Introduction:

Image: blog.marketsmithindia.com

The automotive industry is a dynamic and ever-evolving landscape, where the interplay of stock market valuations and foreign exchange rates can significantly impact the fortunes of both manufacturers and investors alike. Eicher Motors, an Indian automotive giant synonymous with iconic brands like Royal Enfield and VE Commercial Vehicles, exemplifies this intricate relationship. This comprehensive article delves into the captivating world of Eicher Motors stock and explores how currency rate fluctuations shape its financial tapestry.

The company’s stock performance has been meteoric in recent years, driven by a confluence of factors, including its robust financial performance, strategic expansion initiatives, and a burgeoning Indian economy. On the currency front, Eicher Motors’ export orientation renders it susceptible to the vagaries of foreign exchange rates, making an understanding of forex dynamics paramount for investors.

Decoding Eicher Motors’ Stock Performance: Robust Financials, Strategic Expansion, and Market Favorability

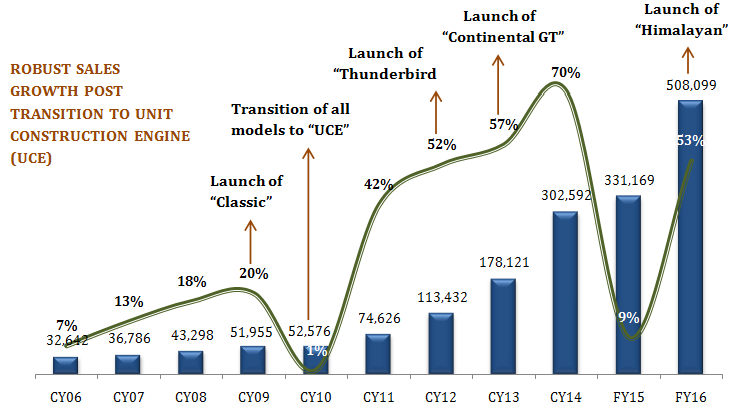

Eicher Motors has consistently posted impressive financial results, buoyed by strong sales, operating efficiency, and a judicious capital allocation strategy. Its revenue has grown exponentially over the past decade, driven by the rising popularity of Royal Enfield motorcycles both domestically and internationally. VE Commercial Vehicles, the company’s commercial vehicle arm, has also contributed significantly to the revenue stream, leveraging its strong presence in the Indian market.

Complementing its organic growth, Eicher Motors has pursued strategic expansion initiatives, including acquisitions and partnerships. The acquisition of Polaris India, a leading manufacturer of all-terrain vehicles and personal watercraft, expanded Eicher Motors’ product portfolio and enhanced its presence in the lucrative off-road vehicle segment.

Favorable market conditions have further propelled Eicher Motors’ stock performance. The Indian economy has witnessed sustained growth, providing a fertile ground for automotive sales. Additionally, the government’s push for infrastructure development and the increasing affordability of vehicles have created tailwinds for the industry.

Currency Rate Impacts: The Delicate Dance of Exports and Imports

As a significant exporter of two-wheelers and commercial vehicles, Eicher Motors is inevitably influenced by foreign exchange rate fluctuations. When the Indian rupee appreciates against foreign currencies like the US dollar, Eicher Motors’ earnings from exports effectively decrease. This is because the company receives fewer rupees for the same number of dollars earned from overseas sales. Conversely, a depreciation of the rupee boosts export earnings, making Indian products more competitive in the global marketplace.

On the import front, Eicher Motors sources certain components and raw materials from foreign suppliers. When the rupee depreciates, the cost of these imports increases, potentially impacting the company’s profit margins. However, Eicher Motors’ astute hedging strategies have helped mitigate the risks associated with currency rate volatility, ensuring consistent profitability.

Bullish Bets or Cautious Approach: Navigating the Eicher Motors Stock Trajectory

Analysts remain largely bullish on Eicher Motors’ stock, citing its strong fundamentals, growth potential, and prudent management. The company’s focus on innovation and product development, coupled with its expanding global footprint, is expected to continue fueling its long-term growth. However, investors should be cognizant of the potential impact of currency rate fluctuations and the cyclical nature of the automotive industry.

Cautious investors may opt for a more diversified approach, balancing their holdings in Eicher Motors with other stocks or asset classes to mitigate risk. Monitoring the movement of foreign exchange rates and the broader economic environment can also be prudent in making informed investment decisions.

Image: www.sanasecurities.com

Eicher Motors Stock Forex Rates

In Conclusion: Riding the Rollercoaster of Stock Markets and Currency Waves

Eicher Motors’ stock market journey reflects the dynamic interplay of financial performance, strategic decisions, market sentiment, and currency rate fluctuations. While the company’s strong fundamentals and growth prospects provide a solid foundation, investors must navigate the ebb and flow of foreign exchange rates to optimize returns. A comprehensive understanding of both domestic and global economic factors will enable investors to make informed decisions and ride the rollercoaster of stock markets and currency waves with confidence. As Eicher Motors embarks on its next chapter of growth, it promises to remain an exciting case study in the ever-evolving landscape of automotive investing.