The dynamics of international finance are ever-evolving, with foreign direct investment (FDI) playing a pivotal role in shaping the complexities of foreign exchange rates. In India, FDI has emerged as a potent force, profoundly influencing the value of the rupee and the overall trajectory of the economy. In this comprehensive guide, we delve into the intricacies of FDI and its multifaceted impact on India’s forex landscape.

Image: timesofindia.indiatimes.com

Understanding Foreign Direct Investment

Foreign direct investment is a form of long-term investment where a foreign entity establishes a substantial stake in a domestic company. This typically involves the acquisition of either voting or non-voting shares in the target firm. FDI serves as a crucial catalyst for economic growth, enabling the transfer of capital, technology, and expertise across national borders.

The Two-Way Street of FDI and Forex Rates

FDI exerts a multifaceted impact on foreign exchange rates, primarily through the interplay of supply and demand. When foreign investors acquire Indian assets, they exchange foreign currencies for rupees in order to make their investments. This influx of foreign currency leads to an increased demand for the rupee, resulting in its appreciation.

Conversely, when foreign investors liquidate their Indian holdings and repatriate their profits, they exchange rupees for foreign currencies. This increased supply of rupees in the market leads to its depreciation. Thus, FDI serves as a direct channel through which foreign capital inflows and outflows influence the exchange value of the rupee.

FDI’s Multifaceted Effects on India’s Economy

Beyond its impact on forex rates, FDI has a wide range of implications for India’s economy. Here are some key benefits:

-

Job Creation: FDI often involves the establishment of new businesses or the expansion of existing ones, leading to increased employment opportunities for Indian citizens.

-

Technology Transfer: Transfer of technology and knowledge from foreign investors to domestic firms enhances productivity and fosters innovation.

-

Export Promotion: FDI can boost exports by providing access to foreign markets and facilitating the integration of domestic firms into global supply chains.

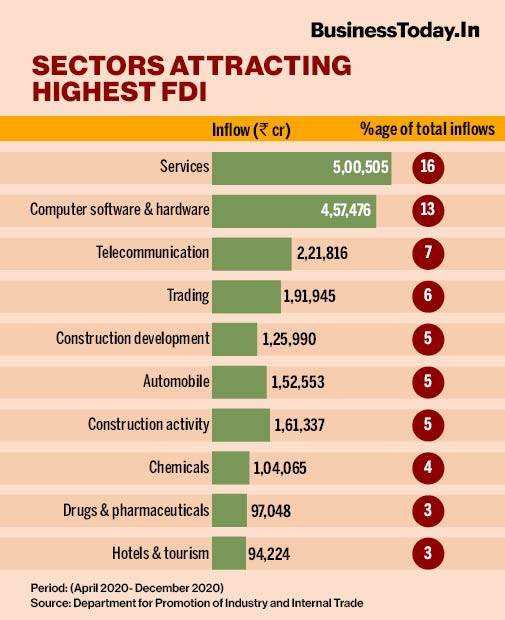

Image: www.forbesindia.com

The Role of FDI in India’s Forex Strategy: Managing Strength and Stability

India’s central bank, the Reserve Bank of India (RBI), plays a crucial role in managing the impact of FDI on the forex market. The RBI employs various tools including interest rates, exchange rate interventions, and capital controls to ensure the stability of the rupee and promote economic growth.

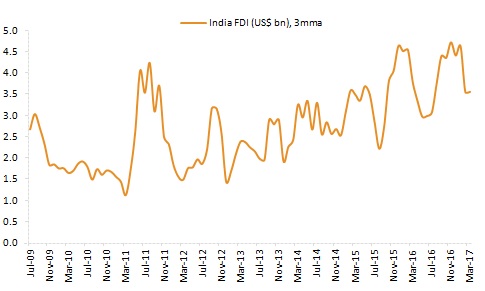

Effect Of Fdi On Forex Rate In India Currently

Conclusion: Navigating the Ebb and Flow of FDI

Foreign direct investment is an indispensable force in India’s economic landscape, with significant implications for the value of the rupee and the broader financial ecosystem. By understanding the interplay between FDI and forex rates, policymakers, businesses, and individuals alike can make informed decisions that leverage the benefits and mitigate the risks associated with this powerful economic phenomenon. As the global financial markets continue to evolve, India remains poised to harness the transformative potential of FDI while safeguarding its economic sovereignty and stability.