Introduction

In the fast-paced world of forex trading, every edge counts. Technical analysis, a crucial tool for traders, empowers them with insights into market dynamics and potential opportunities. Among the plethora of indicators, the Exponential Moving Average (EMA) stands out as a powerful trend-following tool that can help traders make informed decisions and achieve success. In this comprehensive guide, we delve into the EMA, particularly focusing on the EMA 20 and EMA 30, unraveling their significance, applications, and how to harness their potential in your forex trading endeavors.

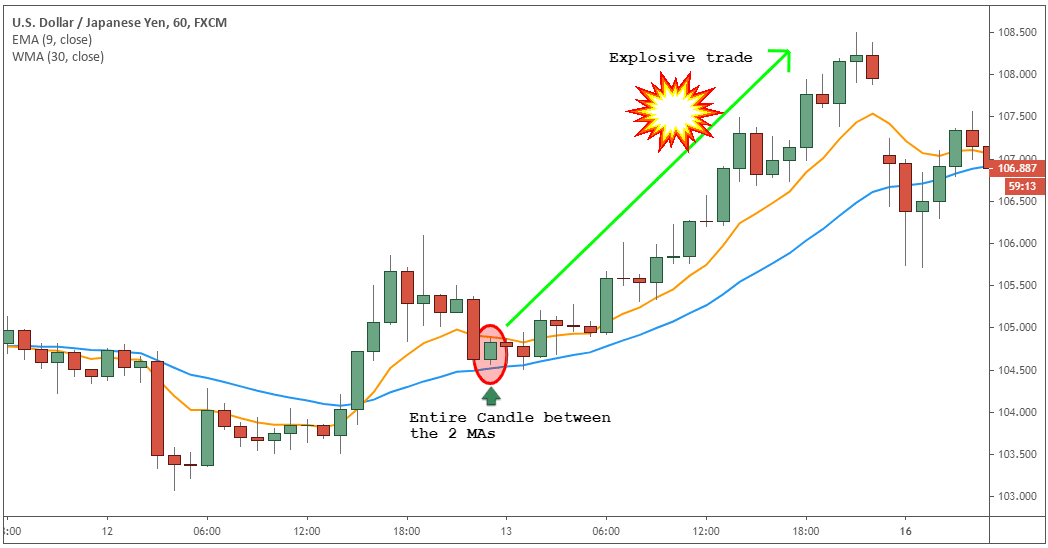

Image: globaltradingsoftware.com

Understanding EMA 20 and EMA 30

Exponential Moving Averages (EMAs) are a type of moving average that places more weight on recent price data, giving them a stronger response to price changes compared to traditional Simple Moving Averages (SMAs). The EMA 20, as the name suggests, is calculated using the past 20 periods of price data, while the EMA 30 uses the past 30 periods.

These EMA indicators are commonly used in forex trading to gauge the overall market trend, identify potential trend reversals, and determine entry and exit points. By analyzing the relationship between the EMA 20 and EMA 30, traders can gain valuable insights into the market’s momentum and direction.

Benefits of Using EMA 20 and EMA 30

- Trend Identification: EMA 20 and EMA 30 help identify the dominant market trend. When the EMA 20 is above the EMA 30, it generally indicates an uptrend, while the reverse suggests a downtrend.

- Trend Confirmation: Crossovers between the EMA 20 and EMA 30 can provide confirmation of trend changes. A bullish crossover occurs when the EMA 20 crosses above the EMA 30, while a bearish crossover happens when the EMA 20 falls below the EMA 30.

- Support and Resistance Levels: The EMA 20 and EMA 30 can act as dynamic support and resistance levels. When the price approaches these EMAs, it often finds temporary support or resistance, influencing future price movements.

- Trade Timing: Traders can use EMA 20 and EMA 30 to time their trades. When the price breaks above or below these EMAs, it can signal a potential trading opportunity.

How to Use EMA 20 and EMA 30 in Trading

- Crossover Strategy: As mentioned earlier, crossovers between EMA 20 and EMA 30 can indicate trend changes. Traders can go long when the EMA 20 crosses above the EMA 30 and short when the EMA 20 falls below the EMA 30.

- Pullback Trading: EMA 20 and EMA 30 can also help identify pullback opportunities within a prevailing trend. If the price retraces towards an EMA, traders can consider taking a trade in the direction of the trend if the price bounces off the EMA.

- Trend Filter: Traders can use EMA 20 and EMA 30 as trend filters. For instance, a trader might only take long positions when the price is above both the EMA 20 and EMA 30, indicating a bullish bias.

- Stop Placement: EMA 20 and EMA 30 can serve as dynamic stop-loss levels. Traders can place their stop-loss orders just below the EMA 20 (for long positions) or just above the EMA 20 (for short positions) to limit potential losses in case of adverse price movements.

Image: tradingstrategyguides.com

Expert Insights and Actionable Tips

- “The EMA 20 and EMA 30 are powerful trend-following tools that can provide valuable insights into market dynamics,” says renowned forex trader Adam Khoo. “Traders should always consider the broader market context when using these indicators.”

- “Combining EMA 20 and EMA 30 with other technical indicators can enhance the reliability of trading signals,” advises professional trader Kathy Lien. “For instance, using the Relative Strength Index (RSI) alongside EMA 20 and EMA 30 can help identify overbought or oversold conditions.”

- “Don’t rely solely on EMA 20 and EMA 30 for your trading decisions,” cautions experienced trader Peter Brandt. “Always conduct thorough market analysis and consider other factors that may influence price movements.”

Ema 20 And 30 Forex

Conclusion:

The EMA 20 and EMA 30 are indispensable tools for forex traders. By understanding their significance, applications, and limitations, traders can harness their power to gain a competitive edge in the fast-paced world of forex trading. Remember, technical analysis is an essential aspect of trading, but it should be used in conjunction with other factors and strategies for optimal results. As with any trading strategy, discipline, risk management, and continuous learning are crucial for long-term success.