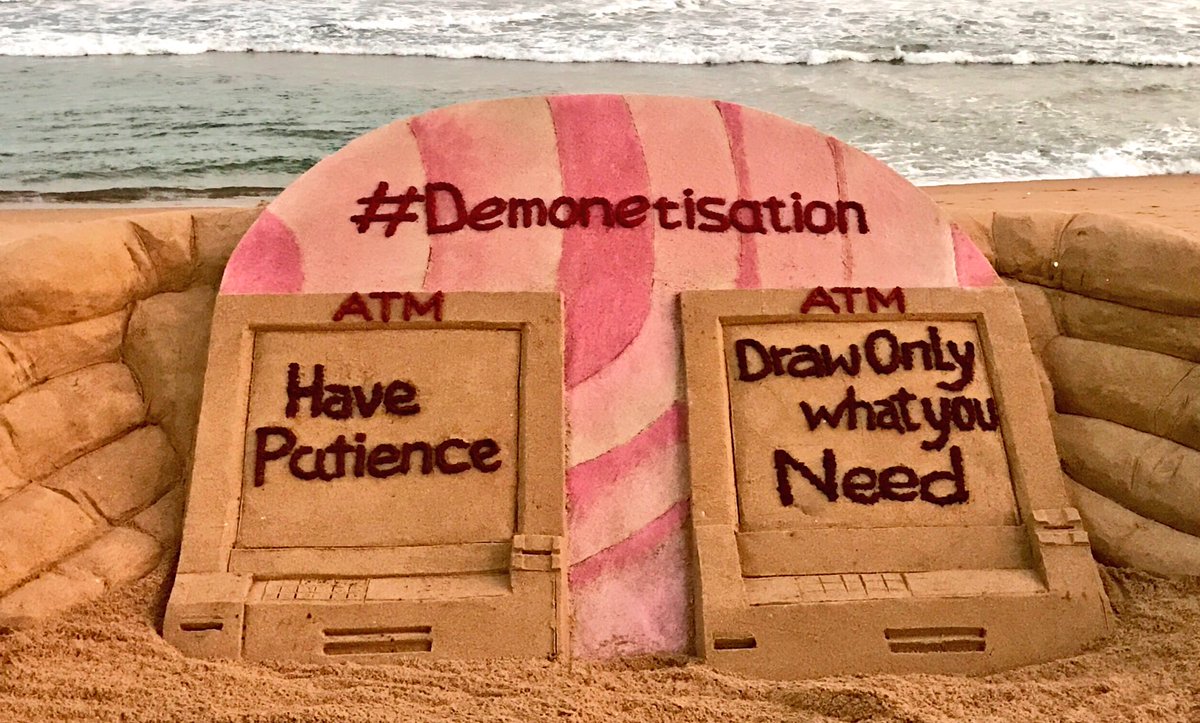

The recent demonetization of India’s high-value currency notes has created a ripple effect not only within the country’s borders but also across global markets. The sudden announcement by the Indian government to invalidate 500 and 1,000-rupee notes has sent shockwaves through the economy, affecting the foreign exchange (forex) market and international trade.

Image: www.innovexia.com

Demonetization, in essence, is a monetary policy aimed at curbing illicit activities like counterfeiting, money laundering, and terrorism financing. By removing high-value banknotes from circulation, the government intends to reduce the flow of black money and bring it under the tax net. While the domestic impact of demonetization is being extensively discussed, the international ramifications are equally significant.

Immediate Impacts on Forex Market

The immediate impact of demonetization was felt in the forex market. The Indian rupee (INR) witnessed a steep decline against major currencies, including the US dollar (USD), British pound (GBP), and Euro (EUR), in the aftermath of the announcement. This depreciation was driven by several factors.

- Demand-supply dynamics: Demonetization reduced the demand for the rupee as people scrambled to exchange their old notes. As fewer rupees were available for trading, its value dropped in relation to foreign currencies.

- Reduced foreign exchange transactions: Transactions involving foreign exchange such as remittances and international trade were impacted as people faced difficulties obtaining both Indian and foreign currency.

- Uncertainty and speculation: The uncertainty surrounding the implications of demonetization led to increased speculation and profit-taking in the forex market, further exacerbating the rupee’s depreciation.

Long-term Implications for Global Economy

The long-term implications of demonetization on the global economy are still evolving, but there are potential impacts to consider.

- Disruption of trade flows: The reduced availability of Indian currency and difficulties in foreign exchange transactions may lead to disruptions in trade flows between India and other countries, particularly for small and medium-sized businesses.

- Slower economic growth: The demonetization process has the potential to slow down economic growth in India in the short term. This could have ripple effects on global trade and investment as India is a significant player in the international economy.

- Shift in investment patterns: Demonetization may encourage investors to shift their focus from physical assets, such as real estate, to financial assets like stocks and bonds. This could potentially lead to changes in global financial markets and investment trends.

Global Response and Policy Coordination

The international community has been closely monitoring the situation in India following demonetization. Monetary authorities and central banks around the world have been coordinating to assess the potential impact on their economies and financial systems.

- Monetary policy adjustments: Some central banks in countries with close trading ties to India may consider adjusting their monetary policies to mitigate the effects of demonetization on their economies.

- Enhanced surveillance: Regulators in different jurisdictions are intensifying their surveillance of financial flows to address any possible illicit activities or attempts to circumvent regulations.

- IMF and development bank support: The International Monetary Fund (IMF) and development banks, such as the World Bank, have expressed their readiness to provide support to India and its neighbors as needed.

Image: www.business-standard.com

Effect Of Demonetisation On Forex

Cautious Optimism and Future Outlook

While demonetization poses challenges in the short term, there is cautious optimism about its long-term benefits for the Indian economy. The potential reduction in black money, increased tax revenues, and promotion of digital payments could contribute to greater transparency and economic stability.

The impact on the forex market is likely to stabilize over time as the Indian government provides clarity on the implementation process and market participants adjust to the new environment. The international community also continues to monitor the situation and is committed to mitigating any potential risks to the global economy.

In conclusion, demonetization has had a significant impact on the forex market and the global economy. While the full effects are yet to unfold, close coordination between governments and central banks, as well as ongoing monitoring and assessment, will be crucial in managing the transition and navigating the forthcoming opportunities and challenges.