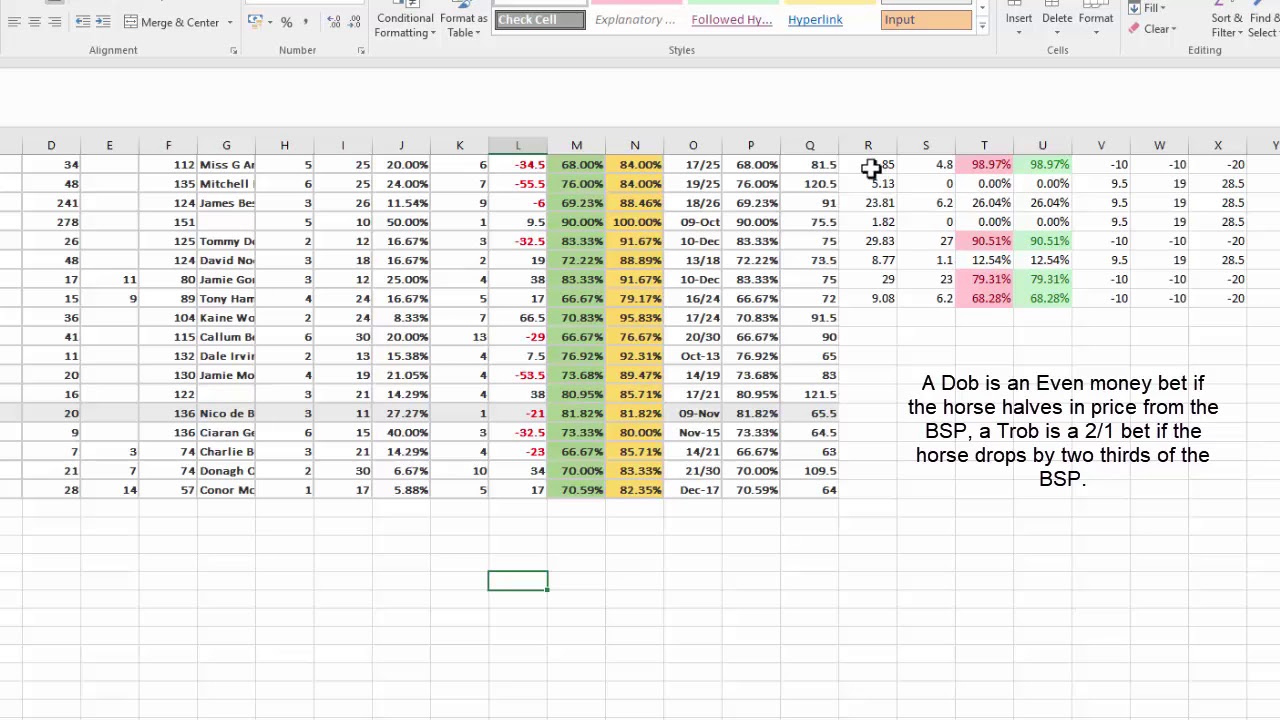

Image: www.forexfactory.com

FAQs on Excel Commodity Calculation

Q: What is the significance of the pip value in commodity calculations?

A: The pip value represents the minimum price movement for a given commodity, making it a crucial factor in determining potential profit or loss.

Q: How does the contract size affect the calculation?

A: The contract size indicates the number of units traded in one standard contract, thus influencing the overall value of the position.

Q: What is the role of the swap rate in commodity calculations?

A: The swap rate represents the cost of rolling over a position from one contract to the next, impacting profitability if positions are held for extended periods.

Excell Formed Calculation In Commodity At Forex Factory

Conclusion

Excel-based commodity calculations are essential tools for forex traders seeking to accurately assess profit or loss potential. By incorporating the tips and expert advice discussed above, traders can enhance their understanding and make informed decisions in the dynamic commodity market.

Are you interested in learning more about Excel-based commodity calculations and exploring the vast resources available on Forex Factory? Enhance your trading strategies and stay abreast with the latest market updates by delving into the world of commodity calculation.