Navigating the foreign exchange (forex) market can be a daunting task, especially when trading between the euro and Swedish krona. This guide will provide you with a comprehensive understanding of EUR/SEK trading, empowering you to make informed decisions and maximize your potential gains.

Image: www.chartoasis.com

What is the EURO to Swedish Krona (EUR/SEK) Currency Pair?

EUR/SEK represents the exchange rate between the euro (EUR) and the Swedish krona (SEK). In simple terms, it indicates the value of one euro in Swedish kronor. The euro is the currency of the European Union, while the Swedish krona is the currency of Sweden. This currency pair is commonly traded in the forex market, primarily by traders and investors.

Importance of EUR/SEK Currency Pair Trading

The EUR/SEK currency pair is widely traded due to several factors, including:

-

Economic strength: The Eurozone is one of the world’s largest economies, and Sweden boasts a stable and prosperous economy with a high standard of living.

-

Proximity and trade: Sweden and the Eurozone share close geographical proximity and have significant trade relations, which creates demand for currency exchange.

-

Liquidity: EUR/SEK is a liquid currency pair, meaning there is a high volume of trading, reducing transaction costs and offering tighter spreads.

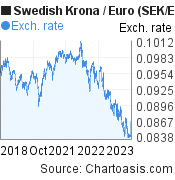

Understanding the EUR/SEK Exchange Rate

The exchange rate of EUR/SEK is constantly fluctuating, influenced by a myriad of factors, such as:

-

Economic data: News and reports on economic growth, inflation, employment, and interest rates in the Eurozone and Sweden impact the exchange rate.

-

Political events: Elections, policy changes, and geopolitical developments can trigger fluctuations in the currency pair.

-

Market sentiment: Fear, optimism, and other market emotions can drive short-term price movements in EUR/SEK.

Image: www.thetimes.co.uk

Advantages of Trading EUR/SEK

Trading EUR/SEK offers several advantages:

-

Diversification: Currency pairing allows for diversification within your portfolio, reducing overall risk.

-

Profit potential: By speculating on exchange rate fluctuations, traders can potentially earn profits from both rising and falling markets.

-

Liquidity: The high liquidity of EUR/SEK ensures ease of entry and exit, minimizing slippage and transaction costs.

-

24/5 Trading: The forex market operates 24 hours a day, five days a week, providing extended trading opportunities.

Strategies for Trading EUR/SEK

Various trading strategies can be employed for EUR/SEK currency pair, including:

-

Trend following: Identifying the prevailing trend and trading in line with it can lead to profitable returns.

-

Chart analysis: Technical analysts study historical price data to identify patterns and forecast future price movements.

-

Fundamental analysis: Examining economic data and geopolitical events can help predict long-term trends in the currency pair.

-

News trading: Trading based on major economic announcements or market-moving news releases can create opportunities for short-term gains.

-

Risk management: Establishing proper risk management measures, such as setting stop-loss orders, is crucial in currency trading.

Euro To Swedish Krona Forex

Conclusion

The EUR/SEK currency pair presents vast opportunities for forex traders and investors alike. By understanding the basics, keeping abreast of market trends, and implementing sound trading strategies, you can increase your chances of achieving profitability in EUR/SEK trading. However, it is imperative to remember that forex trading involves inherent risks, and due diligence must be exercised before engaging in such activities.