In the fast-paced world of finance, Forex trading has emerged as an enticing opportunity for budding traders. The foreign exchange market, the world’s largest financial market, offers the chance to profit from currency fluctuations. However, embarking on this journey can be daunting for beginners. This comprehensive guide aims to demystify the intricacies of Forex trading, empowering you with the knowledge and strategies to navigate this dynamic market.

Image: www.pinterest.com

Forex trading involves buying and selling currencies, speculating on their fluctuations. The market’s decentralized nature and high volatility present both opportunities and risks, making it crucial to approach it with a calculated and well-rounded understanding. In this beginner-friendly guide, we will unravel the essentials of Forex trading, providing you with a solid foundation upon which to build your trading prowess.

Understanding the Forex Market Basics

At the heart of Forex trading lies the exchange rate, the value of one currency against another. Fluctuations in exchange rates are influenced by various economic, political, and global events. Understanding the factors that drive these changes is a key step in successful Forex trading. Fundamental analysis, which studies macroeconomic data and news, and technical analysis, which interprets historical price patterns, are valuable tools in this endeavor.

Types of Forex Trading Instruments

The Forex market offers a wide range of trading instruments, including currency pairs, spot Forex, forward contracts, and options. Each instrument has unique characteristics and risk profiles. Currency pairs, such as EUR/USD or GBP/JPY, are the most popular, representing the buying or selling of one currency against another. Spot Forex involves the immediate exchange of currencies, while forward contracts and options allow for future delivery or the right to buy or sell at a predetermined price.

Leverage: A Double-Edged Sword

Leverage is a powerful tool in Forex trading, magnifying profits and losses. By using leverage, traders can control a larger position with a smaller initial investment. However, it is essential to use leverage responsibly, as it can amplify both gains and losses. Proper risk management strategies, such as setting stop-loss orders and managing position size, are crucial when utilizing leverage.

Image: learnpriceaction.com

Developing a Trading Plan

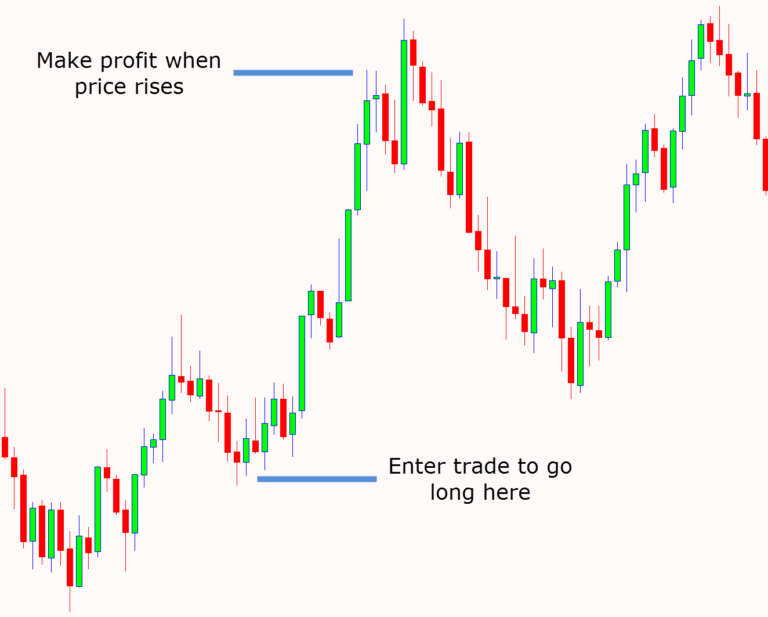

A well-defined trading plan is the cornerstone of successful Forex trading. It serves as a roadmap, outlining your trading strategy, risk appetite, and specific market conditions that will trigger trades. A comprehensive trading plan should include entry and exit points, profit targets, and stop-loss levels. Sticking to your trading plan, even in challenging market conditions, is key to maintaining discipline and achieving long-term success.

Choosing a Forex Broker

Choosing a reputable and reliable Forex broker is paramount for a seamless trading experience. Factors to consider include the broker’s regulatory status, trading platform, fees and commissions, customer support, and educational resources. Taking the time to research and compare different brokers will ensure you select one that aligns with your trading needs and preferences.

Risk Management: The Key to Survival

Risk management is the backbone of Forex trading, as it helps traders minimize losses and protect their capital. Setting appropriate position sizes based on your risk tolerance, using stop-loss orders to limit potential losses, and diversifying your portfolio across different currency pairs are essential risk management techniques. By implementing sound risk management strategies, you can significantly enhance your chances of survival in the Forex market.

Trading Psychology: Mastering Your Emotions

Trading in the Forex market can be an emotionally charged endeavor. Greed, fear, and overconfidence can cloud judgment and lead to poor trading decisions. Developing a strong trading psychology is vital to overcoming emotional hurdles. Emotional detachment, patience, and discipline are key traits that successful Forex traders possess. By controlling your emotions and trading rationally, you can increase your chances of making sound trading decisions.

Easy Forex Trading For Beginners

Continuous Learning and Adaptation

The Forex market is constantly evolving, driven by global economic developments and technological advancements. Successful traders recognize the importance of continuous learning and adaptation. Staying up-to-date with market news, studying trading strategies, and analyzing market trends will help you stay on top of the ever-changing Forex landscape. By embracing a mindset of perpetual learning, you can refine your trading skills and adjust to the dynamic nature of the market.

As you embark on your Forex trading journey, remember that success is not a destination but an ongoing process of learning, adaptation, and risk management. Staying informed, maintaining a well-defined trading plan, and developing a strong trading psychology are the pillars of successful Forex trading. With dedication, perseverance, and a commitment to continuous improvement, you can navigate the challenges of this dynamic market and achieve your trading goals.